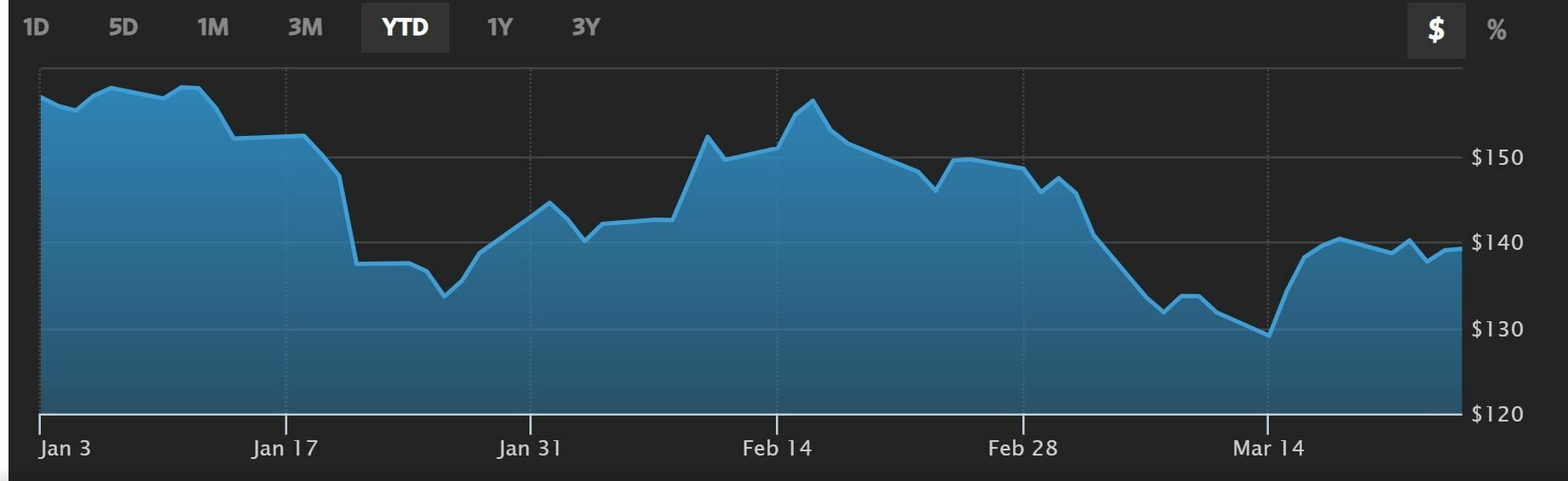

Walt Disney does not seem to be going through his best moment, especially with the open conflict with his workers on account of a law in Florida. His CEO Bob Chapek’s idea of not interfering in political affairs has backfired on the company, taking the stock even further from its best levels of the year. Even last March 14, It marked its worst record of the last year at 128.38 dollars per share.

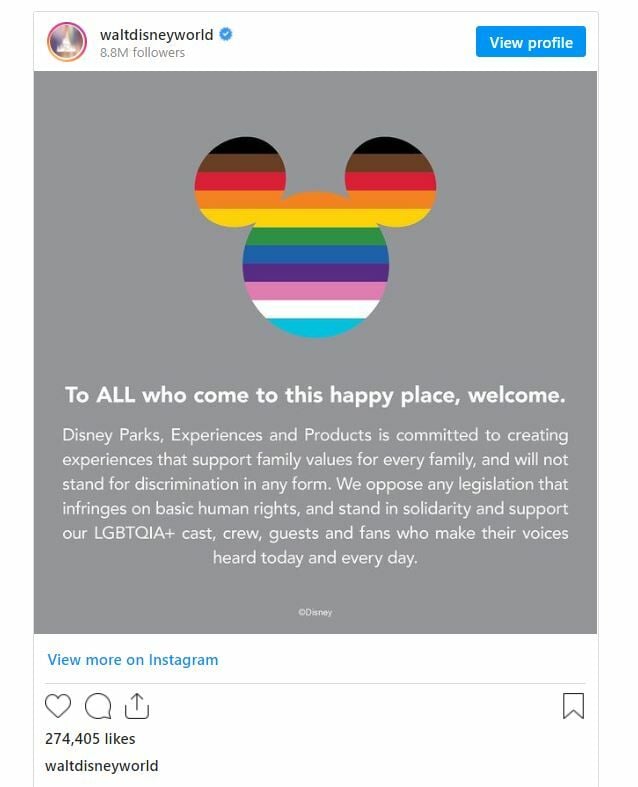

All on account of the strike that has arisen in protest against a law that votes the Senate of the United States sponsored by the Republicans called by opponents “Don’t say gay” and that has forced the company to reverse its neutral stance and apologize to the workers, as well as to suspend their financial contributions to state politicians. Chapek has promised “lasting change” within the company due to the company’s silence regarding the regulations. In addition, he has promised donations of up to 5 million dollars for pro LGTBIQ + groups.

As well has just decided the sine die closure of Shanghai Disney Resort, which is made up of Disneyland, Disneytown and Whising Star Park since last Monday, due to the rebound in local cases of Covid-19 in China. And it adds to the closure of the Hong Kong park, which occurred in January and was expected to open, now with revision, on April 20. At the moment there are 1,366 cases, those that remain in the country are decreasing.

None of this helps a Disney that, in the week, loses 0.83% with cuts in the month that are close to 7% for value. Also in negative, it moves on a quarterly basis, with cuts that reach 9.43% for the value on Wall Street, whileso far in 2022, Disney shares yield 10.2% in the market and year-on-year, the fall exceeds 25%.

While analysts do not seem to be convinced of the course of the value. From Guggenheim its analyst Michael Morris has cut the target price of Disney shares to 150 euros per share from previous 172 rated value-neutral.

All looking at its theme parks, with what happened in Florida and the bad precedent it presents, although it also considers that there has been a rapid recovery after reopening with its new attractions, technological updates. And all this while waiting for an event on this day, the Parks Investor Experience, the first in person to take place after the pandemic.

doesn’t help either hedge fund sales of Disney shares that have occurred in the last quarter. Which leads to a negative outlook on the stock with quarterly sales of up to 6.8 million shares.

For the results of this quarter sales of 20,150 million dollars are expected, what it would mean an improvement over 20% compared to those registered last year in the same quarter. As for Disney +, an increase in investments in programming and production is expected from 800 to 1,000 million dollars.

From Tipranks they collect the opinion of 20 analysts, of which 15 opt to buy the value in the market and 5 more to keep it in their portfolio. Its average target price is $191.63, which gives it an upside potential of 37.7%.

And finally from Truist they reduce the target price of Disney shares to 160 dollars the action from the previous 200 after highlighting its departure from Russia and the relationship between the company’s income and households. Its analysts point out that Russia represents 2% of its total income and estimate 4.6% of broadband households in 2024.

He expects earnings per share to decline to $4.28 from $4.47 previously. But also a drop in revenue to 83.5 billion from the consensus that points to 85,000 million.

If you want to know the most bullish values of the stock market, register for free in Investment Strategies.

–