Entry 2020.12.17 12:00

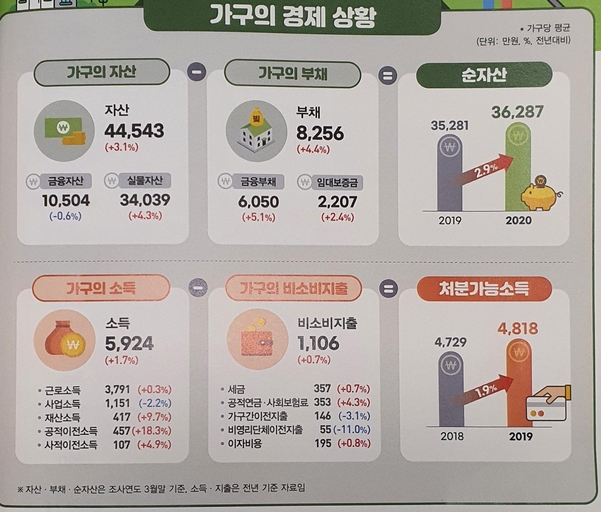

According to the results of the 2020 Household Finance and Welfare Survey conducted by the National Statistical Office, the Financial Supervisory Service and the Bank of Korea on the 17th, the debt per household as of the end of March this year was 82.5 million won, an increase of 4.4% from the previous year. On the other hand, the increase in annual income was far below the increase in debt. Last year, the average household income was 59.2 million won, a mere 1.7% increase from the previous year (58.28 million won). This is the lowest growth rate since the statistics were prepared in 2012.

–

–

The debts of the quintile households with relatively high incomes accounted for 45.2% of the total and 4.2% of the households in the first quintile of income. By household head characteristics, households in their 40s and self-employed households had the most debt.

Household income by income quintile increased overall. In particular, the average income of households in the first quintile was 11.5 million won, an increase of 4.6% from the previous year. The reason why the income of the first quintile households has increased significantly is because the government compensated for the decreased earned income with subsidies. In fact, earned income in the first quintile of last year decreased by 5.2% from the previous year, while public transfer income such as various government subsidies and pensions increased by 131%. On the other hand, households in the fifth quintile saw a mere 1.1% increase in income last year due to the sluggish self-employment industry.

The ratio of debt to assets of all households was 18.5%, up 0.2%p from the previous year. The repayment of principal and interest for households with debt was 11.87 million won, up 1.1% from a year ago (11.75 million won). Disposable income was 48.18 million won, an increase of 1.9% over the same period.

Disposable income refers to income that households can actually use, excluding taxes, public pensions, and social insurance premiums. When the ratio of principal and interest repayment to last year’s disposable income is calculated, it is about 24%. It means that one-quarter of the money available to households was spent paying off debts.

When asked by the National Statistical Office about the burden of repayment of principal and interest on their livelihoods, 7 out of 10 respondents answered that it is “burdened”. 67.6% of respondents said that repayment of principal and interest is burdensome, up 1.1 percentage points (P) from the previous year.

Last year, the householder who had the worst financial situation for households was in their 30s. The debt in their thirties increased by 13.1% (11.67 million won) from the previous year to 182 million won. This is higher than those in their 50s (6.44), 40s (6.0%), 20s (8.8%), and over 60 (1.1%).

Looking at the breakdown of debt in their 30s, mortgage loans, credit loans, and rental deposits increased by 13.1%, 12.1%, and 16.7%, respectively. Although income is relatively low compared to those in their 40s and 50s, it seems that many households have increased their debts through so-called’young-eul’ in order to prepare my own house and increase jeon and monthly rent.

An official of the National Statistical Office said, “The proportion of real estate in household finance was so high that 24% of respondents chose to purchase real estate as a management method when household income increases and extra funds are generated.” As it increases, it can be interpreted as increasing the debt burden of households.”

–

– .