Table of Contents

Blockchain insight platform CryptoQuant has revealed 5 important signs that Bitcoin (BTC) may be nearing a high price. One of these signs has already begun to appear.

1. MVRV ratio

MVRV Ratio is an index that measures the market value of Bitcoin compared to the value created by recent sales. If this ratio is above 3.7, it usually indicates that the price of Bitcoin is approaching the highest point in the current cycle. Currently, this ratio is 2.67, which is still far from the required level. But it’s worth keeping an eye on. In February 2021, this ratio increased seven times when the price hit $60,000.

2. Fear & Greed Index is hot.

The index measures market sentiment on a scale from 0 (fear) to 100 (greed), with a level above 80 often indicating a bullish market. since the latest information CoinMarketCap The index has risen above 80 since November 12 and hit a high of 90 on November 17 and 19, a level not seen since February 2021.

3. New capital flows

The cryptocurrency market needs new capital to sustain growth. This currently continues to show an inflow of new capital. It is a sign of a bull market.

4. Record of Dog Days Destroyed (CDD).

Coin Days Destroyed (CDD) is an index that tracks Bitcoin’s long-held trend. By looking at how many of these coins are being moved or sold.

If this number is higher than 15-20 million, it usually means that long-term investors are starting to sell their coins. and it may be a negative signal for the price, and the latest CDD is at 15.1 million, which is close to the level to be careful.

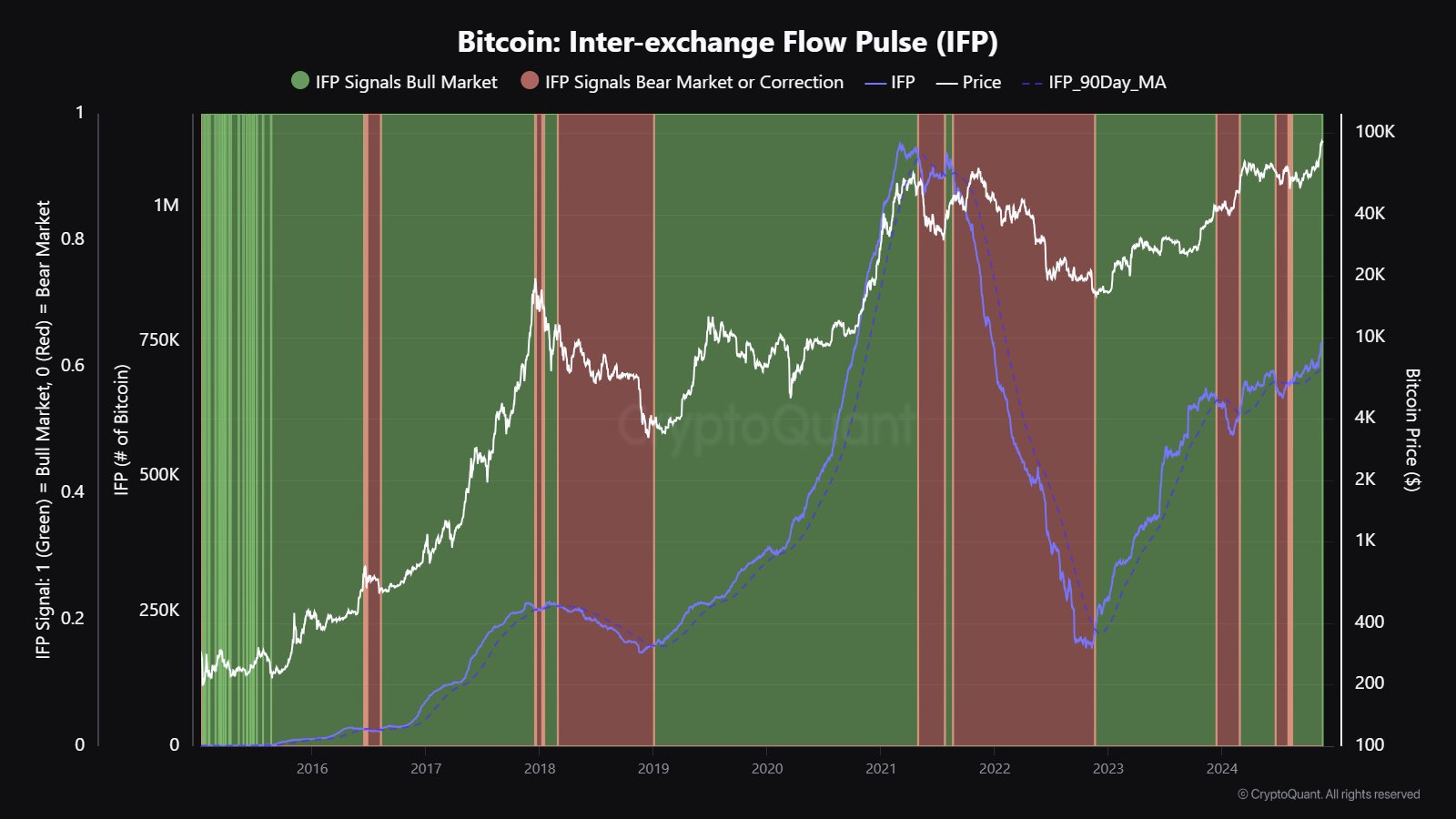

5. Interchangeable Current Pulse (IFP)

The IFP index measures the movement of Bitcoin between exchanges. Especially for the derivatives market to use as collateral Currently, IFP is at 730,000 and still shows a bull market structure. During the previous uptrend, IFP had reached a record high of 1 million.

However, the above article is just a news report. Investing in digital assets is risky. Investors can lose the entire amount. Therefore, investors should always research and assess risks before investing in any asset.

Source: Cointelegraph

2024-11-20 13:07:00

#CryptoQuant #reveals #dangerous #signs #price #Bitcoin #danger #falling #significantly #future

What are the key “danger signs” that could indicate a peak in Bitcoin’s price, as discussed in the article?

1. What are some of the “danger signs” mentioned in the article that suggest Bitcoin’s price could be nearing a peak?

2. How have these signs evolved over time, and what factors might be contributing to their emergence now?

3. What role do derivatives markets play in the current state of Bitcoin’s price movement, and could they potentially exacerbate any impending volatility?

4. What is the Interchangeable Current Pulse index, and how does it relate to the health of the Bitcoin market?

5. Are there any other metrics or indicators that investors should be aware of when assessing the potential risks and rewards of investing in digital assets like Bitcoin?

6. What are some strategies that investors can employ to minimize their exposure to risk while still participating in the cryptocurrency market?