Crypto Market Reels: Bitcoin Plunges Below $95,000, ethereum, solana, and dogecoin Suffer Amid Market Turmoil

Table of Contents

- Crypto Market Reels: Bitcoin Plunges Below $95,000, ethereum, solana, and dogecoin Suffer Amid Market Turmoil

Published:

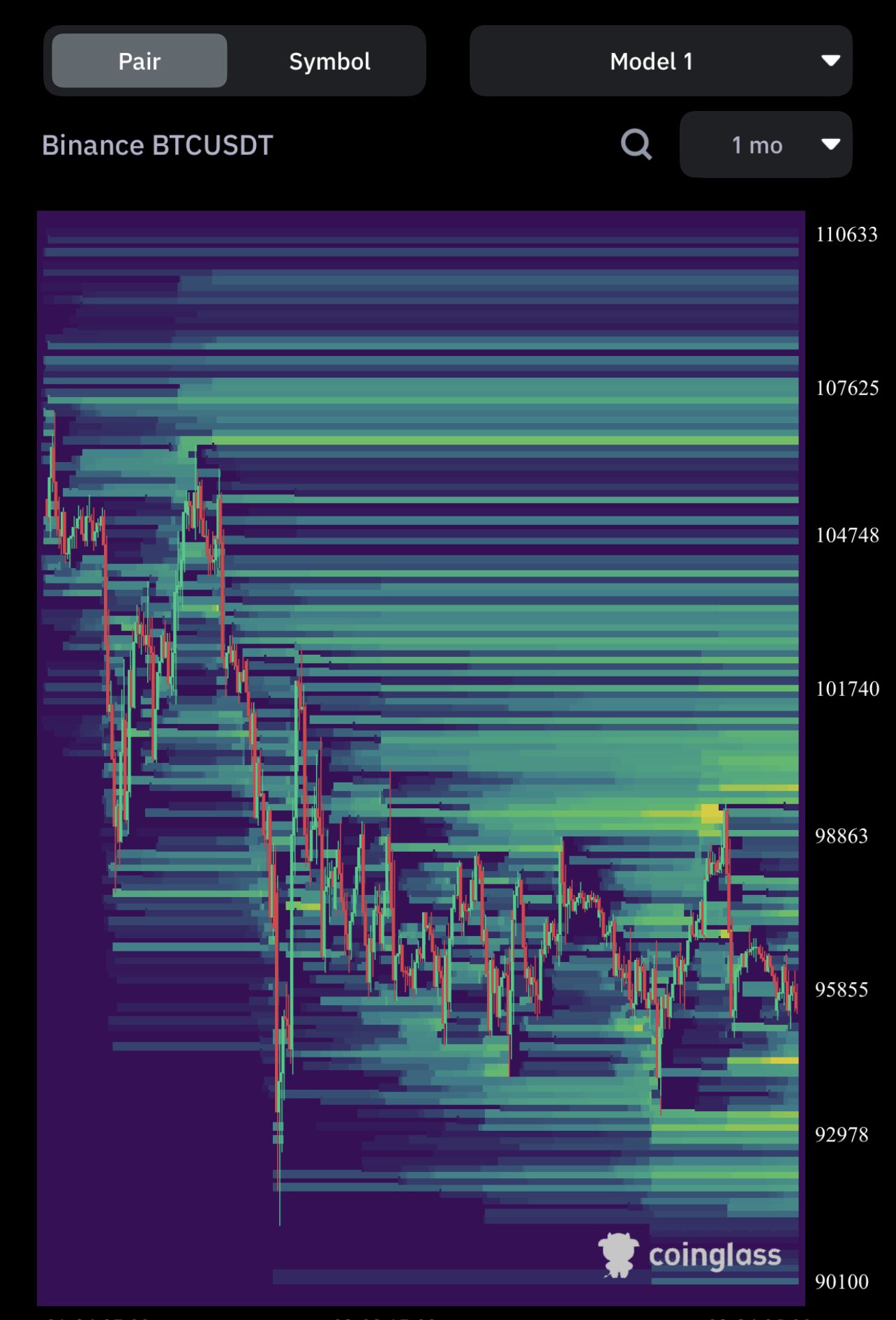

A sharp downturn has shaken the cryptocurrency market, sending Bitcoin, Ethereum, Solana, and Dogecoin into a downward spiral. Bitcoin’s price dramatically dropped below $95,000, triggering widespread concern among investors. The ripple effect has impacted other major cryptocurrencies, with Ethereum and Solana experiencing important losses. Dogecoin,known for it’s volatility,also felt the pressure,contributing to an overall sense of unease in the digital asset space.

According to market data, ethereum is down over 4%, while Solana has plummeted by more than 9%. Dogecoin’s price has also decreased by over 7% in the last 24 hours, reflecting the broad-based nature of the market correction. The confluence of factors contributing to this downturn highlights the inherent risks and uncertainties associated with cryptocurrency investments.

