Equity markets initially fell sharply after disappointing inflation data from the US. Apparently the market has attracted the inversioncard of Uno, because the sentiment has changed completely in the last hour.

Interest rates also reversed, so stocks returned to demand. Perhaps this was – to put it bluntly – the time to vomit. Iron just earlier during the day it was still more than 10% less and closed just 1.7% in positive. I would like to give you a few more explanations, but it is almost impossible in this market. See our interest rate versus AEX below.

Consensus for US inflation in September was 8.1% Year after year. Unfortunately, the actual figure turned out to be 0.1% higher. This may have been a 0.1% drop from 8.3% last month, but we all know how exaggerated the market can react to minor news. Last month’s 8.3% was also a bit higher than expected and even then some stocks were (so to speak) burned to the ground. Today it shows once again that the market can return to that very quickly.

Internal email from ASML

From an internal email from ASML (-0.7%) to its employees, the company banned US employees from providing support, services or shipping products to customers from China until further notice. The reason is the new regulations of US President Biden. ASML must first find out which products are affected by these regulations.

ASML hasn’t been doing so well in recent months, technically speaking. The share is about 50% below the maximum and I know one person who is very happy with it: Arend Jan Kamp. “I stupidly buy ASML on every 10% drop. My scenario is that ASML can go down to -70% and I keep buying them. Buy and keepI hope I’ll never get rid of it again, or at least until my script takes off. And that’s what I assume she will remain a monopolist for the time being and a generous shareholder …Return generates, “Kamp writes in his interesting column on ASML.

#AEX -2.6%. @ArendJanKamp renounces Beursplein 5 and leaves “to Veldhoven for shares” #ASML buy in addition ” pic.twitter.com/9zOFQ8b0ip

– Pieter Kort (@Pieterkort) October 13, 2022

This is how Musk wants to finance Twitter

A genius, crazy or both? That’s always the question with Tesla boss Elon Musk. Next Tesla (+ 2.1%) still manages some companies. Think SpaceX, Neuralink, and The Boring Company. The latter company previously sold flamethrowers, but recently Musk had a new idea: to enter the perfume industry.

The best perfume on Earth!https://t.co/ohjWxNX5ZC pic.twitter.com/0J1lmREOBS

– Elon Musk (@elonmusk) 11 October 2022

But the idea comes from Elon Musk, so obviously it couldn’t be a normal smell. No, the new one fragrance from Musk it is called Burnt hairthat is, burn it. A good joke, I thought to myself, but it turns out actually for sale to be. According to Musk himself, on the first day of the sale, more than 20,000 people have already purchased a fragrance worth $ 100. Twitter (+ 1.5%) Musk joked (I hope) today that he wants to fund the Twitter acquisition with this. Ambitious, because then just under 440 million bottles remain to be sold.

Please buy my perfume so I can buy Twitter

– Elon Musk (@elonmusk) 12 October 2022

Heavy weather ahead for ING

ING Group (+ 3.2%) earlier this week announced a so-called Note on comparative quarters. This is a slightly different communication tool than that Pre-gain note that the bank came up with just before the second quarter figures. Think of it as a bit of market service: the details of 3Q21 are repeated so that the market is able to better judge the 3Q22 data on its own merits. Exceptional they are part of it, especially at large banks operating in different countries: every quarter there is something different to report

While the ING Group is expected to have a relatively good third quarter with the improving interest rate environment for banks, the general economic climate is not. This is rapidly deteriorating and a recession is inevitable. According to analyst Martin Crum, some caution is therefore required. You can read all about it in his analysis of the ENG.

Heavy weather ahead for ING https://t.co/vtKzdEWlrr #IEX

– IEX.nl (@IEXnl) October 13, 2022

The hardest drop for TSMC this year

TSMC (-0.6%). The decline is mainly due to the poor macroeconomic outlook and geopolitical tensions.

