Financial authorities order strict limits on the total amount of loans… Tighten the reins to stop rising house prices

Kookmin Bank will not grant new approval if it exceeds 100 million KRW combined with existing credit loans

Shinhan-Hana decided to lower the limit for professional jobs… Possibility of affecting private business loans

Authorities “to increase loan capacity for small business owners”

-Banknotes, which began to restrict new credit loans at the end of last month, began tightening additional loans. When the loan application amount exceeds 100 million won, combined with the existing loans, there are even places that do not provide loans at all. Surprised by the surge in household loans, the government and supervisory authorities have ordered strict limits on the total amount of loans from banks. Some are concerned that small business owners and self-employed people are being criticized as the threshold for credit loans rises.

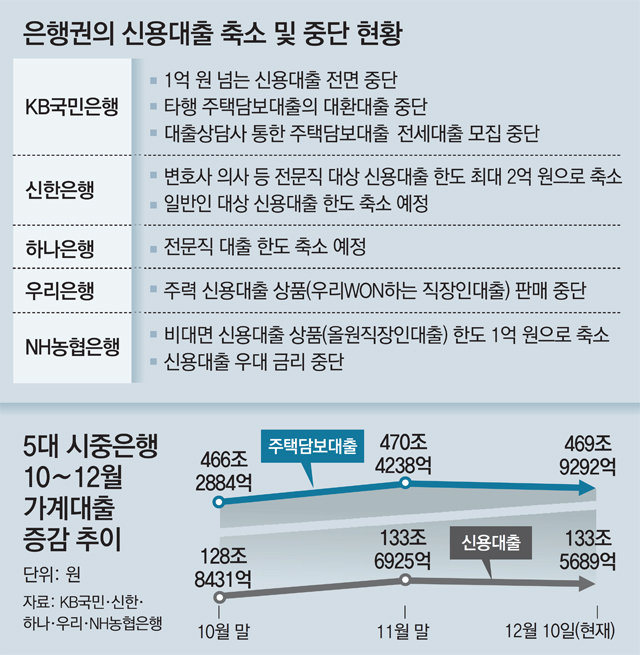

According to the financial sector on the 13th, KB Kookmin Bank decided not to execute all household credit loans exceeding 100 million won from the 14th to the end of the year. When receiving a new credit loan, if it exceeds 100 million won combined with the existing credit loan, it will not give a new approval. However, it does not apply when the maturity is extended. An official from KB Kookmin Bank said, “The measure to stop large credit loans is unusual.” KB Kookmin Bank will also stop converting mortgage loans from other banks to Kookmin Bank loans until the end of the year.

From the 14th, Shinhan Bank decided to lower the credit limit for professional professions such as doctors and lawyers from the previous maximum of 300 million won to 200 million won. Hana Bank is also planning to come up with a plan to lower the credit limit for professionals.

The reason why banks have stepped up to stop credit loans is that a risk signal was turned on last month as the increase in other loans (including credit loans) soared to a record high of KRW 7.4 trillion. As a result, the Financial Supervisory Service called on bank executives on the 4th of this month to intensively order total volume management, and banks took out loan suspension cards.

View larger-Financial sectors such as commercial banks have already tightened credit loans since the 30th of last month. High income earners with an annual income of over 80 million won must undergo a total debt repayment ratio (DSR) to receive a credit loan of over 100 million won. In addition, if a person who received a credit loan of more than 100 million won buys a new house in regulated areas such as Seoul within one year, the loan will be recovered within two weeks. Thanks to this, as of the 10th of this month, the credit balance of the five major commercial banks (133,5689 billion won) has decreased by 123.6 billion won (0.09%) from the end of last month. An official from a bank said, “From last month, according to the guidelines of the authorities, new loans were reduced, and the increase in credit loans has since declined.” Nevertheless, the government and the supervisory authorities decided that the government and the supervisory authorities had to tighten the rein as the rise in house prices has been rising again nationwide, including Seoul. In order to cope with the unrest in the real estate market and the surge in household loans, some loan regulations are necessary, but in the banking sector, it is believed that the tightening of household loans can also affect loans to private businesses such as small business owners. This is because there is a large number of small business owners who want to raise funds through credit loans. Another bank official said, “If the household credit loans are tightened like this, the rest of the loans will inevitably be crunched.” It is known that the city of Seoul recently sent an official letter to a commercial bank to request that entertainment bars and ballrooms be released from the lending-restricted business. An official from the financial sector said, “Because loans are restricted according to the government policy, banks will not be able to open loans at will.”

View larger-Financial sectors such as commercial banks have already tightened credit loans since the 30th of last month. High income earners with an annual income of over 80 million won must undergo a total debt repayment ratio (DSR) to receive a credit loan of over 100 million won. In addition, if a person who received a credit loan of more than 100 million won buys a new house in regulated areas such as Seoul within one year, the loan will be recovered within two weeks. Thanks to this, as of the 10th of this month, the credit balance of the five major commercial banks (133,5689 billion won) has decreased by 123.6 billion won (0.09%) from the end of last month. An official from a bank said, “From last month, according to the guidelines of the authorities, new loans were reduced, and the increase in credit loans has since declined.” Nevertheless, the government and the supervisory authorities decided that the government and the supervisory authorities had to tighten the rein as the rise in house prices has been rising again nationwide, including Seoul. In order to cope with the unrest in the real estate market and the surge in household loans, some loan regulations are necessary, but in the banking sector, it is believed that the tightening of household loans can also affect loans to private businesses such as small business owners. This is because there is a large number of small business owners who want to raise funds through credit loans. Another bank official said, “If the household credit loans are tightened like this, the rest of the loans will inevitably be crunched.” It is known that the city of Seoul recently sent an official letter to a commercial bank to request that entertainment bars and ballrooms be released from the lending-restricted business. An official from the financial sector said, “Because loans are restricted according to the government policy, banks will not be able to open loans at will.”

The financial authorities said that the recent tightening of household loans is aimed at controlling overall household debt, and that small business loans continue to proceed. An official from the financial authorities said, “When calculating the bank’s loan-to-deposit ratio, we will lower the risk weight imposed on loans to private business owners, thereby increasing the capacity for loans to small business owners.”

Reporter Kim Hyung-min [email protected]

Copyright by dongA.com All rights reserved.

—

–