Results 2020

Loans to companies closed 2020 with a balance of 42,600 million euros, 17% more, after rising by 6,100 million euros in the year

29/01/2021

With “sadness” but with “a lot of hope” for the new stage that is now beginning. Thus, the president of Bankia, Jose Ignacio Goirigolzarri, in which it was the last presentation of the results of the entity alone before joining CaixaBank. Some results that have been welcomed by the market with an increase of 4.43% at the close of the stock market.

In this sense, Goirigolzarri has expressed the “pride” of belonging to the Bankia team, in a stage that has qualified as “Wonderful, culminating an extraordinary transformation”And in which he took stock of the milestones achieved.

Fusion

Regarding his role in the new CaixaBank, he ensures that his contribution to the new project must be understood “In terms of service” And not from “Personal claims” in the sense of culminating his career.

The Chairman has assured that the organization of the new CaixaBank has not yet been defined and, therefore, has preferred not to go into assessing its role and components.

Understands that pending authorizations from regulators for the merger are progressing as planned, “We have no information that there is anything exceptional in this regard”, therefore, it hopes to present the results of the first quarter with the new entity.

Competition approval

Furthermore, it believes that there will be no competition problems because although CaixaBank will be the outstanding leader in Spain with a 25% share in both credit and deposits, Goirigolzarri maintains that it will be in line with the reality of other European countries with similar or higher shares.

Second, it points out that according to the Herfindahl Index, which reports on the concentration of a market, the new entity will be at a level of 1,300, when the EC understands above 1,800 as problematic, “With what we are still far away”, has said.

It has also shown that, in the current context, “Banks not only compete with other banks“, Expressly citing startups, fintech or large companies, for which he has underlined that in the Spanish market there are “Very remarkable levels of competence” Y “Concentration does not have to mean less competition.”

For these reasons, it does not foresee that the CNMC resolution will establish obstacles to the operation.

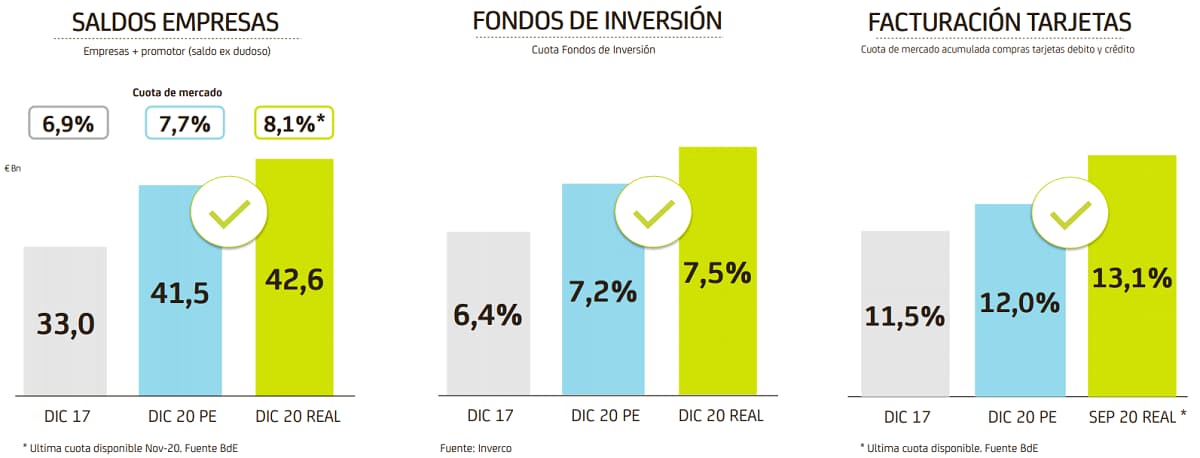

A fourth quarter of records

Regarding the data for 2020, he has especially valued the contribution of the fourth quarter, which in his opinion has been “Spectacular in terms of activity”: with significant growth in credit to companies, investment funds and mortgage production –Bankia recognizes that a good part of the new mortgages already come from the subrogation of clients to the developer loan, a business that it resumed in 2017–.

In addition and as indicated, “well above” of what is foreseen in the recently completed strategic plan.

