Jakarta, CNBC Indonesia – The Composite Stock Price Index (JCI) has strengthened again this week, amid mixed sentiments this week.

The national benchmark stock exchange index rose 0.19% on a point-to-point this week. In the daily period, the JCI only corrected at the beginning of trading this week, namely on Monday (20/9/2021) and Tuesday (21/9/2021). On Friday (9/24/2021) trading yesterday, the JCI closed slightly up 0.03% to 6,144.82.

During the week, the value of JCI transactions reached Rp 64.2 trillion. Foreign investors were also recorded to have taken net buying (net buy) in a fairly large amount, reaching Rp 2.75 trillion in the regular market. However, in the cash market and negotiations, foreigners recorded a net sale of Rp 352 billion.

In the midst of the strengthening of the JCI this week, several stocks managed to score the biggest rally (top gainers) and posted the biggest decline (top losers).

According to data from the Indonesia Stock Exchange (IDX), of the six stocks that are top gainers this week, the average increase is more than 60%, there are even more than 80% so far this week.

The following is a list of stocks that have become top gainers this week.

|

– – |

Shares of listed plastic producer PT Yanaprima Hastapersada Tbk (YPAS) lead the row of shares top gainers this week.

YPAS shares have skyrocketed by more than 80% to a price of Rp 965/unit, from last week’s price of Rp 535/unit.

It is not yet known why YPAS shares skyrocketed by more than 80% and is leading top gainers this week. However, IDX itself has included YPAS shares on the radar of stock exchange supervision due to the unusual increase in the share price (Unusual Market Activity/UMA) on Tuesday (21/9/2021).

Responding to the volatility of its shares, YPAS itself has notified the stock exchange that the company is not aware of any material information or facts that may affect the company’s share price.

The next in the second position was occupied by property issuers, PT Andalan Sakti Primaindo Tbk (ASPI) which shot up 69.09% to the level of Rp. 93/unit this week, from the previous week’s price of Rp. 55/unit.

The stock with a mini market capitalization value (Rp 66.13 billion) had touched the auto rejection above (ARA) on Wednesday (23/9/2021), which skyrocketed to 34.55%, after previously being stagnant for 4 days.

Meanwhile, in the third position, there are shares of issuer of natural rubber processing, PT Indo Komoditi Korpora Tbk (INCF) which jumped 69.05% to the level of Rp 426/unit this week, from the previous week’s price of Rp 252/unit.

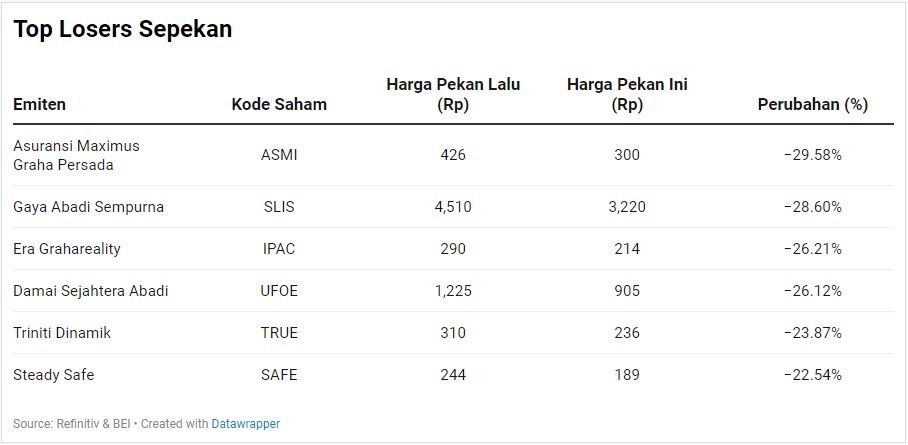

Meanwhile from list top losers, the stocks that entered the list this week experienced a correction on average range 22% to 30%.

The following is a list of stocks that have become top losers this week.

– –– |

Shares of insurance issuers, PT Asuransi Maximus Graha Persada Tbk (ASMI) led the way top losers this week, where ASMI shares fell by 29.58% to the level of Rp. 300/unit, from the previous week at the level of Rp. 426/unit.

ASMI shares were suspended by the IDX on Thursday (2/9/2021) early last September. However, a day later, on Friday (3/9/2021), the IDX opened the suspension of ASMI shares again.

Before being suspended by the stock exchange, ASMI’s shares were also included in the radar of stock exchange supervision due to the unusual increase in stock prices or UMA.

ASMI shares last closed in the green zone on August 10, after which this stock always closed in the red zone and often touched the limit. auto rejection bottom (ARB).

Next in the second position was the share of issuer manufacturer of electronic components and electric vehicle assembly, PT Gaya Abadi Perfect Tbk (SLIS), which fell 28.6% to a price level of Rp 3,220/unit this week, from last week’s price of Rp 4,510/unit. units.

SLIS becomes a stock that suffers auto reject down (ARB) in volumes in the last one month. From mid-August until now, the strengthening of SLIS shares only occurred on Tuesday (14/9/2021) and Wednesday (15/9/2021) trading last week.

Within a month, this stock price fell by 60% with an average daily decline of 4.21%.

In fact, since the beginning of this year, the stock price has gone up more than 3x. In mid-August the stock exchange authorities began to observe the pattern of unusual transactions in this stock.

While in third position, there are shares of property franchise issuers with the brand ‘ERA’, PT Era Grahareality Tbk (IPAC) which fell by 26.21% to the level of Rp 214/unit this week, from the previous price of Rp 290/unit last week. then.

IPAC shares were also included in the stock exchange’s surveillance radar due to the unusual increase in share prices (UMA) about two weeks ago.

CNBC INDONESIA RESEARCH TEAM

(chd / chd)

– .