+ CRIPTOVALUTA.IT EXCLUSIVE BITCOIN DATA ANALYSIS+ It was already understood that there was a little more than 48 hours ago, when Bitcoin initiated a phase of lateral but bearish movements, which brought it, once again today, below the 60.000$.

What, however, few of the analysts have gone to investigate is the volume of short, or the positions open to discount against Bitcoin. Positions that have grown considerably in the last few hours, absorbing a first blow during the morning.

A situation that someone might decide to to follow operating downwards with the Capital.com platform – go here to receive a free trial account with unlimited virtual capital – platform that allows you to shortare in a simple and immediate way.

We can also use it to do rcrypto – automatic trading with MetaTrader and TradingView, two of the platforms most used by professionals, both for cryptocurrencies and for other markets, with 20€ we can move on to a real account.

Shorts are growing, but is there any reason to worry?

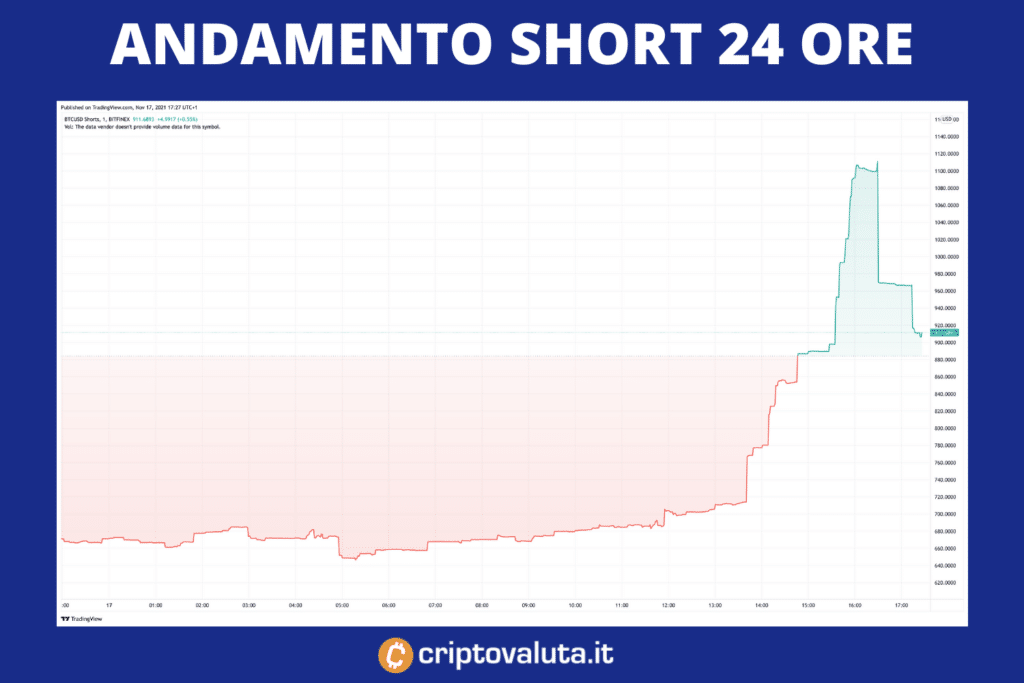

The volume of short its Bitcoin, on all the main ones squares in circulation, is in sharp increase, as the infographic attached to the first part of our study demonstrates.

–

What is happening is clear: starting from 11:00 one has started growing parabola from short, which increased the volume until the 100%, and then return to milder advice only around 17:00, albeit in sharp rise compared to the values of the sun 24 hours ago.

First signal: the bears are trying – and taking advantage of low volumes he was born in narrow range within which all the trading its Bitcoin, they are trying to gain something from any further reductions.

