Crypto credit, commonly known as crypto lending, is by far the largest sector in decentralized finance. The growth continues. But crypto lending has a big problem. The credit protection makes the business uninteresting for large customers.

Crypto lending still has great potential

The idea of lending without banks or central authority, without identification and without unnecessary paperwork took off by storm. Protocols like Aave and Compound popularized the principle.

According to Statista, there are currently more than 40 billion in funds in the entire crypto lending market. Crypto lending has a number of advantages over traditional money lending. The properties already mentioned increase the comfort for both sides significantly.

At the heart of the loan is a protocol that relieves the lender of a lot of work. The lender, which in this case is not a bank but a private investor, feeds the protocol with money. The borrower does the same. Because instead of an identification and personal screening, only a loan security has to be deposited. This means that fraud or a lack of cover on the part of the borrower can be ruled out.

On the one hand, funds can also be borrowed from people who would otherwise be considered unworthy of credit. On the other hand, in order to protect the lenders from possible volatility and to generate profits for them, a loan security must be deposited in advance, which exceeds the amount of the loan. This security is usually at a value of 120 percent of the loan.

The problem of securing credit

Ideally, all parties involved benefit. Instead of having to convert the much-loved cryptocurrency into fiat, a person can take out a loan and pledge their own cryptos as collateral.

Of course, he also gets the loan paid out in the form of crypto, which he can then exchange for fiat. If he pays off his loan in time, the security is paid out to him, which in the best case has increased in value.

However, the advantages that this principle offers also leave behind a decisive disadvantage. Individuals or institutions in need of credit rarely have the funds to post collateral in excess of the loan.

Accordingly, it is less about the actual granting of credit and much more about the well-known principle of the pawn shop. The customer is paid a lower value for a security provided. If something goes unplanned, the security will make up for the lost loan.

Crypto lending is therefore mostly associated with speculation. The possible clientele is therefore quite limited. If a new clientele is to be developed, new business practices are required.

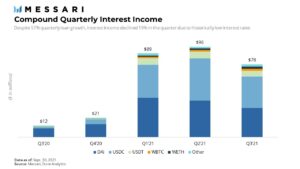

According to a report by Messari, crypto lending has skyrocketed, sending interest paid skyrocketing in absolute terms. However, the numbers have been declining since the third quarter of 2021.

The more lenders are involved, the lower the interest rates. Currently, more users want to borrow money than invest money. While interest in credit increased by 57 percent, the volume of money invested increased by only 48 percent.

Most investors deposited Wrapped Ethereum (wETH) and stablecoins USDC and Dai. However, the gap between the two groups narrowed. Messari believes that in a few months there will be more lenders than borrowers. The interest paid by the borrower would therefore fall sharply and could lead to a collapse of lending.

Krypto-Lending ohne Collateral

In the crypto scene, the term collateral refers to credit security. Crypto lending without collateral could attract new customers and at the same time increase the demand for the crypto loans. The collapse considered possible by Messari would then remain pure fiction.

The question is how such a system can be implemented in reality without betraying the basic principles of decentralized finance. The avant-gardist Aave has an idea for this. Aave calls the principle Credit Delegation.

Accordingly, a user provides a borrower with the necessary security. Instead of an automated protocol, personal agreements and trust play a role in this case.

In addition to the loan, the borrower also borrows the loan security, which is not dispensed with in this scenario either.

Aave calls the user who provides the security Delegator. He then agrees the contract personally with the borrower. All other details can either be recorded via smart contract or find a legal solution.

The delegator also earns money alongside the lenders from this deal.

Instead of the usual automation, this idea requires personal negotiation and trust. The risk is correspondingly high. Aave may also face a lot of trouble with this business idea.

The Canadian economist Campbell Harvey dedicated his own to this idea Video, in which he explains the principle in detail. He also mentions another thought: fixed rate loans.

Fixed Rate Crypto Lending

The interest rate, which has to be paid by the borrower and causes the lender to invest in the first place, varies depending on the liquidity of the loaned currency.

High and variable interest rates make loans uninteresting for many potential customers. There is now the approach of completely waiving interest and, in contrast, charging the borrower a fixed fee.

A platform that is already implementing the idea is called Liquity. In addition, Liquidity only requires collateral of 110 percent. This is a low value compared to the competition. Compound has also been selling the product since June 2021 Compound Treasury, at which the fixed interest rate of four percent applies.