The distinction between success and failure in Fx / CFD buying and selling is most likely to depend primarily on the assets you pick to trade every 7 days and in which route, not the specific methods you could possibly use to decide the entry and exit points for the trade.

So, at the beginning of the week, it is great to glance at the significant image of what is developing in the market place as a full and how these developments are afflicted by macro fundamentals, complex elements and market sentiment. Examine on for my weekly analysis.

Basic investigation and marketplace sentiment

In my preceding September 4th examination, I wrote that the best trades of the week would almost certainly be:

- 1. The EUR / USD was bought off, gaining .92%.

- 2. The GBP / USD was offered off, which was up by .68%.

- 3. Buy USD / JPY, which is up 1.77%.

This created a tiny regular gain of .06%.

Growing danger hunger dominated the news final 7 days, which saw a wave of US dollar sell-off and strong gains in fairness markets towards the end of the week, which differs significantly from the strong threat aversion it has. begun the 7 days. The key S&P 500 index finished the 7 days up 3.47%, while just about all the other main international indices had been up. The US dollar index finished the 7 days reduced.

The rise in risk urge for food was not afflicted by heightened expectations of tightening by the US Federal Reserve and the European Central Bank, not to point out sharp boosts in Financial institution of Canada and Reserve Lender of Australia curiosity premiums. The Federal Reserve is predicted to increase the curiosity charge by .75% at its future plan assembly afterwards this thirty day period, though the European Central Financial institution made its biggest amount hike of decades final Thursday, boosting the rate of the 12 months. .75%. The European Central Lender also lifted its inflation forecast, forecasting an typical fee of 8.1% by way of 2022, and reported that “inflation remains pretty superior and is possible to continue to be above the goal for a prolonged time “.

In terms of market movements, the Japanese yen was the most extraordinary exterior the equity current market, which observed a further more steep drop. The first moves before in the 7 days were being met with indifference by Japanese policymakers, but some (this kind of as the deputy key minister) are now beginning to report dissatisfaction with the thought of further sturdy withdrawals.

The details of the crucial financial data produced past 7 days can be summarized as follows:

- The critical refinancing level and the monetary policy assertion of the European Central Bank

- Financial institution of Canada Rate and Overnight Level Assertion (Canadian Dollar) – .75% increased, the Canadian dollar is now the primary international forex with the maximum desire amount at 3.25%.

- Reserve Financial institution of Australia (AUD) money charge and assertion – .50% increased.

- Australian GDP info: quarterly improve of .9%, as extensively anticipated.

- The announcement of the appointment of the new Key Minister of the United Kingdom – Liz Truss, as broadly expected.

- Hearings of the British Monetary Report (British Pound) – Nothing exciting happened listed here.

- US ISM products and services PMI facts: showed that the US services sector is more robust than predicted.

- Alter in Canadian work and unemployment charge – Canada professional a sharp rise in the unemployment fee, from 4.9% to 5.4%, as the unemployment rate was projected to rise to only 5.%.

The forex trading industry saw relative strength in the Swiss franc in excess of the earlier 7 days. By much the weakest forex was the Japanese yen.

Global coronavirus an infection fees fell very last week for the eighth straight 7 days. The only considerable raises in verified conditions of the novel coronavirus in common are now happening in Russia and Taiwan.

Subsequent week: September 12 – September 16, 2022

Following 7 days will likely see a identical degree of volatility in the marketplaces than last week, with some vital inflation facts thanks. The statements evaluated, in purchase of probable relevance, are the following:

- Consumer Rate Index in the United States

- Uk Customer Cost Index

- Uk GDP

- Producer Selling price Index in the United States

- Retail product sales in the United States

- The GDP of New Zealand

- Australian unemployment level

- U.S. Empire State Manufacturing Index

- Preliminary info on shopper self-confidence from the United States

Monday, September 12th is a public vacation in China.

