This article was written exclusively for Investing.com.

The September 22nd seems to have reserved many surprises. The first, for many, was Powell’s firm tone at the press conference that QE may soon begin to decline. The next was forecasts of a rate hike in 2022 and 4 hikes by the end of 2023. Most markets responded correctly, with soaring and rising yields.

The yield curve has changed quite drastically, with rates across the curve having risen since 2 years, with a significant increase in bonds now climbing nearly 8 basis points (bps) to around 30 bps. Meanwhile, rates a, e rose by 16 bps or more.

Flattening of the curve

The immediate impact was that the yield curve flattened, but began to slope as the. Perhaps most importantly, the overall yield curve has flattened dramatically since early spring, when it stood at nearly 1.6%.

10-year Treasury Bonds daily chart

This is a subtle but very important change, because the front of the curve is going up while the long one is not growing fast enough. It’s the bond market’s way of suggesting that there will be a much more interventionist Fed going forward, but for an economy that probably won’t grow that fast.

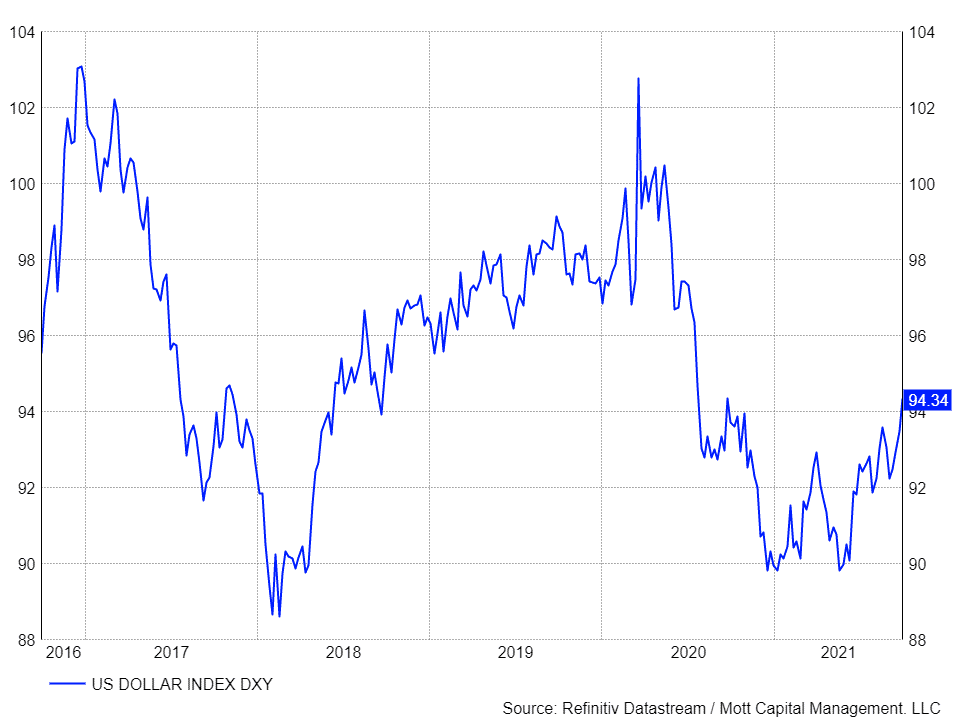

Soaring of the dollar

The dollar index seems to confirm the idea given by the yield curve, spiking to the highest since autumn 2020. It makes sense that the dollar will strengthen if the Fed ends QE and shorter-term rates rise. The dollar also appears to be preparing for a more interventionist Fed.

—

—

Dollar index daily chart

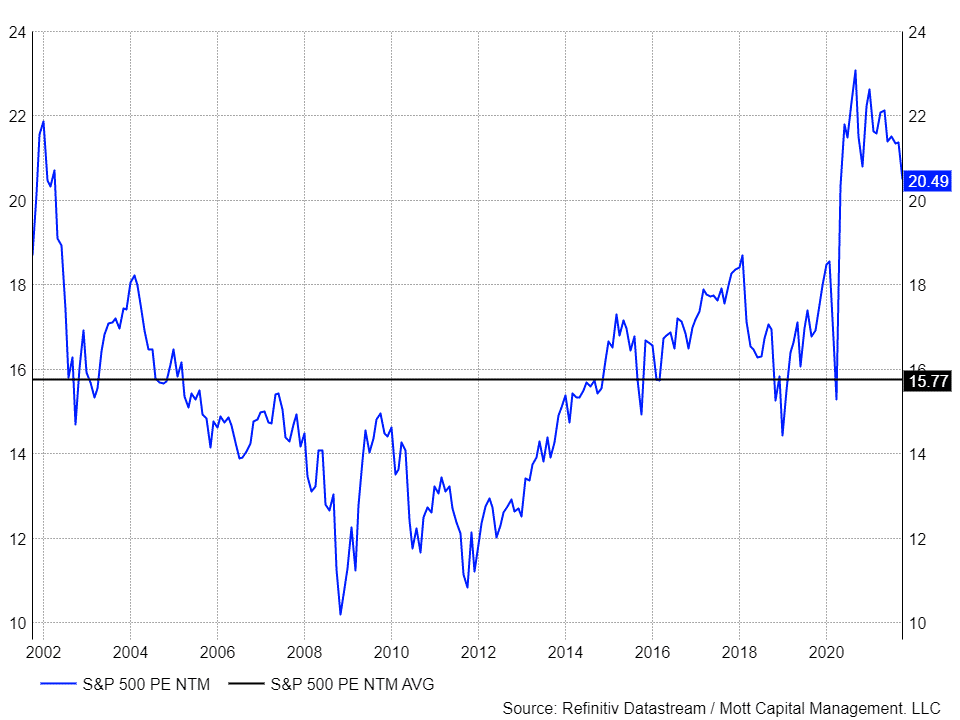

The unprepared shareholder

The stock market seems unprepared for this paradigm shift. The valuation is still at historically high levels, with the index trading at around 20.5 times the 12-month earnings estimates. Although the PE ratio has dropped from its peak of 23.5 in September 2020, it is still very high compared to historical levels. Over the past decade, the index averaged 16.6 and over the previous 20 years, it averaged 15.7. The only period in which there was a similar multiple was in the late 1990s.

The valuation of the S&P 500 indicates that the market still expects a super accommodative Fed and solid economic growth. The yield curve suggests the exact opposite. The stock market seems to finally be starting to realize this idea, with the index peeling off about 5% from the highs, but the multiple suggests that there are still many more bearish risks to come.

—

—

On top of that, it would seem natural for the stock market to resist a change in monetary policy by the Fed, especially one of this magnitude. The same scenario occurred in the fall of 2018, when the Fed planned to continue raising interest rates. The market struggled against the Fed’s monetary policy stance and ultimately won.

Rising bond yields and a strong dollar will mean equity prices will have to fall, and the higher they go, the more the market will be convinced of a more interventionist Fed. Let’s put in a bit of a slowdown in growth and we have a recipe for a crash in the stock market similar to that of 2018.

–