Apple has just published, as it does every year, what are the deadlines to order its products if we want them to reach us before Christmas. That’s the theory, the one that tells us, for example, that, if we want an iPhone 13, whatever the model, we have to order it before December 22nd.

What they don’t tell us, It is likely that Santa Claus will have to look for another alternative in the market, because chips are still scarce in the market and despite the transfer that the company is carrying out in Asia, favoring the assembly of iPhones to the detriment of iPad, supply delays are occurring, with lack of stock, at least in what refers to Spain where they arrive with a dropper, and the gossips speak of the expectation of the month of February, although we hope not for the fans of the brand.

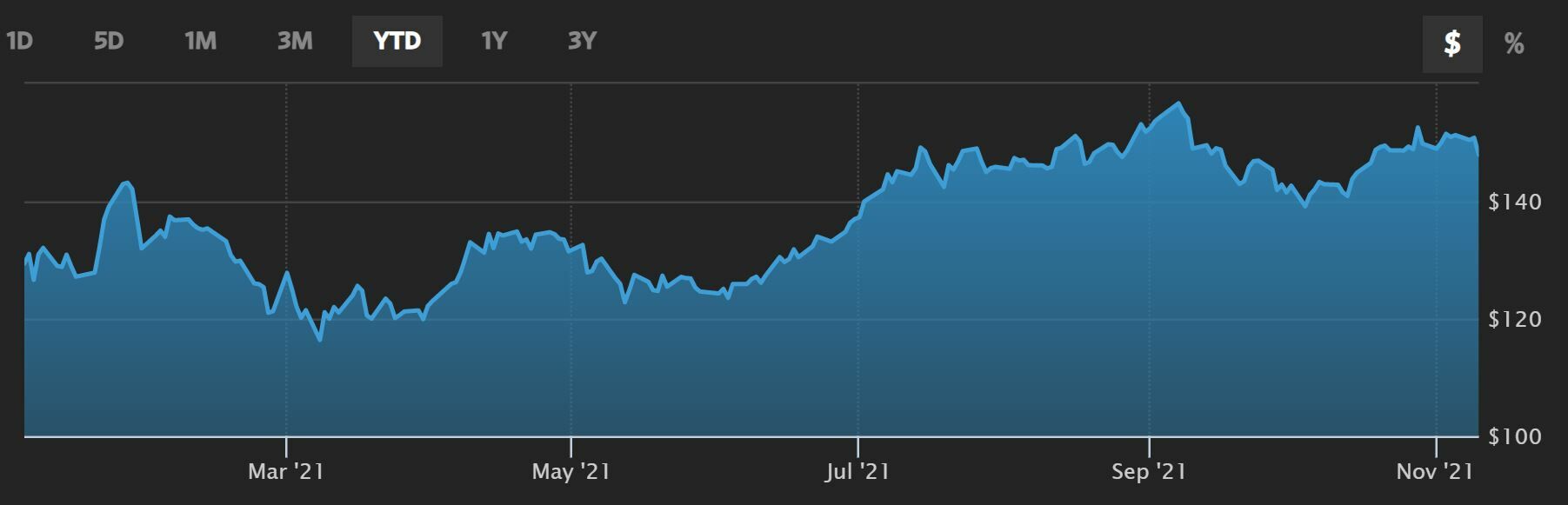

This can mean a serious offense to the company ahead of Christmas in one of the highest sales periods of the entire fiscal year. Something that is already being reflected in the price of its shares in the market, very marked by the laterality in this second part of the year, although they remain positive.

Apple shares, specifically, fell 2% in the last five sessions, gained 2.9% so far this month, barely marked changes in the preceding three months, with just 0.65% cuts while so far this year it maintains modest gains of 11.5%, and with a distance of 6.5% from the best levels of the year, at $ 157.26 per share on September 7. The company is worth 2.43 trillion on the stock market dollars compared to 2.48 that Microsoft is already worth.

