In the Chicago market, very good prices are maintained in wheat in the face of a world balance that is projected to be adjusted, while soybeans continue its downward path.

In the last week, wheat contracts in the Chicago market had important increases, accumulating a gain of more than US $ 13 / t in the last 6 trading rounds.

Among the main fundamentals is the latest quarterly stock report published by the United States Department of Agriculture (USDA) on Thursday, September 30, showing a 1.4 Mt drop in wheat storage in the United States, with a total record of 44.8 Mt. This figure was found below what was discounted by the market, giving a boost to prices.

It is important to emphasize that the 2021/22 harvest has already started in the northern hemisphere, and some key countries did not have favorable results. Among them are Canada, Russia, Ukraine and the United States, which recorded significant drops in production, partially tempered by the recovery exhibited in the European Union as a whole, in relation to the previous season.

According to the USDA, world production would be at historical records at 780 Mt, although the growing global consumption (787 Mt) would exceed the total harvest and would keep the world cereal balance very tight. At the same time, greater certainties are still lacking regarding the production to be obtained in the countries of the southern hemisphere, considering that a critical period for cultivation is being entered.

At the local level, GEA of the Rosario Stock Exchange estimates a 2021/22 production of 20.5 Mt, or 3.5 Mt above the previous cycle. According to the information provided by the Ministry of Agriculture, Livestock and Fisheries (MAGyP), most of the crops in the central area of Santa Fe and Córdoba are in a general state between Good and Very Good, as is the key region in the south of Buenos Aires. However, the northern part of the country, once again, has a water deficit that would be affecting the state of wheat in general terms.

Due to the high global consumption of wheat due to the greater use for animal feed and industrialization, negative adjustments are projected in the final stocks of the 2021/22 cycle, mainly in the main exporting countries (shown as G8 in the graph). The pressure of the importing markets would cause to lose inventories by 42 Mt at the end of the 2021/22 cycle, representing a fall of 17.55% compared to the 2020/21 season for the group of the main exporting countries; These are Argentina, Australia, Canada, the United States, Kazakhstan, Russia, Ukraine, and the European Union. For the rest of the countries, meanwhile, the final stocks would remain stable at 241 Mt.

This adds additional pressure to the global wheat market, since the volume of grain in the hands of those who really have the necessary logistics to supply the world is the critical point when balancing import needs with available cereal

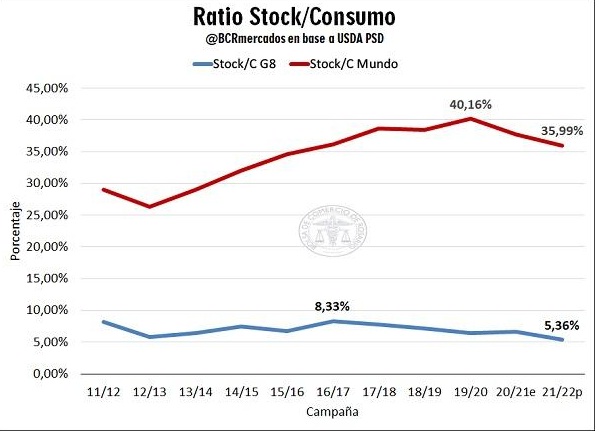

A key indicator to deepen the analysis of the global supply and demand balance is the Stock / Consumption ratio, which shows the level of grains in stock with respect to the needs of demand. When the quotient falls, it means that there are few stocks in relation to what is consumed, so prices tend to rise. According to USDA data, the stock of the main exporting countries in relation to world consumption for the 2021/22 season would fall to 5.36%, continuing with a downward trend after having reached a peak of 8.33% in the 2016 season. / 17 and even below the 5.83% registered in the critical 2012/13 campaign. At the world level, this indicator would be down for the second consecutive season, standing at 35.99%, in line with the solid international demand for wheat.

Read also

Weather forecast for October, November and December

Regarding the soybean market, the price of the oilseed in the Chicago market was US $ 457.1 / t on October 6, close to a minimum of the last nine and a half months. In this way, after having reached a maximum of US $ 610 / t in the month of May, a very important drop of US $ 153 / t is observed in a key crop for Argentina. This is mainly due to the good harvest rhythm that is taking place in the productive regions of the United States. On the other hand, after a month has elapsed since the beginning of the US soybean campaign, oilseed exports stand at 1.8 Mt compared to the 7 Mt registered the previous year at the same time of year. In addition, the USDA quarterly stocks report published last week showed a storage of the North American bean above that expected by the market, which ended up putting downward pressure on the prices of the grain.

Despite the aforementioned, if the price comparison is observed in year-on-year terms, the price of soybeans in Chicago is still 19% (↑ US $ 73.5 / t) above that registered last season in the same moment.

–