Technical investigation

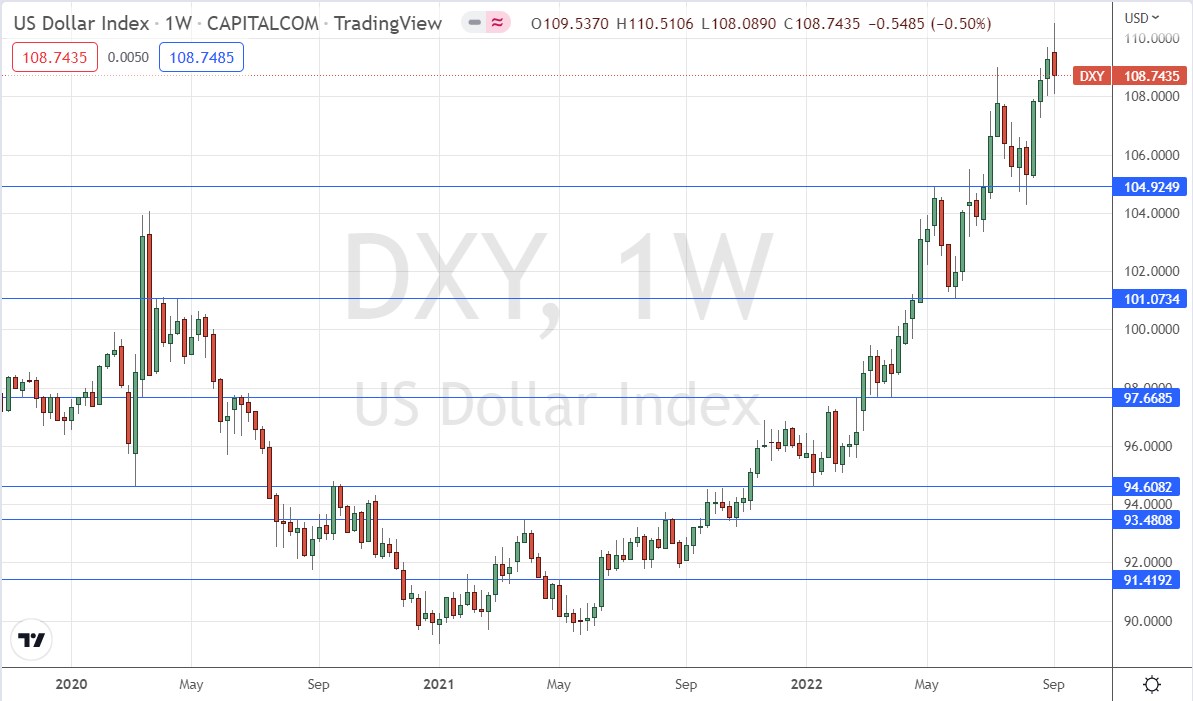

US greenback index

The weekly value chart down below exhibits that the dollar index fashioned a bearish candle that shut reduced against the lengthy-time period bullish development.

The downward movement is neither remarkable nor out of the regular, so I see no explanation to address it as anything at all other than a organic downward correction within just an uptrend. This is attributed to the substantial reduce wick of the candle and the fact that the US greenback was not a significant driver in the foreign exchange market very last 7 days.

We may well have witnessed a new guidance amount forming on previous week’s low near or at the 108.00 degree, introducing to the bullish circumstance.

Nonetheless, it is most likely that it will be a very good strategy to seem for lengthy positions on the US dollar in the coming 7 days. This is a quite potent and long-phrase bullish trend for the big currencies in the foreign exchange marketplace, even though market place sentiment is at present against.

EUR / USD

The EUR / USD fashioned an upward outer band very last week just after originally plunging to a new small, the cheapest in 19 several years. Though this is a bullish indicator, it indicates that the selling price has not been capable to maintain previously mentioned the resistance at the $ 1.0100 stage, so we are not actually viewing a robust signal of a bullish reversal.

Despite the fact that the European Central Bank elevated fascination costs past 7 days by .75% and indicated additional shorter-time period hikes, the Euro did not close the 7 days with stable gains.

The remaining strength of the USD, as perfectly as the fundamental headwinds versus the EUR, indicate that there is nevertheless an opportunity to trade a shorter pattern in this pair. Nonetheless, it could possibly be worthwhile to use a rather huge trailing prevent decline for this pair, as more than the several years making use of ATR 3 has created greater final results than ATR 1.