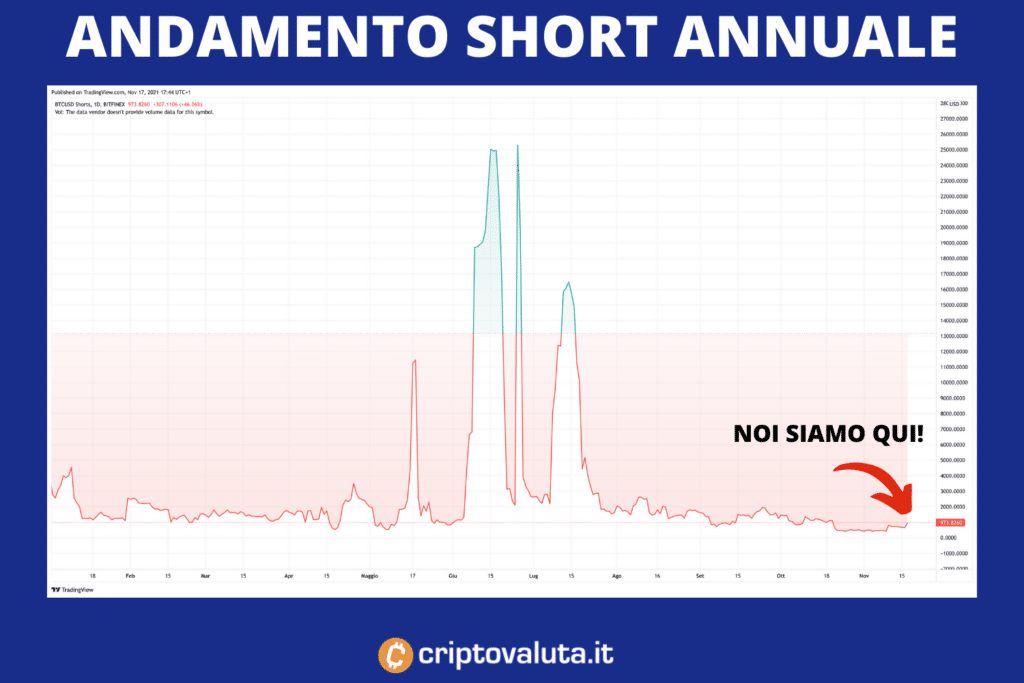

Who looks at last 24 hours might think of a disaster that is mounting, to the need to close their positions and possibly to tag along looking for some reverse profit. As always, however, things should be put in prospecttrying to avoid the noise from short period.

We are still far from the maximum crack levels of May and June

The second chart will help us put in prospect what is actually happening on the markets. Because if it is true that there was a surge within the same trading day, it is equally true that we are actually far from the highs reached during the year.

Highs that were worth approx 23 times what we touched today – just to offer a true one proportion market trends and in particular of short which are placed on Bitfinex, which are then in proportion identical to what we find inside the others exchange and other platforms that allow shortare.

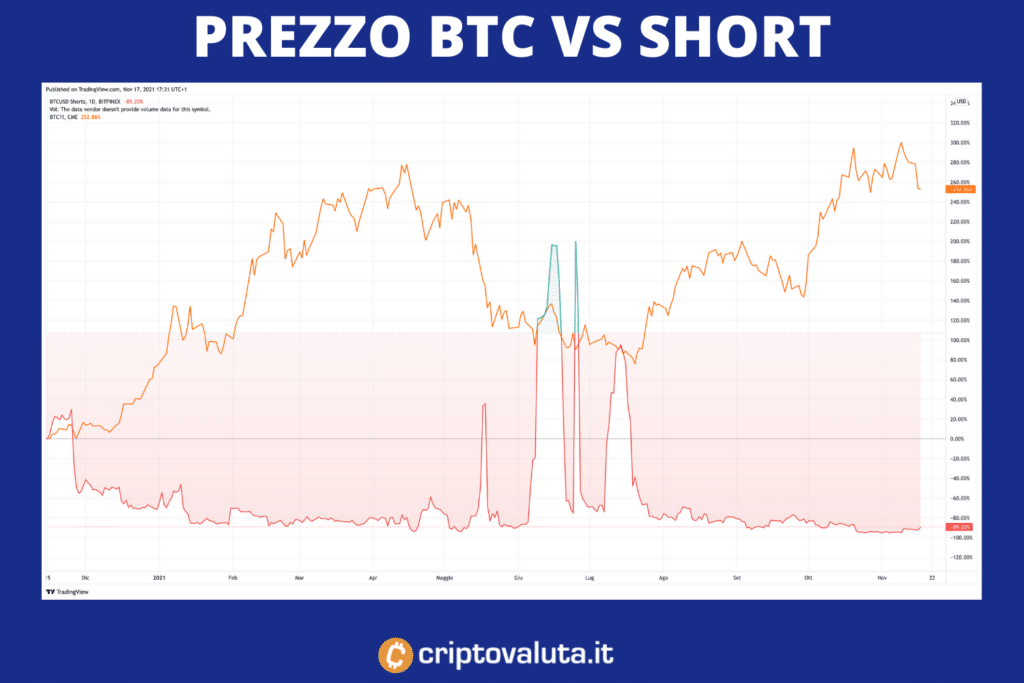

Shorts always come with a certain lag

That is with a certain delay on the decrease in price – and this is a signal as important as it is counterintuitive: most of the short they arrive only after a negative trend it has already established itself, trying to increase its strength.

The superimposed graph makes this dynamic clear – and makes a pull sigh of relief to anyone who is worried about this increase in shorts on the market. Increase that, this time too, would seem to be more related to late comers that to an effective control by the bears.

Perhaps it is the right time to go against the grain

Salmon, the metaphor they use on Wall Street for indicate who goes against the tide compared to other market operators, they almost never have a long life. However, the data we have reported would seem to signal the opportunity to move in this direction.

While the short montano – albeit in a relatively shy way, it could happen that geese we actually saw during the month of June, when at most short we have seen the local price peak correspond. So we welcome further increases in short if these help Bitcoin to go up. Then hoping for an output in style July, when the collapse of the short marked the beginning of the rebirth.

Anyone wishing to take a position now on this specific market configuration can do so with eToro – go here to get a free virtual account with all available features, which offers us all the analysis tools of the market and also exclusive fintech to copy the best (including auto – trading on the crypto sector).

Better that, we hope for them, are not yet shortando Bitcoin, which despite a phase of lateral movements could demonstrate an upright strength even by return of post.

–