The hardest drop ever for TSMC https://t.co/MdNcI9dfCw #TSMC #Invest #Actions

– Paul Weeteling (@PaulWeeteling) October 13, 2022

Round of questions

Tomorrow, of course, a brand new episode of IEX InvestorsPodcast will appear. This also means that you can leave all your questions to analyst Niels Koerts or market commentator Arend Jan Kamp in the comments.

Annuities

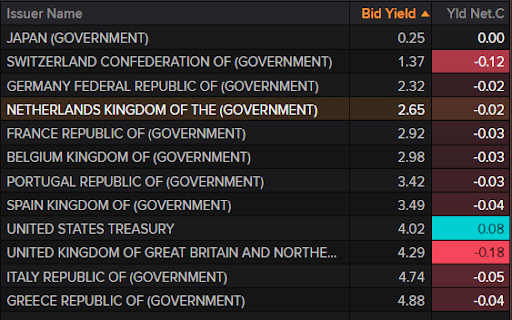

Interest rates were all over the place today. Eventually, we dropped two basis points, taking the Dutch 10-year yield to 2.65%.

Wide market

- The AEX (+ 0.3%) underperformed with the German DAX (+ 2%) and the French CAC 40 (+ 1%).

- The CBOE VIX (Volatility) index falls to 31.9 points. High, but we haven’t seen real volatility yet, so above 50.

- Wall Street trades as follows: S&P 500 (+ 1.7%), Dow 30 (+ 1.9%) and Nasdaq (+ 1.4%).

- The euro was up 0.8% against the US dollar at 0.998.

- Gold (-0.4%) and silver (-0.9%) are down.

- Oil: WTI (+ 2.4%) and Brent (+ 2.3%) are up.

- Bitcoin (-1.8%) is trading at a minimum.

The Damrak

- The next quarterly data of Ahold Delhaize (+ 1.6%) will once again confirm the strength of the supermarket company’s business, both in the United States and in Europe. This is what analysts have come to expect from UBS ahead of the November 9th update.

- Analysts expect the profitability of steel companies such as ArcelorMittal (+ 2.3%) will be under pressure from high energy costs. Of course, this applies to all heavy industry companies.

- Fagron (-10.9%) is severely punished on the stock exchange today. The share is more than 7% lower, while the turnover figures were at first sight reasonably up. Revenues increased 21.5% to € 173 million, a better fraction of the consensus of € 171.8 million. Analyst Niels Koerts believes that Fagron does not help private investors in presenting the data. The drug manufacturer reports no fewer than four different growth figures. It would be the management’s credit if there was clearer communication with shareholders. Fortunately Koerts has it in his Fagron’s analysis all taken for you.

- Tom Tom (+ 1.5%) is likely to have plunged back into the red in the third quarter, but less deeply than last quarter. This is the expectation of analysts according to the commercial consensus of the navigation specialist.

- It is clear that the fund office NSI (+ 1.1%) is completely surprised by the government’s measure of ending the FBI regime by 2024. The company is doing very well on its own, but many environmental variables are transforming dramatically against NSI. CEO Bernd Stahli talks about a “storm” raging at the bottom. Read all about it in the last analysis by NSI.

Tips (source: Guruwatch.nl)

- Fagron: at 21 € from 23 € and buy – Degroof Petercam

- Postnl: at € 1.85 from € 3.60 and reduced to keep – ING

- Just Eat Takeaway: at 20 € from 26 € and buy – Goldman Sachs

- Just Eat Takeaway: at € 18 from € 19 and keep – Sanford C. Bernstein & Co

- Prosus: at 78 € from 90 € and buy – Citi Research

Agenda Friday 14 October

03:30 Inflation – September (Who)

04:00 Balance of Trade – September (Chi)

08:45 Inflation – September (Fra)

11:00 Balance of trade – August (euro)

2:30 pm Retail Sales – September (US)

14:30 Import Prices – September (USA)

16:00 Michigan Consumer Confidence – October vlpg (USA)

16:00 Company Inventories – August (US)

Coen Grutters is the editor of IEX. The information in this column is not intended as professional investment advice or as a recommendation to make certain investments. Click here for an overview of the investments of the IEX publishers.