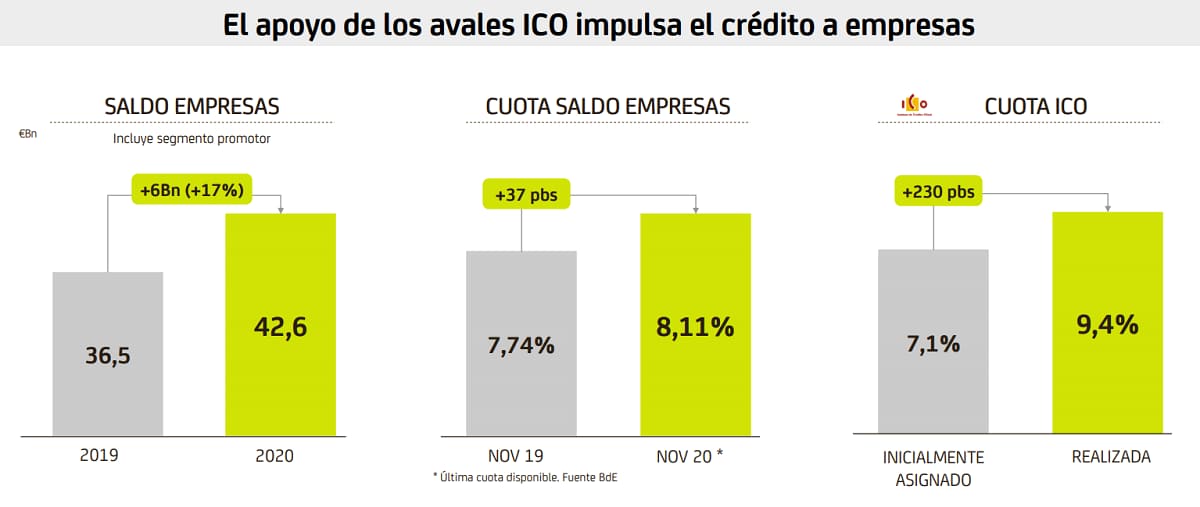

Gross customer credit closes 2020 at 124,328 million euros, 3.1% more than in December 2019 due to new operations with companies guaranteed by ICO, which increase the stock of healthy credit in companies by 17% in the year.

While non-performing loans fell 2.5% after sales made at the end of the year.

ICO

As Goirigolzarri pointed out, the entity’s dynamism in the formalization of credit with the ICO’s endorsement is striking, and although the initial allocation by the Government to the entity was 7.1% (of all the credit granted by the market), Bankia has managed to scratch the share of other entities to end the year with two points more than its initial share (9.4%).

In other words, 1 out of 10 ICO credits to companies has been signed by Bankia.

