The year before, the service at the branches was unified, and from last November the tariffs and business conditions of the “blue” merged ČSOB and “red” Postal savings banks into one document. The last phase will come this year: common internet banking.

According to so far only basic information for clients, it is not clear whether it will be only the transition of Poštovka to the existing ČSOB internet banking (in the change report the bank writes about its improvement), or whether a completely new internet banking will be created (as they suggest new business conditionswhich will take effect on 1 April).

“In the period from the effective date of the conditions, the transfer of clients from the Electronic Banking Services of Poštovní spořitelna and ČSOB Electronic Banking to the new ČSOB Electronic Banking services will take place,” the new business conditions state. They then use a different abbreviation for the joint product than for the current ČSOB internet banking. We will find out more details from the bank’s spokesman, we will add them later.

In any case, the change will not take place on April 1, but it should be gradual and specific clients will learn about it in time.

New identity

Even if it is only an improved form of their existing internet banking, at least one change awaits ČSOB clients. Instead of the current name and password, they will start logging in via ČSOB Identity. Some have voluntarily activated this before – so far it was needed mainly for multibanking (access to the account through other banks) and now also for verification when accessing the Citizen’s Portal and similar services. However, even clients with activated Identity continued to enter the internet banking itself – ie their account – with their previous login data.

“In the first half of the year, we plan a gradual transition of retail clients to ČSOB Identity services. This will replace the existing way of logging in to internet and mobile banking, “says spokesman Patrik Madle. Therefore, some clients who have activated Identity before will no longer have to remember two different login names and passwords. Newly, logging in to the account using Identity will become mandatory for all clients – so the remaining ones will have to activate it first. This is simply done through the current internet banking, but the conditions for the password are more complicated: at least nine characters and it must be a combination of lowercase and uppercase letters with numbers or special characters (a five-digit password is enough for the current account login).

ČSOB, together with Česká spořitelna, is the first to allow clients to make thanks banking identity easily accessed the state’s online services, especially the aforementioned Citizen’s Portal. All clients who have so far arranged a ČSOB Identity can now register with ČSOB. Anyone who has just reactivated it may encounter a delay of several minutes when logging in to the Citizen’s Portal for the first time: the state must first “register” it, ie compare its identity with state registers. About the novelty, which in the future will also offer verification against private companies (energy suppliers, telecommunications operators, e-shops, betting companies, etc.), we they wrote in detail in early January.

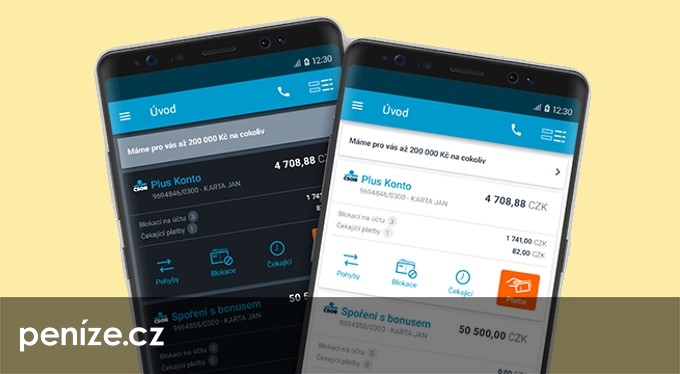

New mobile banking

For smartphones, ČSOB is preparing a completely new mobile banking called ČSOB Smart, which will replace the existing ČSOB Smartbanking. “It will be faster, clearer and will bring some interesting news,” he writes without further details.

It will also appear in mobile applications virtual assistant Katewhich will help arrange travel insurance or remind the card to expire.

Main changes in the tariff

From 1 April, ČSOB, including Poštovní spořitelna, will abolish the fee for changing the payment card limit for payments on the Internet and for transactions at the post office. In practice, this will help people who change the limit in person at a ČSOB or Czech Post branch, or by telephone. The bank introduced a fee of CZK 25 for such a change only from last November.

To make it not so easy: ČSOB will continue to charge a fee of CZK 25 for changing the payment card limit for payments at “stone” merchants or for ATM withdrawals. Of course, only if you want to make such a change at the branch, post office or telephone. On the contrary, via internet or mobile banking, any changes to the limits on the card are free of charge – nothing changes.

Clients from the age of 58 (with the benefit set on the Plus Account) will have free outgoing payments entered by credit card at the post office from April. The goal is to make it easier to manage their account.

On the other hand, fees for transactions that can otherwise be handled free of charge in internet and mobile banking will become more expensive for all clients. It’s about:

- cash withdrawal at a ČSOB branch (increase from CZK 80 to CZK 100),

- outgoing payments entered by a document at a ČSOB branch or by telephone (from CZK 75 to CZK 95), via a collection box (from CZK 60 to CZK 75) and a document at the post office (from CZK 40 to CZK 60),

- outgoing card payments at the post office (from CZK 25 to CZK 30, in addition to the above-mentioned benefits for clients aged 58 and over),

- cash deposit made by a third party to the account (from 100 to 125 CZK).