Jakarta, CNBC Indonesia – Indonesia’s condition so far is still good amidst many countries in the queue to enter the abyss of recession and crisis. But the government must remain vigilant, because there is a ‘time bomb’ ready to explode.

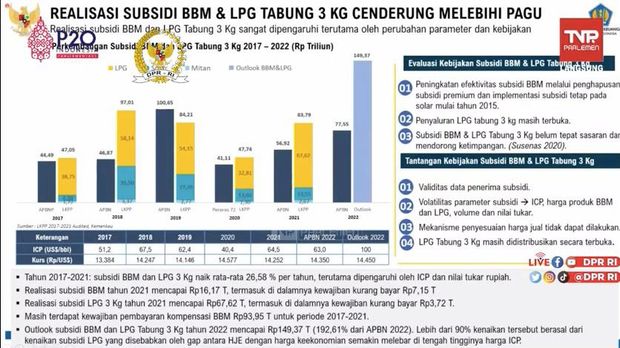

The time bomb is an energy subsidy, which includes fuel oil (BBM), 3 kg LPG and electricity.

This year, the government spent up to Rp 520 trillion to keep the energy price from rising. At the same time to pay off debts to PT Pertamina Persero and PT PLN Persero which have held prices in the last two years.

The high need for subsidies is the impact of the spike in world oil prices. Initially the government’s assumption was US$ 68 per barrel, but the war between Russia and Ukraine brought world oil prices past US$ 120 per barrel.

The government’s move to withhold subsidies is considered appropriate by some to keep inflation under control at the level of 2-4%. So that Bank Indonesia (BI) does not need to rush to raise the benchmark interest rate which can restrain the pace of economic recovery after the COVID-19 pandemic.

|

Photo: BKF Ministry of Finance (Doc. BKF Ministry of Finance) BKF Ministry of Finance (Doc. BKF Ministry of Finance)- – |

However, efforts to contain these prices could not last long. Moreover, there is still the possibility of world oil prices soaring.

“How long can we endure it?,” said Head of Economic and Research UOB Indonesia, Enrico Tanuwidjaja in an interview with CNBC Indonesia, quoted Wednesday (29/6/2022)

The government has a limit, which must reduce the fiscal deficit to below 3% of Gross Domestic Product (GDP). Meanwhile, the current deficit is estimated at 4.5% of GDP. Reducing the deficit must be done gently so as not to cause a shock effect in the economy.

The weakening of the rupiah exchange rate that has occurred in recent times will also be a big burden for energy subsidies. This is because the supply of fuel and LPG relies on imports. The US dollar is expected to move to a level above Rp 15 thousand.

Radhika Rao, DBS Group Research Senior Economist views the risk of a widening of the deficit to occur if energy prices continue to be restrained. So the option to increase fuel prices, especially pertalite, could be the government’s choice.

“Fuel prices may need to be partially adjusted in June/3Q22. Assuming a partial adjustment of fuel prices, the 2022 fiscal deficit is likely to narrow to -4.5% of GDP vs. targeted -4.85%,” he said.

Photo: BKF Ministry of Finance (Doc. BKF Ministry of Finance) Photo: BKF Ministry of Finance (Doc. BKF Ministry of Finance)BKF Ministry of Finance (Doc. BKF Ministry of Finance)- – |

The government can also focus on pushing the wheels of the economy through more productive spending. According to Radhika, now is the right moment to boost economic growth.

The increase in inflation is certain to occur after the increase in fuel prices. If there is a price increase of 10%, inflation could be 4.2-4.3% and 25%, close to 5.5%. Therefore, the next response will come from Bank Indonesia (BI) to reduce inflation.

“A change of direction, indicating tightening, is likely in June/July, which will be followed by a hike in the benchmark interest rate. As core inflation continues to strengthen and domestic assets come under pressure from weak risk taking, even if partially mitigated by a strong trade balance , we estimate a cumulative 75bp increase is possible this year,” he explained.

Next article

Again, BBM Subsidies Threatened to Swelling Hundreds of Trillions

–

–

(me/me)

–