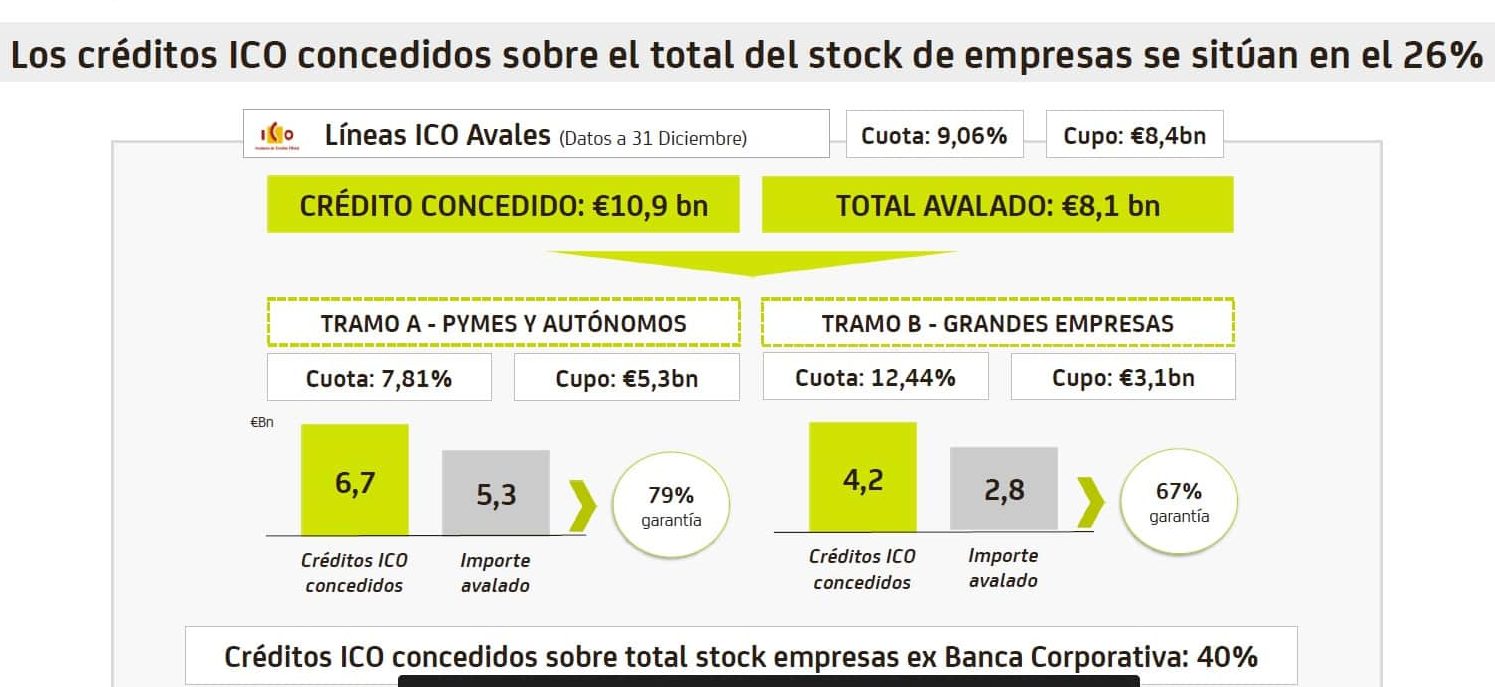

Jose Sevilla, CEO of Bankia has detailed that the entity has granted freelancers, SMEs and companies about 11,000 million euros in credits with ICO endorsement and has

formalized 49,000 mortgage defaults and more than 61,500 defaults on consumer loans.

In this way, the percentage of ICO credits granted over the total company stock is 26%.

However, the president of Bankia believes that the growth registered in 2020 by corporate credit will not be repeated in 2021, and has outlined that the support measures and government guarantees “They have been great”For families and businesses.

Monitor insolvency

Now, and he was also alerting him in the presentation of 3Q results, he believes that “Work so that the liquidity crisis does not turn into a solvency crisis”Therefore, it is very positive about the extension of the deadlines and shortcomings in this type of instrument.

In addition, Seville has clarified that the entity will try to find solutions and will position itself next to its customers when difficulties arise, however, it has highlighted that of the consumer credit moratoriums that have already concluded, 90% are returning credit no delays beyond 7 days, while of the remaining 10%, only 2% are presenting defaults over 90 days.

In the business segment, of the almost 11,000 million granted with ICO endorsement, the extent of the previous debt that these companies had with the bank has been studied, which amounted to about 16,000 million, for which Bankia has put about 4,200 million in ” special surveillance ”.

According to Seville, it is a classification ahead of the supervisor’s requirements and “Preventive”.

Next steps

Before the summer, the Bankia brand will have disappeared from entities and branches. A change that will begin “slowly but quickly”, shortly after the commercial closing of the operation, scheduled for March and that will last between three or four months.

In this sense and when asked by the media, Goirigolzarri has once again emphasized that regardless of whether the State gets to recover all or not the aid invested in the entity, the decision to rescue was the right one.

New dividend and commissions

The forecast is that the new CaixaBank will be able to pay the expected dividend, limited to 15% of the profit, as soon as possible, after authorization from the ECB, something that has already been requested.

Regarding the commission policy of the new entity, Goirigolzarri has considered that it will be similar to the one currently applied by both entities, as they have the same philosophy.

Currently, more than three million Bankia clients do not pay commissions, since they have opted for a greater relationship with the entity, in fact only in 2020 there have been 700,000 clients who have joined its relationship program “Because you ”to stop paying them.

–

:strip_exif()/i/1406206049.jpeg?f=fpa)