–

–

On the night of June 13, the price of the first cryptocurrency dropped to levels near $25,000, Ethereum – to $1300.

At the time of writing, the quotes of the first cryptocurrency fell below $24,700.

The price of Ethereum is holding near $1260.

Bitcoin has failed the $24,000 level.

–

Bitcoin quotes fell below $23,000 (-17.1% per day, according to CoinGecko). In the futures market, the total volume of liquidations approached $1 billion.

Ethereum has fallen in price over the past day by 20.1%, to $1192. The total capitalization of the cryptocurrency market reached $988.9 billion.

–

–

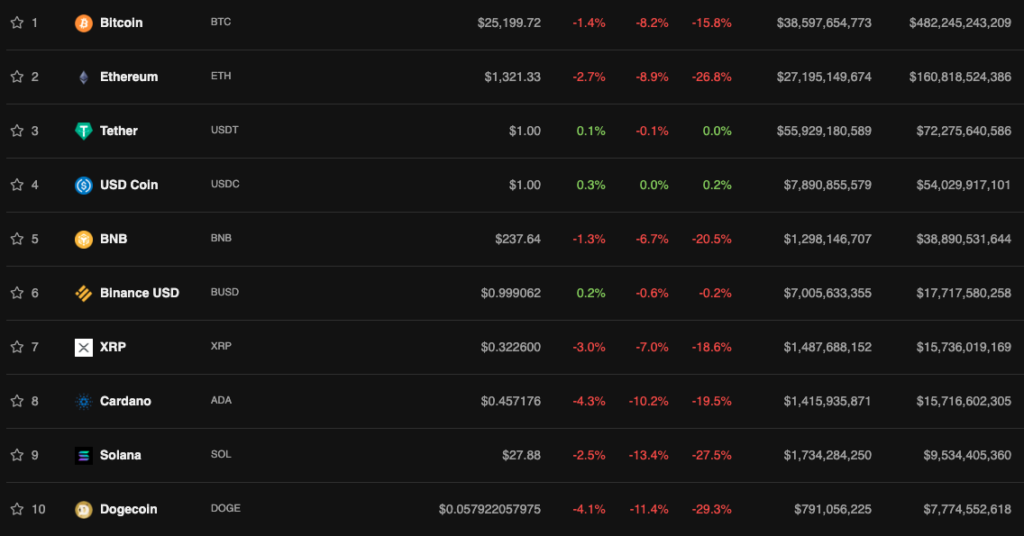

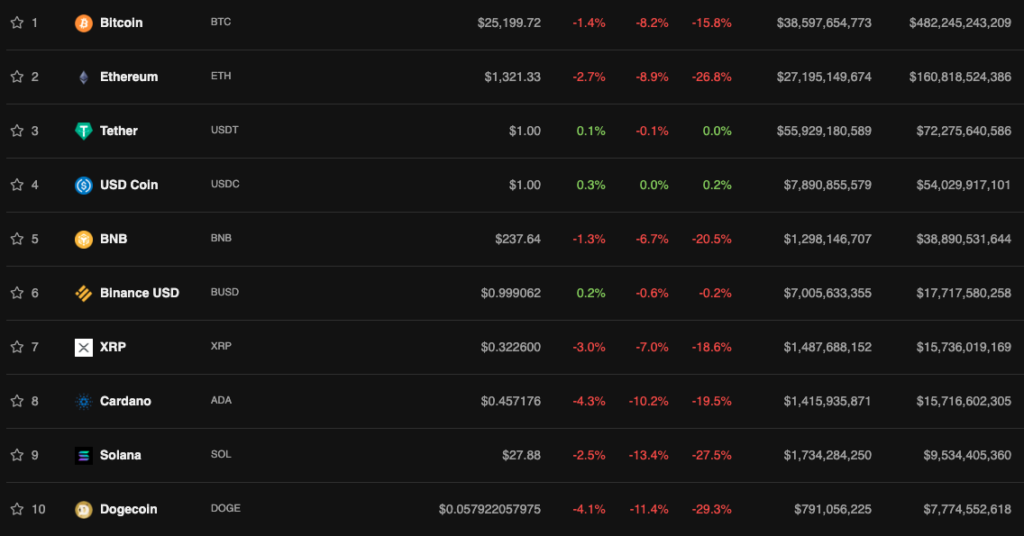

At the time of writing, the price of bitcoin is about $25,600. The cryptocurrency has lost about 6.5% in a day, according to CoinGecko.

Over the same period, Ethereum fell by 8.9%. The current price is $1313. Judging by the charts, the decline in the first and second cryptocurrencies was accompanied by a surge in trading volume.

Following the flagships, almost the entire market moved into the red zone. Solana (-13.4%) and Dogecoin (-11.4%) showed the largest drop over the past day.

The total capitalization decreased by almost 6% and is less than $1.1 trillion. BTC dominance index – 45.3%, ETH – 15.1%.

According to Coinglasspositions in the futures market were liquidated in the amount of more than $ 500 million.

The index of fear and greed in the crypto industry has reached 11 points (“extreme fear”).

Bitcoin Fear and Greed Index is 11. Extreme Fear

Current price: $26,808 pic.twitter.com/jOE6ArjuID— Bitcoin Fear and Greed Index (@BitcoinFear) June 13, 2022

On June 10, Bitcoin fell below $30,000 amid news about accelerating inflation in the US. On that day, an analyst under the pseudonym PlanC noted that he did not yet see a significant trend reversal in the near future.

Thought of The Day 🤔

In the current macro backdrop it doesn’t matter how many charts are showing confluence that we are reaching historically oversold levels. #BTC

As long as #Bitcoin remains correlated to risk on assets I don’t see a significant trend reversal anytime soon.

— Plan©️ (@TheRealPlanC) June 10, 2022

The head of MicroStrategy, Michael Saylor, noted that inflation “has not reached its peak, like bitcoin.”

Inflation hasn’t peaked, and neither has #Bitcoin.

— Michael Saylor⚡️ (@saylor) June 10, 2022

Monday started lower for traditional markets as well. The Hong Kong Hang Seng fell 3.19%, while the Japanese Nikkei 225 fell 3.01%. Futures on the Nasdaq Technology Index shed 4.44% and the S&P 500 shed 2.91%.

Recall that the investment director of Guggenheim Partners Scott Minerd admitted that the cost of the first cryptocurrency could drop to $8000.

Former Bitcoin Critic Peter Schiff called “highly likely” the fall in the price of the asset to $10,000 in the event of a sharp breakdown of the $30,000 level.

Galaxy Digital founder Mike Novogratz allowed a further decline in the cryptocurrency market. In his opinion, the next few quarters will be volatile due to the negative on Wall Street.

Subscribe to ForkLog news in Telegram: ForkLog Feed – the entire news feed, ForkLog — the most important news, infographics and opinions.

Found a mistake in the text? Select it and press CTRL+ENTER

–