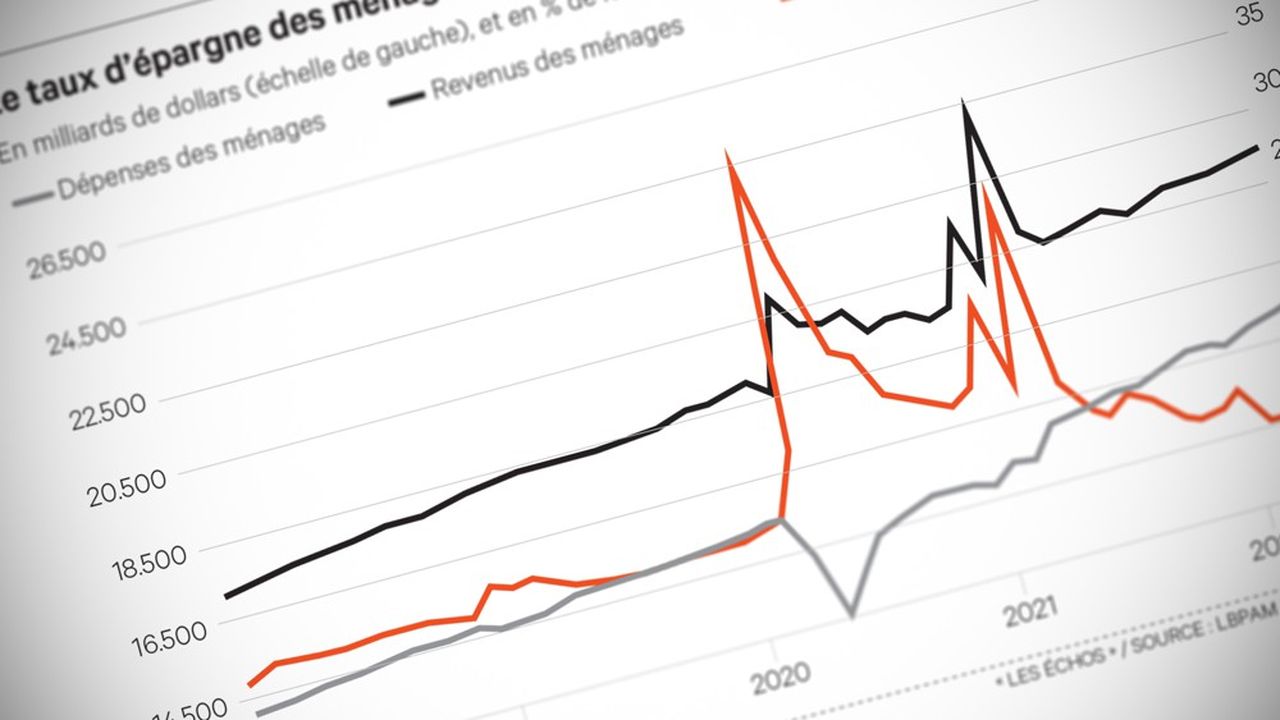

‘Saving is a wonderful reality, especially when our parents practiced it.’ Mark Twain’s compatriots prove him wrong. It was their own savings, accumulated during the pandemic period, that enabled them to reduce their savings rate (4.4% of disposable income) and provide a better than expected spring for consumption in April.

“This is reassuring for US growth in mid-2022, even if consumption should begin to slow in the second half of the year and the risks of a more marked slowdown than expected remain significant” judge the economists of La Banque Postal Asset Management.

They still assess the excess mattress, compared to the pre-Covid trend, at almost 10% of GDP, without forecasting a lower savings rate, because of the fall in asset prices, the rise in interest rates. borrowing and inflation.

To note

The estimated savings rate of American households in April _4.4% of disposable income_ is three points below its pre-Covid level and the lowest since the beginning of 2008, also notes LBPAM.

–

–

What changes the re-election of Emmanuel Macron?

What are the main challenges of the coming five-year term? To identify the challenges of this new beginning, the expertise of the editorial staff of Les Echos is invaluable. Every day, our surveys, analyses, columns and editorials accompany our subscribers, help them understand the changes that are transforming our world and prepare them to make the best decisions.

I discover the offers-