household loans increased by 6.6 trillion won last month compared to the previous month. Citizens enter a savings bank in Seoul on the 11th. [연합뉴스]” data-type=”article”/>

According to the Financial Services Commission, household loans increased by 6.6 trillion won last month compared to the previous month. Citizens enter a savings bank in Seoul on the 11th. [연합뉴스]

As household debt has become a detonator for the Korean economy, the financial authorities are pouring out countermeasures, but the increase is difficult to detect.

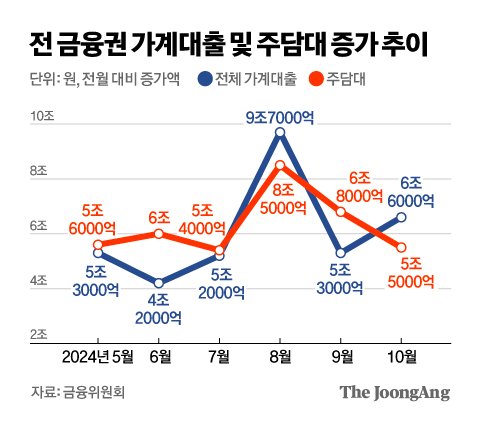

According to the ‘October Household Loan Trends’ announced by the Financial Services Commission on the 11th, household loans across the financial sector last month increased by 6.6 trillion won compared to the previous month, exceeding the increase in September (5.3 trillion won). Of the increased household loans, 5.5 trillion won are home mortgage loans.

Reporter Kim Young-ok

Last month, secondary financial institutions such as credit card companies, insurance companies, Saemaeul Geumgo, and savings banks led the overall increase in household loans. As major banks significantly raised their lending thresholds due to pressure from financial authorities, household loans in the banking industry only increased by 3.9 trillion won last month. Those who could not get a loan from a bank knocked on the doors of second-tier financial institutions to buy a house. In fact, the increase in loans from second-tier financial institutions reached 2.7 trillion won (compared to the previous month) last month alone, reaching the highest level in 2 years and 11 months since November 2021 (3 trillion won). The increase in mortgage loans from secondary financial institutions alone reached 1.9 trillion won.

This is a typical ‘balloon effect’ in which loan demand shifts from the banking sector to the secondary financial sector. There is an interpretation that it will be difficult to stop the increase in household debt as long as market liquidity continues to be concentrated in real estate.

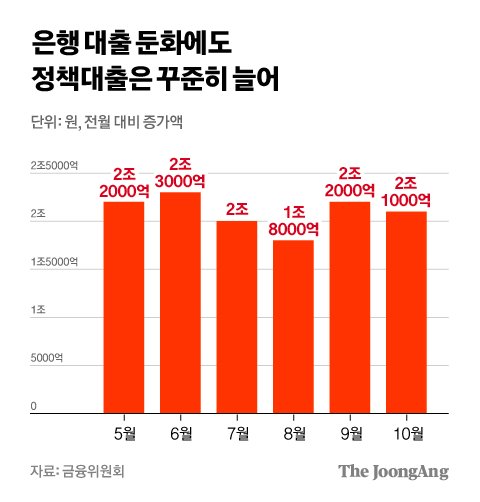

In particular, the proportion of policy loans in bank loans has increased. Stepping stone and support loans increased by 3.4 trillion won last month, accounting for more than half of the increase in household loans. Although Bogeumjari loans decreased by 1.3 trillion won, the total increase in policy loans recorded 2.1 trillion won due to a significant increase in stepping stone loans. Policy loans have been increasing by an average of 2 trillion won per month since last May.

Reporter Cha Jun-hong

According to the National Assembly Budget Office, the balance of policy finance (loans, guarantees, insurance, and investments) of public financial institutions amounted to 1,868.4 trillion won as of the end of last year. It increased by 86 trillion won (4.8%) from the previous year. It is 1.71 times the national debt (based on the central government, 1,092.5 trillion won) in the same year.

The problem is that the rate at which policy finance grows is excessively fast. Compared to five years ago, policy finance increased by 50.4% (KRW 625.8 trillion). Policy finance mostly consists of guarantees and loans. Guarantees, which account for about half of these, increased by 57.2% compared to five years ago, driving the increase in overall policy finance. Most of the increased amount in guarantees is coming from the Housing and Urban Guarantee Corporation (HUG), which provides guarantees for the return of deposits for rent.

Even if the bank reduces its main collateral due to pressure from the financial authorities, this does not apply to policy loans that must be provided when the requirements are met. In fact, the increase in the bank’s own mortgage loans last month was 1.5 trillion won, which is less than the policy loan (2.1 trillion won). Confusion is only increasing as bank lending regulations to prevent a surge in housing prices and household debt and policy loans to stimulate rising housing prices clash with each other. Dong-Hyeon Ahn, a professor of economics at Seoul National University, said, “Policy loans mean, ‘The government will help you, so take out loans and buy a house.’ The basic premise of buying a house is that house prices will continue to rise.” He added, “In a situation where household loans must be reduced, only banks are pressured to provide policy loans. “It is nonsense to leave it as is,” he said.

Household debt is already at a dangerous level. According to the International Finance Association’s World Debt Report, Korea’s household debt to gross domestic product (GDP) ratio in the first quarter was 98.9%. Among the 59 countries counted by the association, it ranks fourth after Switzerland (126%), Australia (108.9%), and Canada (101.2%). The United States and Japan are only 71.8% and 63%, respectively.

However, there are expectations within the government that household lending will slow down starting this month, as housing transactions have decreased for two consecutive months since August. Housing transaction volume is usually reflected in loans with a lag of 2 to 3 months.

Reporter Jeong Jin-ho, Sejong = Reporter Lim Seong-bin [email protected]