Expert Analysis: Decoding the Crypto Crash

To understand the underlying causes and potential implications of this market plunge, we spoke with Dr.Anya Sharma, a leading expert in financial technology and cryptocurrency markets. dr.Sharma provided valuable insights into the complex dynamics at play.

Dr. Sharma explained that the recent cryptocurrency market correction is due to “a confluence of factors.” She emphasized the importance of analyzing several contributing elements to understand the causes of this volatility. “Firstly, macroeconomic conditions like interest rate hikes and inflation play a meaningful role,” Dr. Sharma stated. “When customary markets experience uncertainty, investors frequently enough move capital to perceived safer havens, impacting riskier assets like cryptocurrencies. This leads to reduced demand and later lower price valuations.”

Regulatory uncertainty also remains a significant concern. “The lack of clear, consistent regulations across global markets creates an habitat of instability frequently resulting in sell-offs,” Dr. Sharma noted. The inherent volatility within the crypto market itself further contributes to these price swings. “The speculative nature of crypto investments means prices can be highly susceptible to market sentiment shifts and even social media hype cycles,” she added.

The psychological impact of Bitcoin’s price drop below a significant threshold cannot be overstated. “the psychological impact is undeniably immense,” Dr.Sharma explained. “Psychological thresholds, like Bitcoin dropping below a previously significant price point, frequently enough act as triggers for panic selling. Investors conditioned to react to these pivotal points exhibit herd behavior. This creates a self-fulfilling prophecy were fear precipitates further losses, nonetheless of the underlying fundamentals of a particular cryptocurrency or the market as a whole.”

Dr. Sharma underscored the importance of emotional intelligence and risk management strategies for all participants in cryptocurrency markets.

Differentiated Vulnerabilities: Ethereum, Solana, and dogecoin

While all cryptocurrencies are susceptible to market downturns, each possesses unique vulnerabilities that influence their performance.Dr. Sharma elaborated on the specific factors affecting Ethereum, Solana, and Dogecoin.

“While all cryptocurrencies are susceptible to market downturns, each has unique vulnerability factors,” Dr. Sharma stated.”Ethereum, such as, being a smart contract platform, is tied to the success of the decentralized request (DApp) ecosystem built upon it. A decline in dapp usage could indirectly effect Ethereum’s price.”

Solana, known for its fast transaction speeds, faces different challenges. “Solana, with its fast transaction speeds, faces different vulnerabilities. Scalability limitations and network congestion in the face of high demand can affect its stability and price,” Dr. Sharma explained.

Dogecoin, often viewed as a meme coin, is particularly vulnerable to sentiment changes and social media trends.”Dogecoin, viewed primarily as a meme coin, is highly susceptible to sentiment changes and social media trends. Its price correlates less with traditional market movements and more strongly with speculative hype,” Dr. Sharma noted. She emphasized that “diversification across different crypto-asset classes is thus a very vital factor for risk mitigation.”

Dr.Sharma outlined several strategies investors can employ to mitigate potential losses and navigate market fluctuations. These include:

- Diversification: “Don’t put all your eggs in one basket. Invest across different cryptocurrencies and asset classes.”

- Dollar-Cost Averaging (DCA): “Investing regularly, irrespective of price fluctuations, helps to reduce the impact of market volatility.”

- Risk Tolerance Assessment: “Understand your risk tolerance.Only invest what you can afford to lose.”

- Basic Analysis: “Research the underlying technology, adoption rate, and team behind each cryptocurrency before investing.”

- Stay Informed: “Follow reputable sources for accurate and up-to-date details on market trends and developments.”

Looking Ahead: Key Factors to Monitor

To anticipate future market trends in this volatile space, Dr. Sharma highlighted several key factors that should be monitored closely.

“Several key factors provide insights into future market dynamics,” Dr. Sharma explained. “Firstly, regulatory developments—particularly in the U.S. and other major jurisdictions—will considerably affect the overall market sentiment. The regulatory clarity and the adoption of comprehensive frameworks will play a crucial role.”

Technological advancements impacting scalability, security, and efficiency will also be critical. “Secondly, technological advancements impacting scalability, security, and efficiency will influence the long-term outlook of various cryptocurrencies,” she stated.

Macroeconomic conditions remain a major factor. “thirdly, macroeconomic conditions remain a major factor, meaning investors should be aware of international monetary policies and global economic events,” Dr. Sharma noted. “the overall level of adoption and institutional investment will be indicative of the overall market maturity.”

