Although the retail sales data in January was significantly better than expected, US stocks opened lower on Wednesday (17th). The Dow Jones Industrial Index fell nearly 100 points or 0.3% at the opening, the Nasdaq Index fell nearly 1%, and the S&P 500 Index fell. 0.6%, fee half fell 1.3%. The Federal Reserve Bank of America (Fed) will announce the minutes of its January interest rate meeting on Thursday.

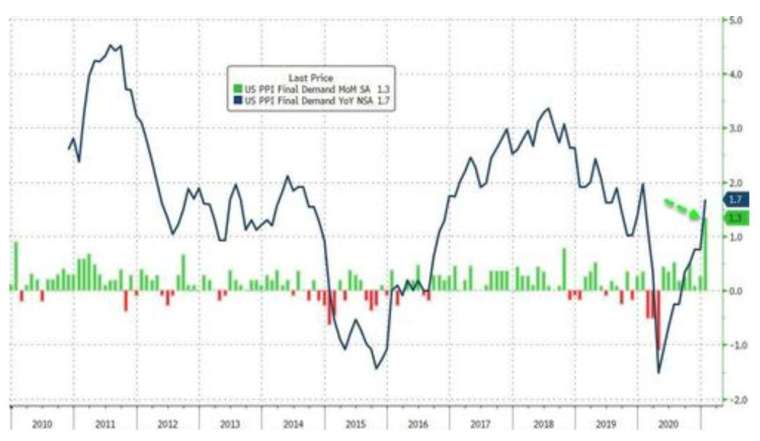

Benefited from the improvement of the epidemic and government stimulus measures, the U.S. Department of Commerce announced a significant rebound in January retail sales, with a monthly increase of 5.3%, which was far better than market expectations. On the other hand, the U.S. Department of Labor announced the January producer price index (PPI). ) Surged 1.3%, the biggest increase since December 2009.

Some market analysts believe that the surge in consumer spending has exacerbated the market’s concerns about rising inflation.

With inflation expectations heating up, the 10-year U.S. Treasury yield hit a new high in nearly a year on Wednesday, reaching 1.331%, and fell slightly after the market opened on Wednesday.

The Fed will announce the minutes of the January interest rate meeting at 3 am on Thursday (18th) Taipei time. The Fed previously promised to maintain interest rates close to zero and maintain the speed of bond purchases until it achieves maximum employment and price stability. So far.

Commodity section, toUSDDenominated gold fell below 1780 USDContinue to bear pressure after the checkpoint. After reports of Saudi Arabia’s plan to withdraw production reduction measures, oil prices plunged before the opening of US stocks, and the international benchmark Brent crude oil fell 0.17% to 63.2 per barrel. USD, WTI crude oil fell 0.7% and fell below 60 USDMark.

As of 22 o’clock on Wednesday (17th) Taipei time:

- The Dow Jones Index fell 99.36 points, or -0.32%, to 31,423.39 points temporarily

- Nasdaq fell by 136.14 points or-0.97%, temporarily reported at 13911.36 points

- The S&P 500 Index fell 23.33 points or -0.59%, temporarily at 3909.26 points

- Fees and a half fell 43.52 points or-1.34%, temporarily reported 3195.40 points

- TSMC’s ADR fell 0.86% to 138.84 per share USD

- The 10-year U.S. Treasury yield fell to 1.297%

- New York Light Crude Oil fell 0.68% to 59.64 per barrel USD

- Brent crude oil fell 0.17% to 63.24 per barrel USD

- Gold fell 1.25% to 1,776.50 per ounce USD

- USDThe index rose 0.57% to 91.02 points

Focus stocks:

Chevron (CVX-US) Rose 1.34% in early trading to 94.38 USD;Verizon(VZ-US) Rose 3.31% in early trading to 55.94 USD。

According to the filing, Berkshire Hathaway, the holding company of the stock god Buffett, bought communications giant Verizon and oil giant Chevron in the third quarter of last year. As of December 31, Berkshire held a value of 8.6 billion.USDVerizon stock, and 4.1 billionUSDChevron stock.

Slack(WORK-US) Fell 1.63% in early trading to 43.56 USD;Salesforce(CRM-US) Rose 0.36% to 249.49 USD。

The US antitrust regulatory authorities required Salesforce to submit more information and documents regarding the Slack acquisition transaction. Despite this, the company still expects the transaction to be completed before the end of July. Salesforce announced that it would spend 27.7 billion at the end of last yearUSDAcquired Slack.

Hilton Worldwide (HLT-US) Fell 1.28% in early trading to 112.16 USD。

Under severely hit by the epidemic and travel restrictions, Hilton announced on Wednesday that its revenue plummeted 62% to 890 millionUSD, Lower than expected, the adjusted loss per share was reported at 10 cents, well below analysts’ expectations of 4 cents per share. Although the anti-epidemic restrictions have been looser, which has driven the occupancy rate to rebound from the low of last April, the mutant virus still suppressed the recovery of the hotel industry.

Key daily economic data:

- The annual growth rate of retail sales in the United States in January reported 7.4%, the previous value was lowered from 4.8% to 2.5%

- The monthly growth rate of retail sales in the United States reported at 5.3% in January, and is expected to be 0.8%. The previous value was revised down from -0.7% to -1.0%

- The US January PPI annual growth rate reported 1.7%, which is expected to be 0.8%, and the previous value is 0.8%

- The monthly increase rate of the US PPI in January was reported at 1.3%, which is expected to be 0.4%, and the previous value is 0.3%

- The US core PPI annual growth rate in January reported 2.0%, expected 1.1%, previous value 1.2%

- The monthly increase rate of the US core PPI in January reported 1.2%, which is expected to be 0.2%, and the previous value is 0.1%

- At 23:00, Taipei time, the February NAHB real estate market index will be announced, which is expected to be 83.0 and the previous value is 83.0

Wall Street analysis:

Derek Halpenny, director of market research at Mitsubishi UFJ Bank (MUFG), said that the recent rise in U.S. bond yields has caused some investors to re-evaluate their appetite for risky investments, especially considering the high valuations of many stocks.

Bastien Drut, senior strategist at CPR Asset Management, pointed out that the company is still optimistic about stocks. Although there is room for further increases in bond yields, economic growth is a major factor that drives higher yields and stock prices.

As the stock market continues to hit new highs, some strategists warn that the market may need a breather next.

Cannacord Genuity strategist Tony Dwyer released a report on Tuesday that the market is ready for a correction, but at this stage the focus should still be on core fundamentals and global inflation.

–