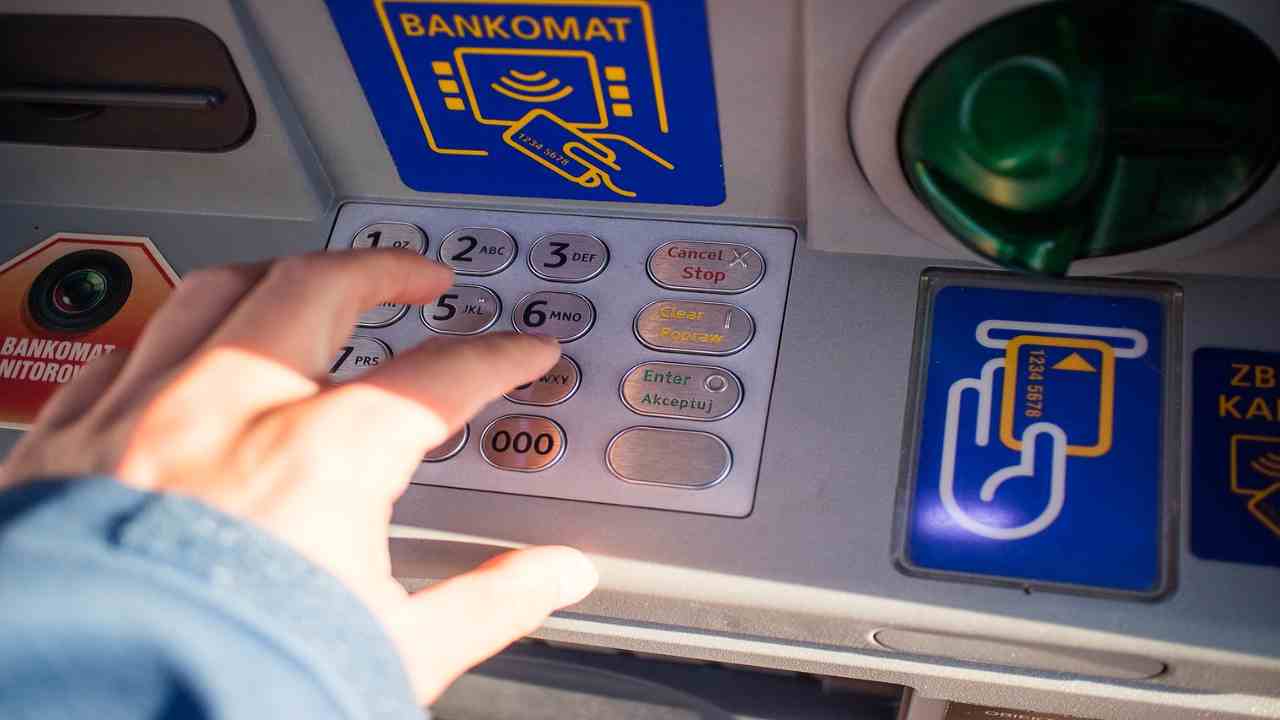

Beware of ATM withdrawals, now they can cost you dearly.

Important news in sight regarding ATM withdrawals. Very soon there will be changes regarding fees and withdrawals. Let’s find out what it is.

Use the ATM to withdraw money from our accounts or our cards has become a habit for everyone. In recent years, governments of different nations have worked for limit the use of cash as much as possible, to make transactions traceable and increasingly secure.

To carry out the cash withdrawal operation in many cases it is required to pay a small percentage or a fixed fee. Precisely on this aspect, some credit institutions could soon introduce particular innovations. Let’s find out in detail what it is.

READ ALSO -> Do you know how much Giulia De Lellis earns? With just one post you can buy a car

Why withdraw more than € 50 at the counter?

Several lenders, including Ing, have announced that as of July this year their customers will have to say goodbye to ATM withdrawals. In reality, the Dutch banking group is preparing to close its branches and for this reason it will rely on other credit institutions as regards withdrawals.

This, however, will also lead to a change in the conditions for withdrawing cash from the ATM. In detail, if you intend to withdraw amounts of less than 50 euros, you will have to pay for the service even if account holders. The only distinction will concern customers who opened the account before 2018 and those who did the same operation after.

READ ALSO -> Italy-Turkey, how much European 2021 tickets cost and where to buy them

As regards the former, they will be exempted from paying for the service if they make a withdrawal exceeding 50 euros; while it will be 50 cents if the withdrawal is less. On the other hand, the fixed fee will be 75 cents at all ATMs in Italy for customers who opened an account after 2018.

–