February Consumer Trend Survey Results

Consumption sentiment improved for the second consecutive month as the spread of the novel coronavirus infection (Corona 19) slowed.

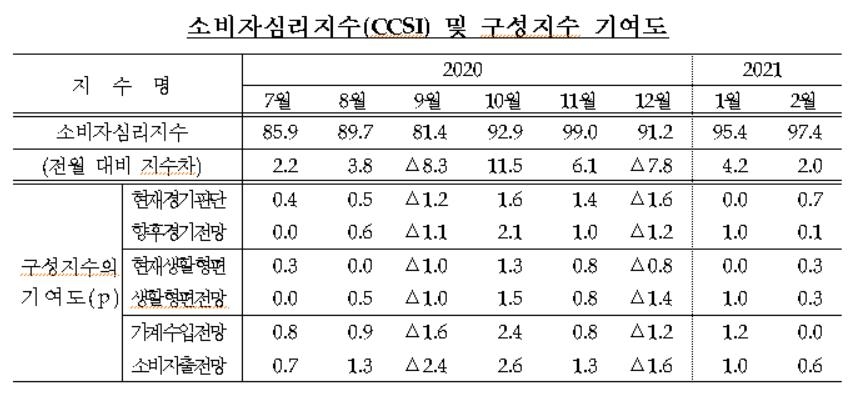

According to the results of the Bank of Korea’s Consumer Trends Survey (February 8-16) on the 22nd, the Consumer Sentiment Index (CCSI) for February was 97.4, up 2.0 points from a month ago.

As a result, CCSI increased for two consecutive months following January (+4.2 points).

The BOK analyzed that this was due to an improved awareness of the financial situation of the economy and households as the spread of Corona 19 at home and abroad had somewhat subsided and expectations for vaccination increased.

–

CCSI is calculated using six indices, including current life style, life style outlook, household income outlook, consumption expenditure outlook, current business judgment, and future business outlook among the 15 indices that make up the Consumer Trends Index (CSI).

If it is lower than 100, it means that consumer sentiment is pessimistic compared to the long-term average (2003-2020).

When looking at the contribution by constituent index, the current economic judgment index (63) and consumption expenditure forecast index (104) showed a relatively large increase at 0.7 points and 0.6 points, respectively.

The increase in positive views on the current economic judgment and future consumption expenditure forecasts led to the improvement in consumer sentiment in February.

In addition, the current life style letter index (87) and the life style perspective index (94) were 0.3 points, and the future economic outlook index (90) and household income forecast index (96) were 0 to 0.1 points, which is a complementary range.

Among the indices not included in the CCSI, the employment period index (80), the current household savings index (92), and the household savings prospects index (94) all remained at the level of January.

The interest rate level forecast index (104) rose 2 points, but the current household debt index (102) and household debt forecast index (99) fell 1 point.

The price level outlook index (144) rose by 2 points.

The wage level outlook index (112) showed the same value as in January.

–

–

–

The housing price outlook index (129) fell by one point for two consecutive months.

A BOK official said, “Although the nationwide apartment sale price is continuing to rise, the government’s announcement of a plan to expand housing supply seems to have dampened the sentiment of rising house prices.”

The inflation rate, which evaluated the consumer inflation rate one year ago and the expected inflation rate, which predicted the consumer inflation rate a year later, both rose 0.2 percentage points to 2%.

This is the first time since August 2019 that inflation and expected inflation rates have recovered 2%.

/yunhap news

–