These days Apple presents several novelties. The most striking is the finding that its CEO Tim Cook has Bitcoin in his investment portfolio, but not Apple as a company and he does not expect me to have it in the short term, nor to accept them as a means of payment. To this the CEO of Microstrategy replied that Apple’s stock would double in price if it did.

The second goes through his presentation of Apple Business Essentials a new service, in beta version that allows small companies, SMEs, that have support for iCloud storage and management of their devices in a subscription with the company, an accompaniment to the smallest companies throughout their digital process.

And the third is his step back after losing in court the start-up delay until December of a court order that enables your App Store developers to offer links to alternative systems that circumvent their fees, as Barrons tells us

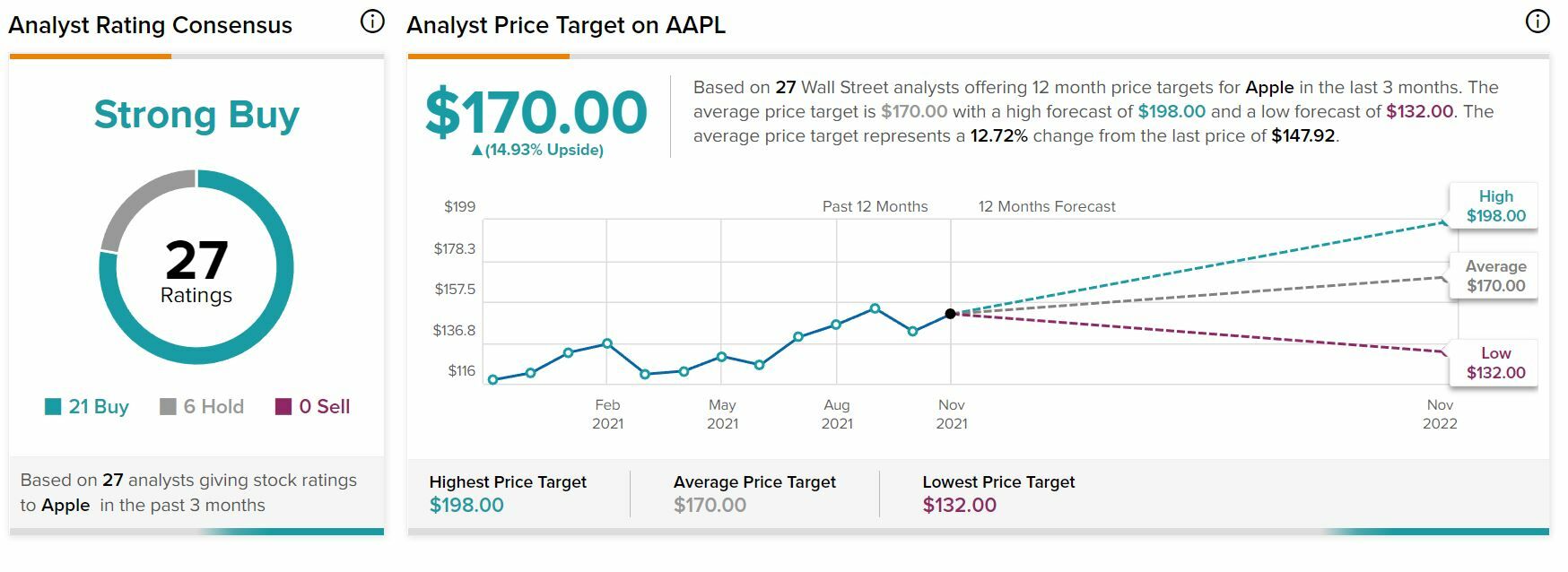

From Goldman Sachs, for example, they have just reduce the target price of your shares to 142 euros per share with a hold rating, which is already below its market price. From Zacks Investment, Apple’s rating has been lowered to maintain from buying with a PO of $ 171 per share.

From TipRanks, place their target price at $ 170 per share on average Thus, they give the value a market path of almost 15% with 27 analysts consulted who follow the value of those who 21 choose to buy and 6 to keep their Apple shares in their portfolio.

If you want to know the most bullish values of the stock market, register for free in Investment Strategies

–