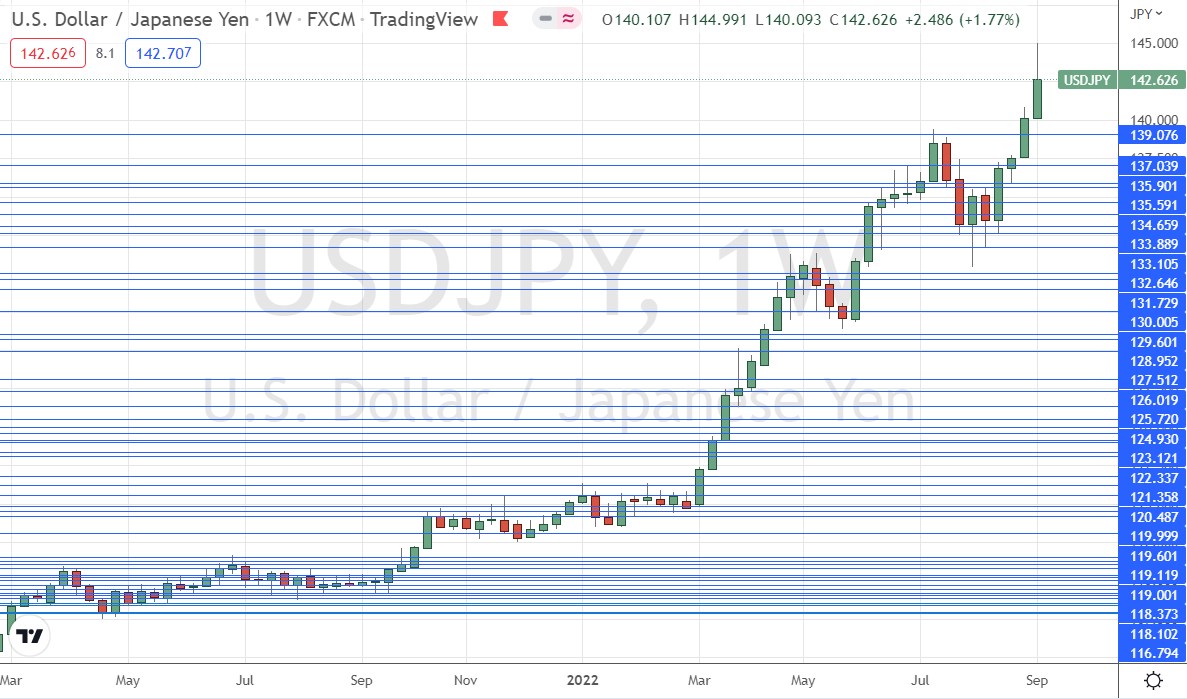

US dollar / Japanese yen

The USD / JPY pair was the moment once again a significant winner final week, hitting a higher of 145 yen, which Japanese politicians flagged as the maximum achievable lengthy-time period, right before supplying up lots of of the gains, but closing even so. rose considerably all through the week, achieving the greatest weekly closing cost in the past 24 a long time.

This strong transfer was generally driven by the Japanese yen, which is preserving weak point as Japanese coverage makers are nonetheless attempting to inflate their financial state, with Japanese inflation remaining perfectly beneath its 2% target. This places the Financial institution of Japan on a extremely divergent path from any other important central lender.

We see a big higher wick in very last week’s candle, and now the cost may have to wrestle to reach the 145 yen degree all over again. Nonetheless, I you should not see a compelling motive why the uptrend ends here.

Craze traders will mainly attempt to remain long on this pair right up until its price drops by a different sizeable amount of money.

Conclusion

I see the most effective prospects in the monetary marketplaces this week are probably to be shorter EUR / USD, lengthy USD / JPY, but I will be seeing the entry details and will only be seeking to trade reversals from important assistance or resistance degrees in line with the very long – pattern. term.

Are you completely ready to trade with our weekly forex market place analysis? We have put jointly a checklist of the ideal forex buying and selling brokers that are worthy of utilizing.

–