Another month gone by, and another higher inflation rate. At least in the United States. We will find out about inflation in the eurozone on 22 June. But the US market is leading, and the implications of the new figure may be huge, including for bitcoin (BTC).

Inflation of 8.6%

It Bureau of Labor Statistics has yesterday revealed that the annual inflation rate in the US was 8.6% in May. That is another increase, the April figure was still 8.3%. In Real Visions Daily Briefing from last night, Peter Boockvar of Bleakley Advisory Group describes that this will have major consequences for financial markets.

The high figure gives the US central bank an excellent excuse to continue raising interest rates. Peter Boockvar mentions Which at least two more announcements of higher interest rates are possible. Then the interest rate at the Federal Reserve would be at least 2%. It was zero a few months ago. That means it will be much harder to get loans, and that should reduce inflation. This process is called quantitative tighteningor in Dutch quantitative tightening.

EEurope is a slightly different case. Besides the aim of keeping inflation under control, the European Central Bank (ECB) also aims to prevent Southern Europe from going bankrupt. This means that interest rates in Europe cannot rise too much. As a result, there is a good chance that inflation in Europe will remain relatively higher.

Bad news for bitcoin

The biggest problem for crypto like bitcoin at the moment is high inflation. Highlighted on Twitter CryptoWhale last month that bitcoin has never been in a bull market as the Federal Reserve pulled the reins. The central bank is now doing everything it can to reduce inflation.

Bitcoin has never once in its history been in a bull market while the Federal Reserve did quantitative tightening.

Smart whales spent the last 12+ months dumping their bags on dumb retail.

The mega crash is inevitable!

— CryptoWhale (@CryptoWhale) May 4, 2022

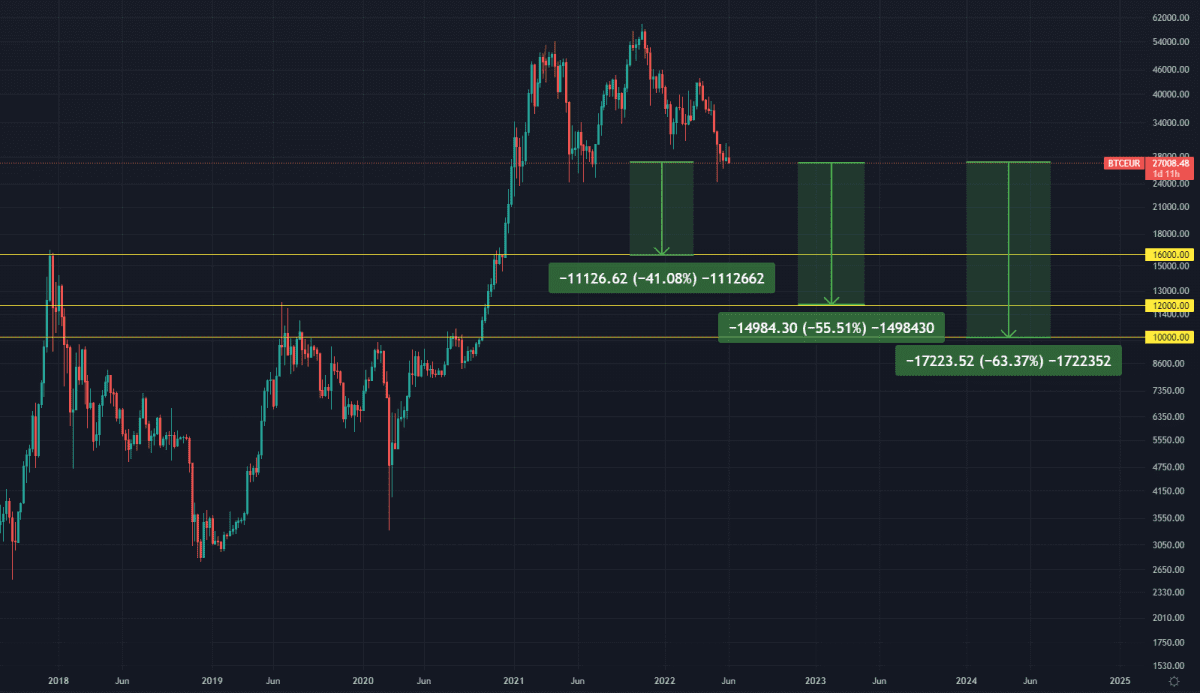

The chance is So big that cryptocurrencies will suffer greatly until this policy ends. If we look at the chart of bitcoin, it is noticeable that there may be little support below the low van 27,000. If the price falls through this, bitcoin may only be able to find support again around 16,000 euros. However, if this price is not is not held, there is a good chance that bitcoin will go towards 12,000 euros or even towards 10,000 euros. At the current price, that is a correction between 41% and 63%.

–