Good that the Damrak was open today despite Ascension Day. After all, days where the AEX can add a nice profit on balance, are currently more than welcome.

While trading volumes – at least for most funds – were nothing to write home about, sentiment was positive and some stocks were able to regain some of their previously lost ground.

This applied, for example, to Just Eat Takeaway, Accsys and Ordina. The former fell (too) hard this year, Accsys recovered from yesterday’s fall (issue) and Ordina is among the major banks as various stock market experts popular.

Less popular – let’s nuance here that this is often regarded as ‘day noise’ – were funds such as JDE Peet’s. and PostNL. JDE Peet’s will undoubtedly also suffer from inflation and consumers who turn to B brands and PostNL has the – justified – fear that the group will not achieve the lowered outlook earlier this year.

All in all, somewhat dependent on the composition of everyone’s portfolio, not such a bad day at all, in which the AEX was able to add 1.3% on balance to 692 points and slowly regains sight of the 700-point limit. This is at the very least a correction for excessively overblown negativity and who knows, may be a reason for a somewhat longer recovery phase.

great day

Knowledge is one of the most important tools with which investors – in the long term – will make a difference. And knowledge is exactly what July 1 can be obtained in the near future from numerous experts who have more than earned their spurs.

The IEX Investor Day in ‘t Spant in Bussum has several appealing CEOs as speakers, such as the CEO of Ahold, CM.com and Ebusco, but also various stock market experts including Willem Middelkoop, Martine Hafkamp and our own Royce Tostrams.

Would you rather spar with the analysts of the IEX Investor Desk? They are also available throughout the day. And note: full is really full.

Nvidia

Nvidia’s price peaked at around $335 last November. There is now only roughly half of that left at a daily price of $158. The question then is which price is a true reflection of the value of the fund. An extensive analysis of the IEX Investor Desk gives a reasoned answer to this:

Nvidia: Demand remains strong, but 26. #NVIDIACorp https://t.co/8secVzKbu6

– IEX Investor Desk (@Investor Desk) May 26, 2022

Unilever

Unilever, like many other companies, is struggling with the consequences of far too high inflation. Complete and timely charging is simply not an option. However, that is now and investing is mainly about the future. Whether there is still something in the barrel at Unilever, read at IEX Premium:

Unilever could use some shareholder activism #UNILEVERPLC https://t.co/FQ8MRbaBNN

– IEX Investor Desk (@Investor Desk) May 26, 2022

Accsys

Wood breeder Accsys turned to the emissions weapon this week to strengthen its balance sheet and raise capital for further investments. This leads to a dilution of approximately 7%. That’s according to an analysis of the Investor Desk not insurmountable:

The money is running out at Accsys #Accsys https://t.co/Ku6F9gWNhI

– IEX Investor Desk (@Investor Desk) May 26, 2022

Expensive brands, healthy profit margins

Investing is a tricky business, especially now that prices are under heavy pressure. The first question investors should ask themselves is whether they want to be invested, followed by which sector, for example, and then also in which specific stock.

The Investors’ Desk has taken a detailed look at the sector of sportswear manufacturers. More concretely: Adidas, Puma, Nike and Under Armour. The mutual valuations vary widely and then the question is which of these four stocks offer the best returns. That answer is given here:

Expensive brands healthy profit margins https://t.co/NSORwbw0Wl via @IEXnl

— Martin Crum (@martinjancrum) May 26, 2022

Wall Street

Investors in the US were told that the US economy shrank by 1.5% in the first quarter (year-on-year). That is a bit disappointing, previously calculated at 1.3%.

This does not necessarily lead to the conclusion that the American economy is already in recession: a recovery in Q2 is expected, which means that this fraught term can be avoided at least for the moment.

The economic contraction did not really make a big impression, Wall Street started in good spirits, partly thanks to better-than-expected figures from retailer Macy’s. After a good two hours of trading, the Dow Jones was up 1.4%, the S&P 500 gained 1.5% and the Nasdaq peaked with a gain of 2.2%.

Annuities

Interest rates on the capital market appear to be on the upward path again. Proportionally, the Italian 10-year yield is worryingly high, especially since the country’s debt mountain fluctuates around 160% of GDP. And then even a relatively mild 2.9% hurts financially.

