Posted 21. 5. 2021 at 12:50

Hi traders! We definitely have a very interesting week behind us, which tested the general confidence, whether cryptocurrency market is still in the bull market.

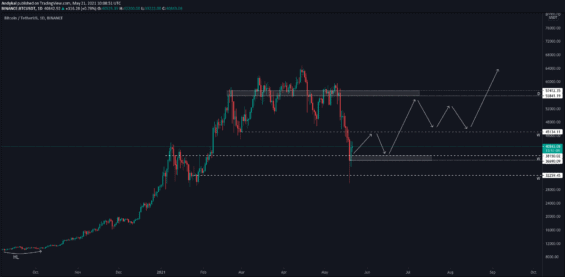

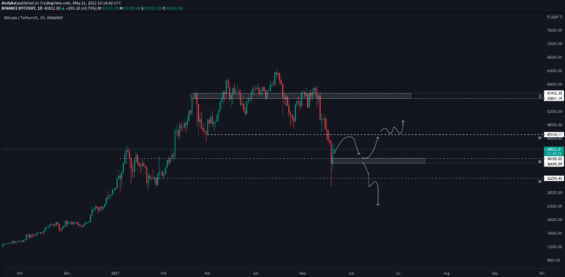

V past analysis I also showed a bearish scenario that would bring the price of Bitcoin to the price of 38 thousand. USD, or even in the zone of 34-32 thousand. USD, where BTC finally created its temporary bottom.

Looking at the daily chart, the only zone that BTC lost is 45 thousand. USD, which is the main support I used to focus on to maintain the bullish momentum. Here, this level will act as the main resistance.

As bad as this dump may seem, in reality, it did not hurt the structure so much, and we anticipated it in advance that it could occur

The probabilities are therefore rather on the side that the created bottom is already the final day a Bitcoin will gradually continue the uptrend. Of course, it will not be overnight.

As you can see, there are 4 key price levels on the Bitcoin chart above:

- 32 200 USD – This is a support that BTC must no longer be tested if we are to keep up with the bullish trend

- 38 000 USD – the level above which BTC should now be maintained in order for the bounce to come to the next resistance

- 45 000 USD – untested resistance, which will be the most important level of all – so it will separate bear and bull market

- 55 000 USD – if BTC reaches this far, the bullish trend will probably continue in time. Even so, these levels will act as resistance

What is important to mention is that we are not in a context where we should expect BTC to go full steam up and overcome these levels simply, as it did before.

It is very likely that it will respond to individual levels, so the strategy for the next weeks will sell on resistances and buy at pullbacku on supporty.

As I outlined above, the important level is 45 thousand. USD – here it will be decided whether we can keep the bullish momentum or not. So if you have a bearish bias, you should focus on finding short setups at this level.

Situation on the altcoin market

Last week I wrote that Altcoins are now not a place to invest money, because we have dominance on very strong support.

Now we see reactivation, so Bitcoin is much stronger. Currently on less resistance, but it is likely that Bitcoin’s dominance in the cryptocurrency market will rise to 50-53% in the coming weeks.

Conclusion

Although the collapse of the entire cryptocurrency market was very rapid and strong, as you know from the weekly analyzes, it was expected and did not lose any bullish structure. Rather, we should continue to higher levels, at least for testing 45 thousand. USD, but probably also 55 thousand USD.

During this upward move, however, Bitcoin will be rather stronger than altcoins, because dominance has room to go 7-10 pp higher.

–

![[Bitcoin] Analysis 21. 5. 2021 – Is the bear market really coming? »Finex.cz [Bitcoin] Analysis 21. 5. 2021 – Is the bear market really coming? »Finex.cz](https://cdn.finex.cz/wp-content/uploads/2021/05/bitcoin-cena-analyza-21-5-2021.jpeg)