With results that have perplexed more than one investor by breaking records, this season of results, which is coming to an end, will leave behind optimism about economic growth, corporate profits and the willingness of investors to catch the trends, as indicated by Bank of America (BofA).

In their latest survey of global fund managers, strategists at Bank of America Global Research found that Several indicators of the business cycle fell back in April after having risen sharply in the spring.

And while all of these measures remain high by historical standards, in the context of strategists calling for economic growth to peak and earnings multiples to contract, the signs are starting to mount that we’re going to a new rhythm in this recovery. A gear in which fewer people are sure of everything will improve from here on, ”says Udland.

The first graph in the BofA note that highlighted that the net percentage of investors expecting a stronger economy in the next 12 months fell to 84% in May from 90% last month. The net percentage is the difference between those who think the economy will be stronger and those who think the economy will be weaker in one year.

Free webinar to learn how to invest by Indicators

Investment Strategies organizes a webinar to learn how to invest with Premium indicators. Sign up for free!

–

And while this measure is still clearly elevated by historical standards, what this data shows is another change in the expected exchange rate in the economy. Growth is expected to continue, yes, but probably at a slower pace than today.

As for corporate profits, BofA respondents view the situation in a similar light to the broader economy, with a net 78% of respondents expecting global earnings growth over the next year. But like growth expectations, this too is 6 percentage points below the prior month’s reading of 84%.

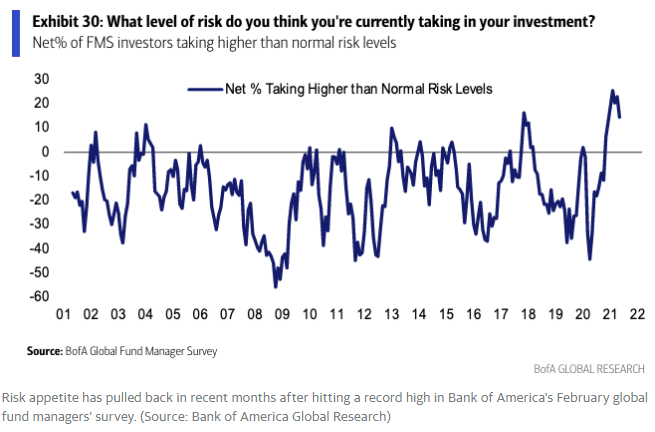

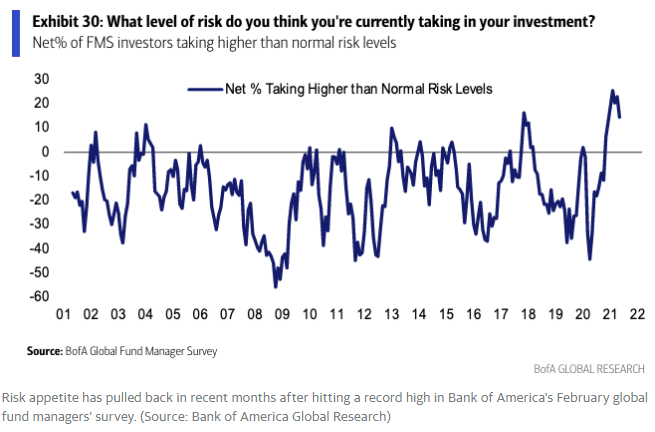

Let’s take these readings together and we can see why the survey also shows investors withdrawing from taking abnormally high levels of risk in their portfolios after risk appetite reached a record high in February’s survey of fund managers.

–