The AEX (-1.2%) started the day with a small plus, but nothing is left of that at the end. Ironically, the trigger is a rock-solid US jobs report.

Rock-solid jobs report ruins sentiment

The US added 528,000 jobs last month, more than double the 250,000 the market was counting on. The unemployment rate of 3.5% was also lower than the consensus of 3.6%.

Even more striking is the strong wage growth. Wages rose by an average of 5.2% year-on-year in July, significantly ahead of the 4.9% economists expected. These strong job numbers make it clear that the US labor market has not yet cooled down.

This is of course also seen by the Fed officials, which has made a faster rate hike more likely. Equity investors in particular are not waiting for the latter. After all, the higher the interest rate, the less they are willing to pay for a share.

No reason to panic

On the other hand, we should not exaggerate this drop of slightly more than 1%. The AEX has rebounded considerably in recent weeks. The reinvestment index is only 7% in the red this year and we had signed up for that at the beginning of June.

Today it is the insurers that keep their heads above water. This comes as no surprise because companies like NN Group (+1.1%) in ASR (+0.5%) actually benefit from an interest rate rise, because income from fixed-income products is rising.

You should not have the chippers today. In particular ASMI (-4.7%) will suffer, although investors who entered at the beginning of this summer have nothing to complain about. The share has been absolute since the publication of the half-year figures on fire.

Galapagos

The market reacts enthusiastically to the half-year figures of Galapagos (+3.0%). Turnover rose a few percent to €274 million and operational cash burn fell to €217 million.

This cash burn is the result of the high investments in R&D. This should eventually lead to one or more blockbusters. The IEX Investor Desk is skeptical about this, because things have often gone wrong in the past.

The high cash position of €4.4 billion (€68 per share) forms a reasonable floor under the price. Still, analyst Martin Crum sees the stock correcting rather than rising further. You can read exactly how this works in the article below

Cost outweighs benefit at Galapagos #Galapagos https://t.co/bRyzZSopvi

— IEX Investors Desk (@Beleggersdesk) August 5, 2022

Ali Baba

Yesterday became Ali Baba (-4.2%) was rewarded with a small plus before its half-year figures, but today it completely surrenders all price gains. Not unjustly, because the half-year figures were nothing to write home about.

Growth – and that is not unimportant for a growth company like Alibaba – completely stopped in the second quarter. In particular, the performance of the cloud services is disappointing. Here, Alibaba only managed to achieve a 10% increase in turnover. By comparison, Amazon Web Services grew 33% last quarter.

On the other hand, Alibaba is priced considerably more friendly. The Chinese giant is trading at a multiple of 9 times its estimated 2023 profit. For Amazon, you already pay 40 times the profit.

You can read in the article below whether analyst Paul Weeteling considers Alibaba worth buying.

Alibaba cloud services growth is disappointing https://t.co/FG357PgE2U #Ali Baba #Investing #Stocks

— Paul Weeteling (@PaulWeeteling) August 5, 2022

Annuities

The movements in the interest rate market are unprecedented this year. Due to the strong jobs report, the US 10-year Treasury yield rises by no less than 17 basis points to 2.85%.

- Netherlands: +11 basis points (+1.22%)

- Germany: +13 basis points (+0.93%)

- Italy: +6 basis points (+3.00%)

- United Kingdom: +16 basis points (+2.04%)

- United States: +17 basis points (+2.85%)

The weekly lists

- AEX this week: -0.9%

- AEX this month: -0.9%

- AEX this year: -9.4%

- AEX reinvestment index this year: -7.8%

Herstelrally

European indices remained relatively close to home this week. The positive note is the Italian stock market with a gain of 0.9%. On Wall Street, especially the Nasdaq (+1.0%) to get the hang of it. In particular, the penalized technology funds have been in good shape lately.

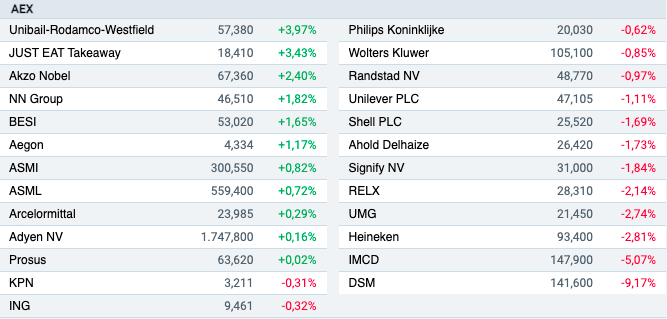

AEX

The numbers of DSM (-9.2%) were not bad at all, but the market is reacting like a wasp stung. Perhaps it is in the above-average valuation of the stock. The same applies to IMCD (-5.1%). The penalized stocks, on the other hand, are surfacing this week.

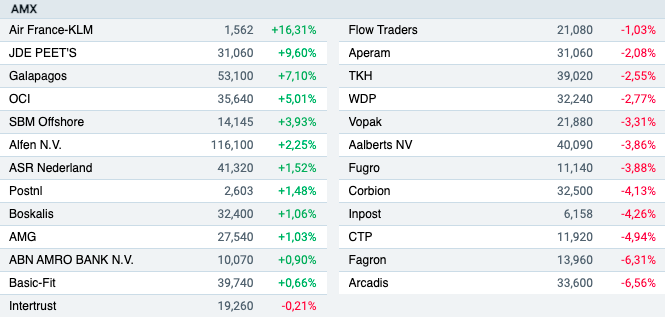

AMX

It’s a mystery to me why Air France-KLM (+16.3%) is rising so fast. The mountain of debt remains too high and the airline will never become a serious cash machine. But hey, the high volatility makes these types of stocks always fun to follow.

GOES Peet’s (+9.6%) is rewarded for its excellent half-year results. Fagron (-6.3%) lags behind because there is still no clarity about the problems in the US. Arcadis (-6.6%) has also been in bad shape since the announced acquisition of IBI Group. Although, the entire year is not enough at the engineering office.

ASCX

The stunner of the week is Pharming (+17.9%). Everything stands or falls with the market introduction of the drug Leniolisib. If the drug is approved in the first quarter of 2023, the biotech company could well become the share of 2023. If not, it will be a year to soon forget. I don’t dare to bet my money on it.

Finally, I wish you a nice weekend. This week Arend Jan writes the preview.

–