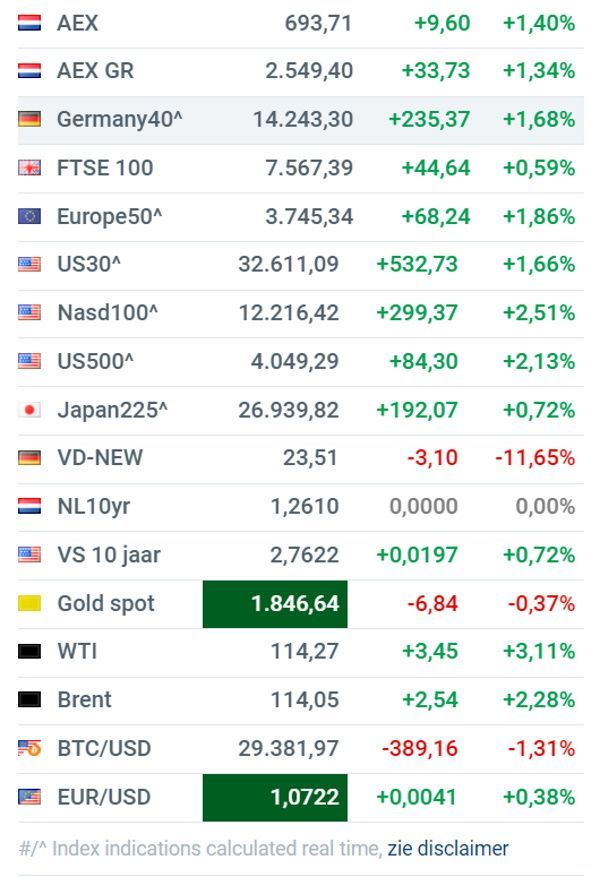

broad market

In the broad market, it is particularly striking that energy prices are rising sharply again. This time both oil and gas prices. A small $115 for a barrel of oil causes considerable economic damage, although the Opec+ countries will undoubtedly think otherwise.

Furthermore, it remains a battle with bitcoin around $30k, the VIX remains at an elevated level and there is still little to experience with gold and silver.

The Damrak

- Adyen (+5.1%) surfs along on the positive daily sentiment, but is still far, far below its ath. the fund has almost halved and that does not apply to the (strong) corporate performance

- Iron (+3.6%) is finally leading the way among the AEX chippers with a nice daily profit

- Just Eat Takeaway (+ 8.0%) tries again to get above €20, my Excel really shows a completely different real company value (disclaimer: I’m long myself)

- prosus (+ 4.2%) is also benefiting from the favorable (daytime) sentiment, but still has a long way to go

- Shell (+ 1.0%) has made a completely justified price catching up this year and is on its way to the €30

- Aalberts (+2.5%) is performing exceptionally well from a business perspective and the moderate price development does not accurately reflect this

- PostNL (-1.4%) was a bit weak all day

- BAM Group (+ 3.3%) remains in the picture with investors, easing concerns about the Afsluitdijk project will certainly play a role

- fugro (+ 4.4%) is now very far ahead of the game, the Investors’ Desk will shortly come up with an update whether the rally has not gone too far

- Sort (+ 3.3%) will remain popular with both major banks and professional investors for a while

- Gathering at the local market Better Bed (+ 3.6%) a nice daily profit

Advice (source: Guruwatch.nl)

- Prosus: to $93.10 from $164 and buy – Goldman Sachs

- DSM: to €188 from €189 and buy – Barclays

- Prosus: to $90 from $110 and buy – Citi Research

- Apple: to $180 from $210 and buy – Loop Capital

- Alphabet: to $2,950 from $3,550 and buy – KBC

- Meta Platforms: to $190 from $350 and keep it – KBC

Agenda 27 mei

08:45 Economic growth – First quarter final. (fra)

09:00 ASR – Ex-dividend

09:00 Van Lanschot Kempen – Ex-dividend

10:00 Money Supply – April (eur)

14:30 Personal Income and PCE Inflation – April (US)

4:00 PM Consumer Confidence Michigan – May Final (US)

–

Martin Crum is a senior investment analyst at IEX.nl. The information in this column is not intended as professional investment advice or as a recommendation to make certain investments. Crum can take positions on the financial markets.

-urxxuphk5fll.jpg)