Original title: Bullish next week: A-shares will end steadily. The stock daily limit mentioned on Wednesday!

On Thursday, the Shanghai Stock Index opened lower and moved higher. The ChiNext saw a sharp drop in early trading, but then pulled back and closed up. There are the last 4 trading days next week, and it is expected to end smoothly.

The Shanghai stock index did not fall on Friday, which means that the small c wave did not start, so it will hit 3,423 points next. Judging from the China Securities Bank Index, the anti-dumping started after the shock broke, and the MACD bottom of the hourly chart deviated, which means that the anti-dumping will continue and the target is the previous shock platform area. The same is true for the securities sector index, which is expected to continue to rise. This will support the Shanghai stock index to continue to rebound. The GEM bottomed out and rebounded. For the GEM index, there is still hope of a false breakthrough of 2896 points, but it is still only the last inducement.

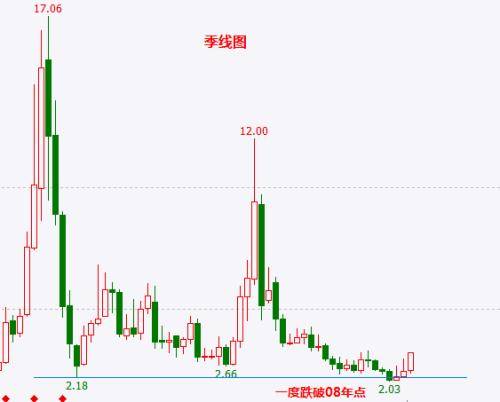

After the wine sector weakened, the power, gas and heating sectors relayed, and resource stocks rebounded again, which will at least support the index fluctuation. I mentioned a stock on Wednesday. The idea of choosing it is to “short-term change to long-term” (See “What should I do if I am afraid of missing opportunities and not willing to cut meat? Take a look at this stock…”). That is to say, the short-term sector started under favorable stimulus, and the technical form is relatively good, and it has certain potential; from the long-term perspective, the stock is at an absolute low position, and the power industry in which it is located is a public utility, with a certain periodicity but there is no so-called recession , And is a state-owned holding, the probability of delisting is close to zero. It can be said that this kind of stock is equivalent to entering, attacking, retreating and defensive. If you can make a short-term profit, you can leave. If you get a set, you will fall down first. The stock’s daily limit on Friday means that even if it is chasing the highest point on Thursday, it is currently profitable, and it will have a chance to make a profit next Monday. If an investor buys, then I congratulate you, but I don’t care when I leave the market, anyway, it won’t hurt you. And if I chase it next week, it won’t be my responsibility if it is covered.

The food and beverage sector has continued to adjust recently, but I personally think that some stocks have short-term opportunities. For example, a beverage leader shrinks and pulls the cross star on Friday, which may be a signal to stop the decline, and there is an arbitrage opportunity in the short-term (the medium and long-term is not very optimistic). Of course, it is unrealistic to expect such stocks to rise continuously in the short-term. This is a “faced stock”, but the trend is relatively stable. The stock’s performance is stable. The current rolling price-earnings ratio is close to 20 times, which is reasonable. Although it is not a state-owned asset, it has a hard brand. Currently, social security and pension funds are included. The probability of delisting is also very low. Even if it is eliminated, it is only time problem. In the future, stock selection is safety first. Don’t deliberately pursue profiteering. In the near future, we are going to continue to “pull generals from the scorpion”. There is really no need to talk about the market. Let’s talk about individual stocks to make up the number of words… (Source: public account “Blackmouth Terminator”)

Source: Financial industry websiteReturn to Sohu to see more

–

Editor:

–

Disclaimer: The opinions of this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides information storage space services.

.