The Club of Public Development Banks intends to integrate ESG principles into their investment practice in the future. (Image: Shutterstock.com/Piyaset)

The new network of development banks could give sustainability initiatives a huge boost worldwide. Because the club’s financial clout is enormous, as the DWS shows in its “Chart of the week”.

The Kreditanstalt für Wiederaufbau (KfW) is well known in Germany. Customers receive discounted loans or other forms of investment support from her. And with it, politicians have a practical vehicle to free up appropriate funds for politically opportune projects. In terms of total assets, KfW is Germany’s third-largest credit institution. This gives a feeling of the forces that arise – and which flows of money could be directed in certain directions – if promotional banks came together.

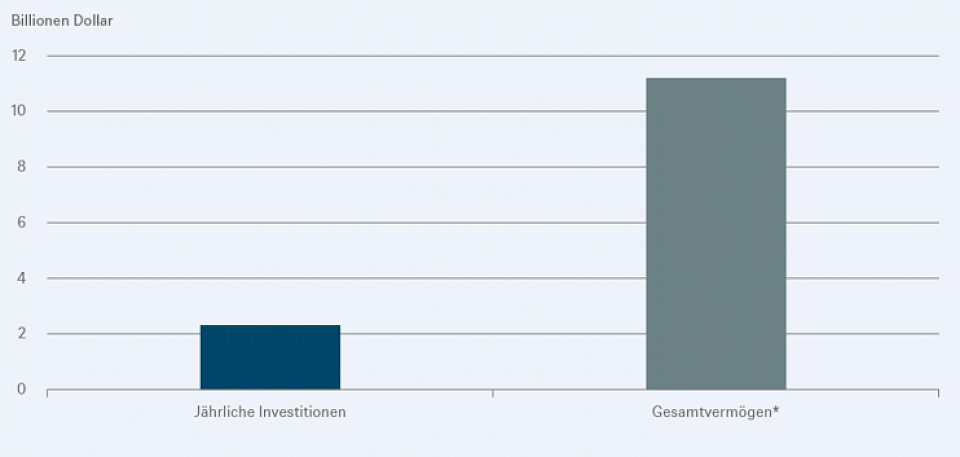

This is exactly what is happening. A summit of financial actors took place this month, simultaneously addressing the Covid-19 crisis, the fight against climate change and the achievement of the sustainable development goals. The Finance in Common Summit, held online during the Paris Peace Forum, brought together the world’s 450 public development banks (PDBs) for the first time. The firepower behind this banking group is enormous: it has total assets of 11.2 trillion. US dollars and grants 2.3 trillion in investment loans every year. US dollars, as the DWS “Chart of the week” shows. This corresponds to around a tenth of all publicly or privately granted investment loans per year.

The financial clout of the public development banks

Quelle: Finance in Common: Building resilience for people and planet; Stand: 11.2020

If this group is now committed to jointly aligning its strategies, business processes and lending rules in accordance with the Paris Climate Agreement and the United Nations Sustainable Development Goals (SDGs), then that will not be a stick-out problem, but should make the eyes of many climate activists shine , so the DWS.

International club with financial clout

Of the 450 banks, 29% are in Asia, followed by Europe (23%), Latin America (22%) and Africa (21%). Your financial clout, however, is more concentrated. The 50 largest PDBs make up 90% of total assets. In a way, her coalition reflects the establishment of the “Network for Greening the Financial System” in 2017, which has grown from its eight founding members to 75 central banks and 13 supervisory authorities from around the world (investrends.ch reported).

“Just as a small but growing number of central banks have signed the Principles for Responsible Investment (PRI), this would be a logical next step for the new PDB coalition,” said Michael Lewis, Head of ESG Research at DWS. “Signing the PRI would formalize what the PDBs have initiated this month, namely the integration of ESG principles into their investment practice.”

–

:quality(80)/cdn-kiosk-api.telegraaf.nl/a30cde2e-3193-11eb-9178-0255c322e81b.jpg)