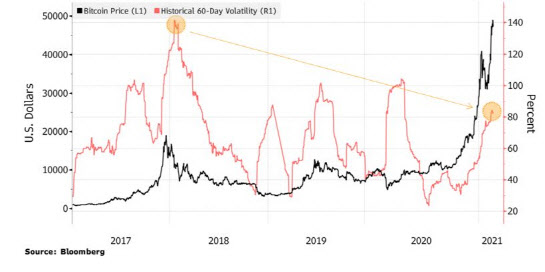

[이데일리 이정훈 기자] Although the price of bitcoin, the leader of the virtual asset market, is showing an all-time rally that rewrites its all-time high every day, the price volatility is not high compared to 2017 and it is less confusing.

|

On the 15th (local time), Bloomberg News reported that the last 60 days remained at a low level compared to the previous 2017 high when comparing the average price volatility of 60 days. In fact, at the time of 2017, the volatility of 60 days reached a maximum of 140%, but now it is only slightly exceeding 80%.

This is because the price of bitcoin has continued to rise since it hit the lowest point of the year in March last year, and the sales volume came out relatively orderly even in the process of adjustment earlier this year, the communication explained.

In particular, since last year, as representative institutional investors such as Paul Tudor Jones and Stan Drunk Miller, who are legends of the hedge fund, have entered the market, long-term investors such as institutional investors and listed companies have led the market rise, rather than speculative individual investors. It seems to have played a big role.

For this, Paolo Ardoino, Chief Technology Officer (CTO) of Bitfinex, a virtual asset exchange, said, “Bitcoin is undergoing an initial process of transitioning from speculative assets to solid assets.”

Bitcoin has not stopped rising as its price surged more than four times last year, and then went through an adjustment this year, rising to just before $50,000 for the first time in history.

“Bitcoin price will show great volatility at some point, but ultimately the market will stabilize,” said Mike McGolan, a strategyist in charge of commodities at Bloomberg Intelligence. “Tesla recently invested in bitcoin in this market. It will be a great opportunity to move into this mainstream, and because of this, the price volatility of bitcoin will potentially go down at or below the gold level.”

However, it is predicted to show relatively high price volatility in the short term. Henry Asrenian Pricewaterhouse Coopers (PwC) Global Crypto Leader in Hong Kong said, “If you are investing in a short period of time and don’t want to see a sleepless day due to sudden changes in prices overnight, you need to refrain from investing in Bitcoin.” Advised.

– .