There are hard times on home bonuses because the Draghi government and the Revenue Agency absolutely want to counter the too many frauds that have emerged on these bonuses.

In fact, the Conte government had very much loved home bonuses and had considered them a precious tool but the government Draghi has started a new counter action on home bonuses and the very last to request it will have the heaviest checks.

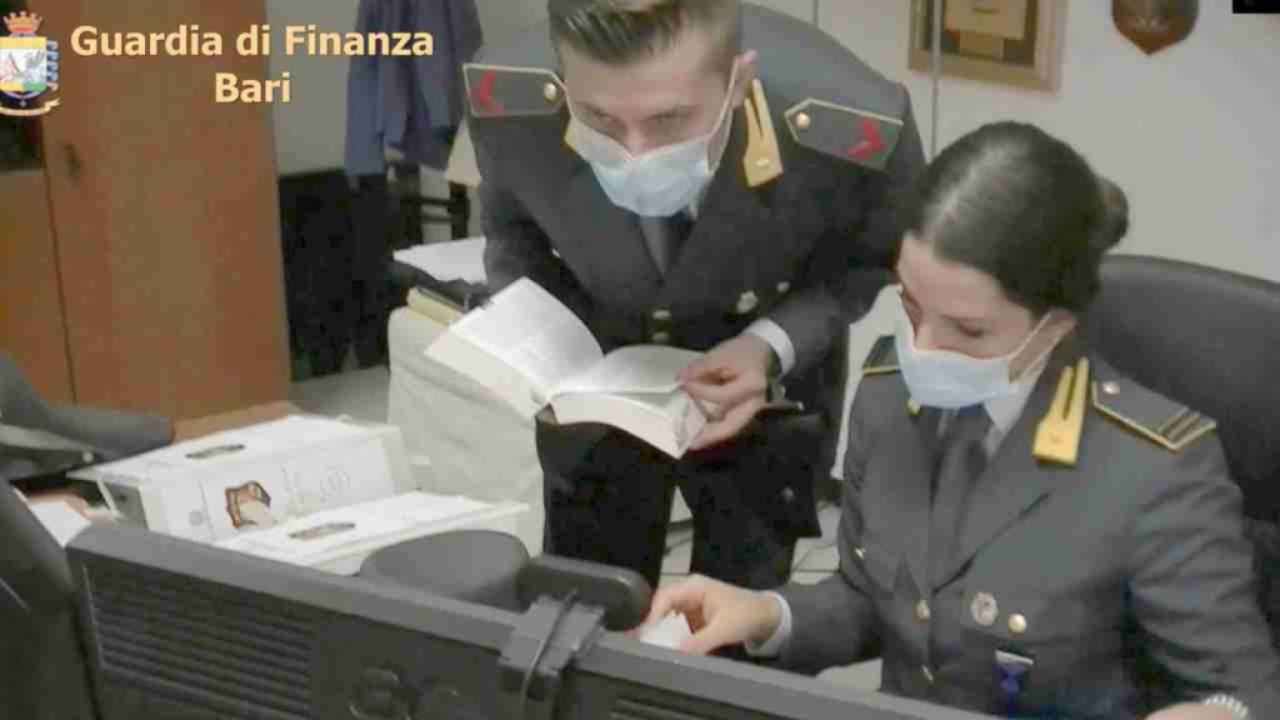

Let’s see what’s going on. Too many frauds have surfaced on home bonuses and so the Draghi government gave a mandate the Revenue Agency to carry out really tough controls.

Too many frauds and new controls

Almost 6 billion frauds have emerged on home bonuses and therefore even if the government also blames the increase in costs what matters at the Revenue Agency it is precisely to discover all the scams.

With a series of circulars, the Inland Revenue has clarified what the criteria will be for stating the crafty home bonus. The Revenue Agency it will compare the value of the property with the value of the bonus requested. If these two values appear not very compatible, there will be heavy and even investigations sanctions. Many will be forced to return the bonus because very easily these values will not coincide or will not be anyway compatible.

New entries circulars

Also the patrimonial situation of the recipient of the house bonus will be compared with the value of the bonus itself. In short, all the various parameters relating to the bonus to the property and to the applicant they will be crossed to see if there is something wrong. A great deal of attention will be paid also to the various companies that have done the work. In fact, if these companies have collected too many jobs with the house bonus or if they appear suspicious in some way, even the beneficiaries will be able to get in the way.

The new parameters

In essence, the new controls will be very insightful precisely on the last ones to have requested it. In fact if it will take time to check the first beneficiaries of the bonuses home controls on the last will be really tight. For these checks, the government intends to use artificial intelligence. In fact, the Revenue Agency currently makes use of powerful tools that they can cross even a lot of sensitive data and therefore for the crafty it will be really impossible to avoid them.

–