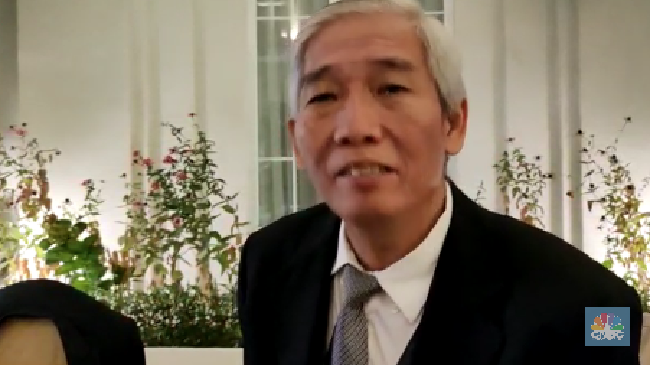

Jakarta, CNBC Indonesia – Indonesian seasoned investor Lo Kheng Hong said that the key to investing is being patient and understanding what you are buying.

“We don’t buy it because there are pom-poms, it’s impatient. If the right investors are willing to be patient and read the financial statements correctly,” said Lo Kheng Hong, quoted Wednesday (23/3/2022).

According to LKH, Lo Kheng Hong’s nickname, many investors are now impatient and buy cats in sacks.

As a regional investor, Lo Kheng Hong was almost bankrupt and barely had any money during the 1998 crisis in Indonesia. However, he was finally able to avoid the threat and bounced back thanks to his work as a stock investor.

“My money was reduced by 85%, the remaining 15%. At that time I was a full time investor, wife, housewife, 2 children, I don’t work anymore, I have 15 percent left,” said Lo Kheng Hong.

This story was told by Lo Kheng Hong while talking at the SPOD event organized by PT Syailendra Capital and broadcast on the company’s YouTube account. Lo Kheng Hong said that when the 1998 crisis occurred, he only had 15% of his entire assets remaining.

Realizing that he was about to go bankrupt, Lo Kheng Hong finally decided to keep all of his remaining assets in the shares of PT United Tractor Tbk (UNTR). At that time, UNTR’s share price per share was at Rp 250 per share.

It is not without reason that the man who is familiarly called LKH did this. According to him, the selection of UNTR as the sole depository location was made because Lo Kheng Hong considered the company to have bright prospects and a high valuation.

“The share price is IDR 250, operating profit per share is IDR 7,800. Operating profit is IDR 1.1 trillion, divided by the number of 138 million shares, right, (earnings per share) IDR 7,800. put everything at United Tractor, you can’t choose anything else. This has mercy for sale at the price of Bajaj, all enter. Buy all of them only at 1 counter,” he said.

(RCI / dhf)

–