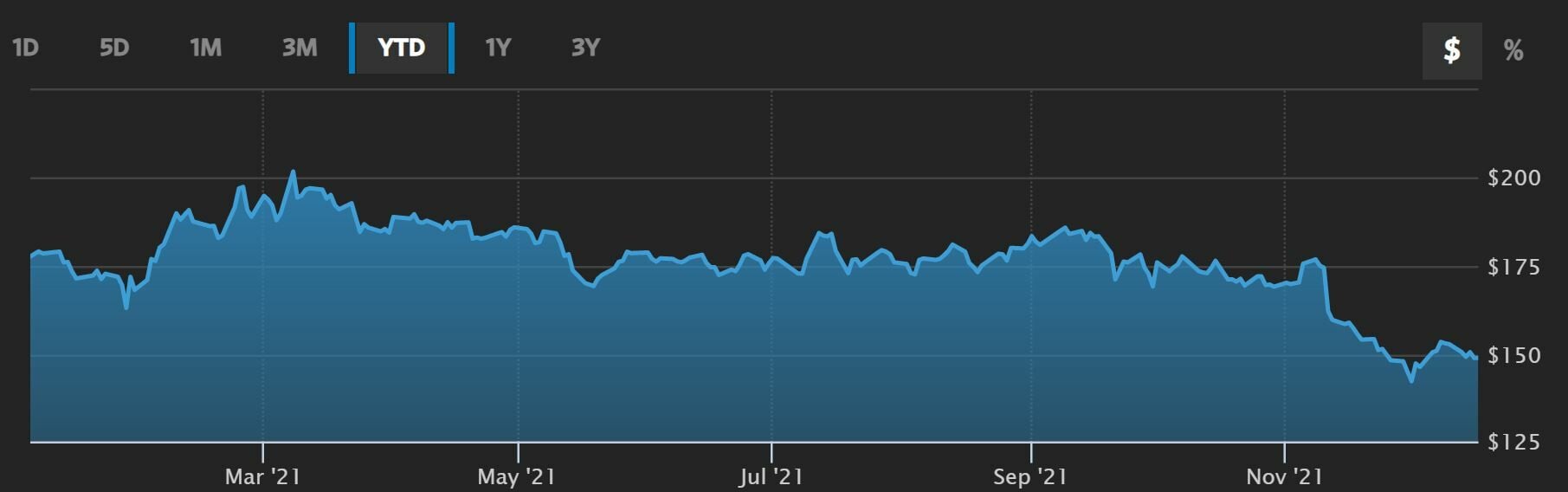

Walt Disney is still marked by the uncertainty injected by the omicron variant, a kind of fall on fall for the value, at a time when it is not fully recovering. The volatility of its price is mainly due to the possibility of new restrictions, but also to its declining figures quarter after quarter, at a time when his guides were already forecasting a substantial improvement.

And it is also that the balance maintained between their businesses since the pandemic dominated the world has been broken: Disney + had remained the great bastion that cut back on Netflix in their journey by leaps and bounds, and although they remain growth expectations for your streaming service by 2024, The truth is that this intermediate point, which leads to greater mobility reduces its subscribers throughout the year while its face-to-face businesses, from cruises to theme parks to big screen premieres, still do not provide the desired income and expected by the group.

But, even though it continues being the final value of a Dow JonesWith which, so far this year and less than 2 weeks to close the year, it takes no less than a 30% difference in its route, the truth is that experts consider that 2022 can undoubtedly be their year as we will now see.

At the moment without expectations because in real time we see that the value cuts 2.6% in its journey in the last five sessions, with falls of 3.4% that marked in the previous month.

Even so, the decreases are much more pronounced in the quarter with falls that touch 19% while, so far this year, the decline in the price of the stock has already reached 17.9% although it has fallen to 14% since December of last year. SOnly since March, the stock has lost a third of its price.

Although, as we will see later, its target price is reduced, the falls in value raise its expectations. In this way, it currently has two concrete and very significant supports in the market. The first is that of Bank of America that has included Disney in the portfolio of the 11 securities that can rise at least 20% in 2022. It is preferred in the communications services sector for its exposure to reopenings, with parks, cruise ships and cinemas, after being downplayed by funds and viewing Disney as a high-quality asset.

Too Jim Cramer, the host of CNBC’s Mad Money what do you see at Disney a clear buying opportunity understanding that in 2022 both movie theaters and theme parks will remain open despite the omicron variant next year, which will increase their income and cash flow.

He is also not worried about the drop in users of his streaming platform because you consider that the new content that comes next year will solve their numbers, with much-anticipated premieres such as the new season, the third of their smash hit, The Mandalorian.

Regarding the recommendations, From TipRanks, of the 24 analysts that follow the value, 18 choose to buy and 6 for maintaining the portfolio value with an average price target of $ 199.23 per share, which gives Disney a potential in the market of almost 34%, with a maximum PO of $ 225 per share and the lowest standing at $ 168 per title.

Among the latest recommendations, that of Loop Capital that has lowered its target price to $ 190 per share from the previous 205, indicating for this increased spending on content production for Disney +, which may affect its profitability. But at the same time, they recognize from the firm that it will be able to catalyze long-term value growth and consider that investors should not believe in short-term weakness while looking to buy opportunities in the market.

If you want to know the most bullish values of the stock market, register for free in Investment Strategies.

–