The daughter of a Cuban medical professional, consumer of the Social Stability Firm (ESEN) She denounced the violation of what was agreed in her mother’s lifetime insurance policy plan, right after a stroke that created her permanently invalid.

“My mom, a health practitioner by job, has paid for lifetime coverage considering the fact that 2007. In September 2021, she had a stroke, from which she was completely disabled, with a certificate from the medical board supporting it,” he stated. Yoana Perez Marshall in their social networks.

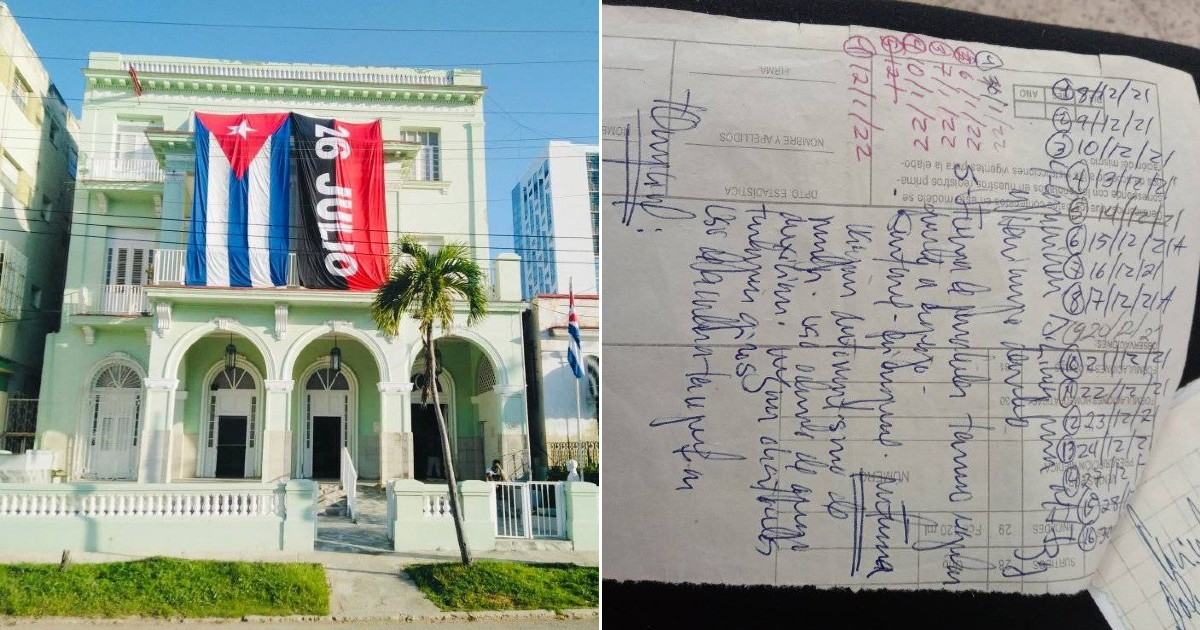

Soon after 6 times of hospitalization, the daughter handed in excess of the summary of the medical history to the insurance policies agent who helps her in the municipality of Marianao in Havana. “This is in which my ordeal commences,” complained Pérez Marsall.

“Up to now I have delivered all the documents requested by the agent I went to the medical center file to check with for his professional medical heritage, because the medical history summary is not ample and the rehabilitation summaries for 4 months, “he explained.

Nonetheless, just after gathering all the needed documentation, the organization continued to investigate the mother’s circumstance, intending to locate out if her mom “experienced substantial blood strain on admission.”

“If the blood force was higher or ordinary, does it transform the long term incapacity my mother has on her left hip, which was her key hand?” Asked the ESEN beneficiary’s daughter.

“According to what I read in the deal, ‘permanent disability’ is the lifelong reduction of purposeful potential of any member or organ of the body brought on by brain vascular accidents,” he explained.

The complainant claimed that he had all the documentation provided and acquired. “No a person from the insurance coverage company has visited my mom, nor has the fellow agent who is aiding me billed me much more for the insurance policy charge … I really don’t know why,” said the influenced daughter.

“Remember that my mom is retired and disabled, and she only promises the funds that is hers, for the reason that she has paid it into life insurance policy for 15 straight yrs. He isn’t going to request for help from anyone and feels cheated… A individual who must be serene ”, he claimed in a publication to which he turned“ right after possessing exhausted all means ”.

ESEN is component of the Grupo Empresarial Caudal, belonging to the Ministry of Finance and Selling prices. In his view site of the enterprise, the ESEN offers insurance plan for persons, also “daily life insurance policies” and which addresses the financial demands that arise in the celebration of the death of a man or woman whose own profits is decisive in the family members economy.

As advertised, daily life insurance plan addresses the adhering to risks arising from the death of the insured, due to permanent full or partial incapacity, short-term disability and pharmaceutical expenditures.

In the case of insurance masking long-lasting overall or partial incapacity, “those endured by the insured as a result of accidents, cardiovascular conditions, vascular brain ailments, diabetes and most cancers are insured delivered that the incapacity takes place in 12 months of the diagnosis of the ailment or harm “.

“I am however waiting for an respond to to a grievance offered to the Nationwide Insurance coverage Organization,” concluded the daughter of a Cuban physician who feels cheated by a condition corporation that sells guidelines that, according to her, do not respect the terms of the contracts they sign with their prospects.

In 2017, the information was known that ESEN paid additional than 990,000 Cuban pesos (about 39,600 pounds) from January to August of that yr. due to long-lasting disability to 63 Avilanese, at an typical of $ 628 apiece. In addition, it paid out 1,919,000 CUP (about $ 76,760) to the beneficiaries at danger of loss of life.

A calendar year later, information emerged that 88% of the cash paid out by ESEN to Ciego de Ávila it was supposed to compensate for losses in agriculture.

According to Cuban Information Agency (ACN)“Coverage is a variety of danger transfer through which the insured gets to be a creditor, on the basis of the payment of a comparatively compact remuneration (the top quality), of a considerably larger sized profit that the insurance provider will have to fulfill in the celebration of a assert , and this involves loss of life, professional medical charges, disabilities, fires, accidents, thefts and plagues, among the some others ”.

“The existence of insurance in Cuba at the second is insufficient, considering that according to modern data, it reaches only 25 percent of the possible market place of the territory, which reveals minor notion of danger in the populace and minimal lifestyle in this regard”, stated the ACN in June 2021.

Designed in 1978, the company “has between its aims the improvement of insurance and reinsurance operations for Cuban and international normal and legal persons, as properly as to have out preparatory and complementary functions to coverage, aimed at possibility evaluation and injury avoidance” .

–