“The recent cryptocurrency market downturn isn’t just a price correction; it’s a stark reminder of the inherent risks in this nascent asset class.”

world Today News Senior editor: Dr. Sharma, thank you for joining us today. Your expertise in financial technology and cryptocurrency markets is invaluable as we dissect the recent crypto market crash, wich saw Bitcoin plummet below $95,000, impacting Ethereum, solana, and Dogecoin substantially. Can you provide a high-level overview of what caused this dramatic market shift?

dr.Sharma: Absolutely. The recent downturn wasn’t caused by a single event, but rather a confluence of factors. Understanding the crypto crash requires analyzing several interconnected elements.Macroeconomic conditions,such as rising interest rates and persistent inflation,played a significant role. When traditional markets face uncertainty, investors frequently enough shift capital to perceived safer assets, reducing demand for riskier investments like cryptocurrencies. This decreased demand directly impacts price valuations.

world Today News Senior Editor: Regulatory uncertainty is frequently enough cited as a major concern in the crypto space. How did this contribute to the recent market turmoil?

Dr.Sharma: The lack of clear, consistent global regulations creates an environment of instability. This regulatory ambiguity inevitably leads to investor apprehension and, consequently, sell-offs. The unpredictable nature of regulatory actions across different jurisdictions significantly impacts market sentiment and confidence. A clear regulatory framework is crucial to fostering stability and attracting long-term institutional investment in the cryptocurrency market.

World Today News Senior Editor: The volatility inherent in the crypto market is well-documented. How did this inherent risk factor contribute to the recent declines, specifically concerning Bitcoin’s psychological price threshold?

Dr. Sharma: The cryptocurrency market, by its very nature, is highly volatile. Bitcoin’s price dropping below a key psychological threshold—in this instance, $95,000—acted as a trigger for widespread panic selling. This illustrates the powerful impact of psychological factors on market behavior. Investors, frequently enough conditioned to react to such pivotal price points, exhibit herd behavior, leading to a self-fulfilling prophecy where fear drives further losses, nonetheless of underlying fundamentals.

Understanding the Unique Vulnerabilities of Different Cryptocurrencies

World Today News Senior Editor: Let’s delve deeper into the performance of specific cryptocurrencies. Why did Ethereum, Solana, and Dogecoin react differently to the broader market downturn?

Dr. Sharma: While all cryptocurrencies are susceptible to market downturns, each possesses unique vulnerabilities. Ethereum, as a smart contract platform, is intrinsically linked to the health of the decentralized request (dApp) ecosystem built upon it. Reduced dApp usage can negatively impact Ethereum’s price. solana, known for its high transaction speeds, faces challenges related to scalability limitations and network congestion under high demand. these technical factors can cause instability and price fluctuations. Dogecoin, often categorized as a meme coin, is extremely sensitive to changes in market sentiment and social media trends. Its price is less correlated with traditional market dynamics and more strongly influenced by speculative hype.

World Today News Senior Editor: What practical strategies can investors employ to navigate future market fluctuations and mitigate potential losses in the crypto market?

Dr. Sharma: Investors should adopt a multi-pronged approach to navigate the volatility:

diversification: Don’t put all your eggs in one basket. Diversify your investments across multiple cryptocurrencies and asset classes to reduce overall portfolio risk.

Dollar-Cost Averaging (DCA): Invest a fixed amount regularly, regardless of price fluctuations. this strategy helps average out the cost per unit and reduces the impact of short-term market volatility.

Risk tolerance Assessment: Understand your risk tolerance before investing. Only invest funds you can afford to lose.

Basic Analysis: conduct thorough research on the underlying technology, adoption rate, and team behind each cryptocurrency before investing.

Stay informed: Follow reputable news sources to stay up-to-date on market trends and regulatory developments.

Key Factors to Monitor for Future Market Trends

World Today News Senior Editor: What key factors should investors monitor to anticipate future market trends in the cryptocurrency space?

Dr. Sharma: Several crucial factors will shape the future landscape of the cryptocurrency market:

Regulatory Developments: Regulatory clarity, especially in major jurisdictions, will significantly influence market sentiment. The adoption of complete and consistent regulatory frameworks is crucial for long-term stability and growth.

Technological Advancements: Advancements in scalability, security, and efficiency will be critical in shaping the long-term outlook for various cryptocurrencies. Innovations like layer-2 scaling solutions and improved consensus mechanisms will directly impact usability and performance.

Macroeconomic Conditions: Global economic factors, interest rates, and inflation continue to play a significant role in determining market sentiment and investor behavior.

* Adoption and Institutional Investment: The level of mainstream adoption and the influx of institutional capital will be key indicators of market maturity and potential for sustained growth.

World Today News Senior Editor: Dr.Sharma, thank you for your insightful analysis. Your advice on diversification,DCA,and fundamental analysis is crucial for anyone considering investing in cryptocurrencies. This has been a truly valuable discussion.What would be your key takeaway for our readers today?

Dr. Sharma: The key takeaway is that the cryptocurrency market is inherently volatile and requires a cautious, informed approach.Accomplished navigation of this dynamic landscape necessitates a thorough understanding of market fundamentals, sound risk management strategies, and a long-term outlook. Remember to always conduct your own thorough research and consider seeking professional financial advice before making any investment decisions. We encourage you to share your thoughts and experiences in the comments section below.