In fact, the governor, Ron DeSantis, listened to the request of representatives, senators and thousands of voices who claimed to address the issue, before it is too late in an election year.

“We must try to do things with sanity and stabilize the insurance system to have a market that works,” said the governor.

“I’m sure we’re going to make it,” he said.

In fact, the House and Senate failed to reach an agreement on insurance during the legislative session that ended March 14, as insurers continue to look for ways to raise prices even higher while canceling policies to reduce financial risk. and refer people to the semi-state firm Citizens, which continues to add policyholders without being able to do so.

Background

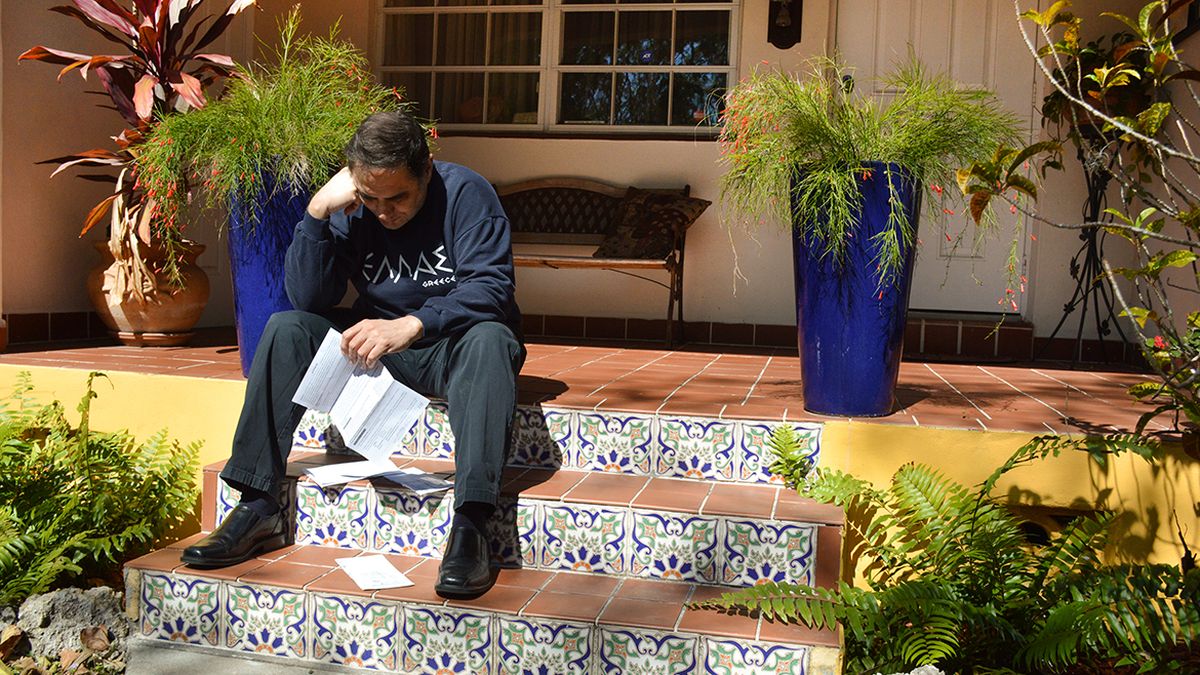

Mario bought his small house 25 years ago and still owes five years on the mortgage. The bank requires him to have home insurance and every time he receives the annual bill from the insurance company they add 1,500 or 2,000 dollars or more.

“When I bought the house in 1997 I was paying about $1,200 a year, and now it’s $4,500. It is not more because I have reduced benefits, if I were not paying 6,000 or 7,000, “explained the man.

Mario’s house does not face the sea, but it is located in Miami, where the amount to pay for insurance is usually higher than in North Florida, because it is in an area “more vulnerable to the danger of hurricanes,” where expenses and the losses are usually higher.

“If I don’t accept the increase, I’m left without insurance and the bank assigns me an even more expensive one,” he said. “I had to ask for a second mortgage to be able to cover expenses,” she stressed.

Francisco, a resident of North Miami Beach, did not receive a bill with increases this time, but something worse: a letter announcing the cancellation of the policy.

“It’s like starting over,” he reflected. “Seek insurance, pay inspection and wait for a response. In the end, I had to go to Citizens and it was the same story: inspection, waiting and more than 5,000 dollars to pay, ”she stressed.

Francisco, who already has his house paid for, chose to give up having insurance, but now he lives with the uncertainty that “if a hurricane takes my roof, I will have to go to the government to pay for the repairs.”

And that is the unknown that perhaps the legislators and the state government do not take into account. If a hurricane causes damage, both the state and the federal government will have to bear a large part of the costs.

In the north and central strip of Florida, where the great storms of the Tropic do not usually hit with the same force as in the south of the peninsula, insurance is cheaper. About $1,300 a year insures the property. And it is there, in the north and the central strip, where a good number of legislators accumulate who seem to ignore the clamor of those who live in the south.

more increases

Every year, the semi-public insurer Citizens, which feeds mostly on annual payments collected to meet outlays, plans to increase insurance rates, followed by private companies that dictate much higher increases.

Also, just a year ago, the state Congress passed HB76 Insurance law that limits the fees of lawyers who represent litigation against insurers, which greatly benefits insurance companies that used to pay the defense of both litigants.

At that time, the counselor for National Claims Adjusters in Florida, Humberto Hernández, told DIARIO LAS AMÉRICAS that, if the then bill was adopted, as it happened, “there would be no lawyer who wanted to represent a lawsuit because they would know that they would only win a percentage of the 20,000 or 30,000 claimed”. And in this way, as is happening now, “the owner is left alone, without legal representation, and the insurer benefits.”

Why

There are multiple explanations, depending on who answers the question why insurers seem to benefit each year and policyholders suffer the consequences.

Some say, like the president of Access Insurance, Mario Moreno, that “this is part of the legal course of the free market,” which favors the national economy so much. Although he also points out, very politically correct, “that there could be interests that could affect one solution or another.”

A month before the legislative session began in January, the president of the state Senate, Wilton Simpson, told this newspaper that they were working “to create a completely new rule to try to make home insurance more affordable”, but it did not happen.

In fact, the senator, and now aspiring to be Commissioner of Agriculture in the 2022 elections, acknowledged that “insurance will continue to rise, so it is very important that we do something about it and at the same time prevent fraud from occurring, which also raise prices.”

“The only way we are going to create more competition to reduce insurance costs is to make sure there is no fraud in the system,” he said.

According to All State, fraudulent claims, such as exaggeration of stolen items, intentional damage and fabrication of supporting evidence, have increased 20% in recent years, which it says cost the insurance industry in Florida millions of dollars.

“We know that there is fraud, but fraud barely reaches 1% of claims,” said the National Claims Adjusters counselor.

In that amount of fraud would not be included, for example, the owners who have a damaged roof or a window affected by old age and wait for the passage of a hurricane to claim expenses.

Meanwhile, Mario, Francisco and possibly millions more wait for a solution to pay less or at least have home insurance, which must take into account the pocketbook of Floridians, and now it is back in the hands of the legislators of the state of Florida.

–