Apple has presented accounts for its third quarter of the fiscal year that have convinced the market. Despite some figures that do not add up to analysts, especially because as it does not present future guidelines, due to the ominous consumption forecasts looming over the second half of the yearand as you know, It is the soul and life of the Cupertino company.

for now, in its third fiscal quarter exceeds market expectations. $1.20 earnings per share83,000 million revenues, about half, 40,670 due to the iPhone, with a gross margin that grows by 43.26%.

Very positive figures, in what the company considers a “challenging operating environment” which have finally performed better than Apple expected, with increases of 2% for quarterly income and that rise to 36% in interannual rate. Another point in favor is undoubtedly the sales of the iPhone, its star ship, especially as the year progresses, something very powerful if we take into account that, as usual, as the presentation of a new model approaches, they decrease sales. The iPhone 14 is expected in September, and this time it has not happened that way.

But there are also important musts, because there are no expectations for the rest of the year, something that analysts usually look at with a magnifying glass, that they expect, that earnings, in its closing quarter of the fiscal year, Apple will earn 1.31 dollars per share and that its sales touch the 90,000 million dollars.

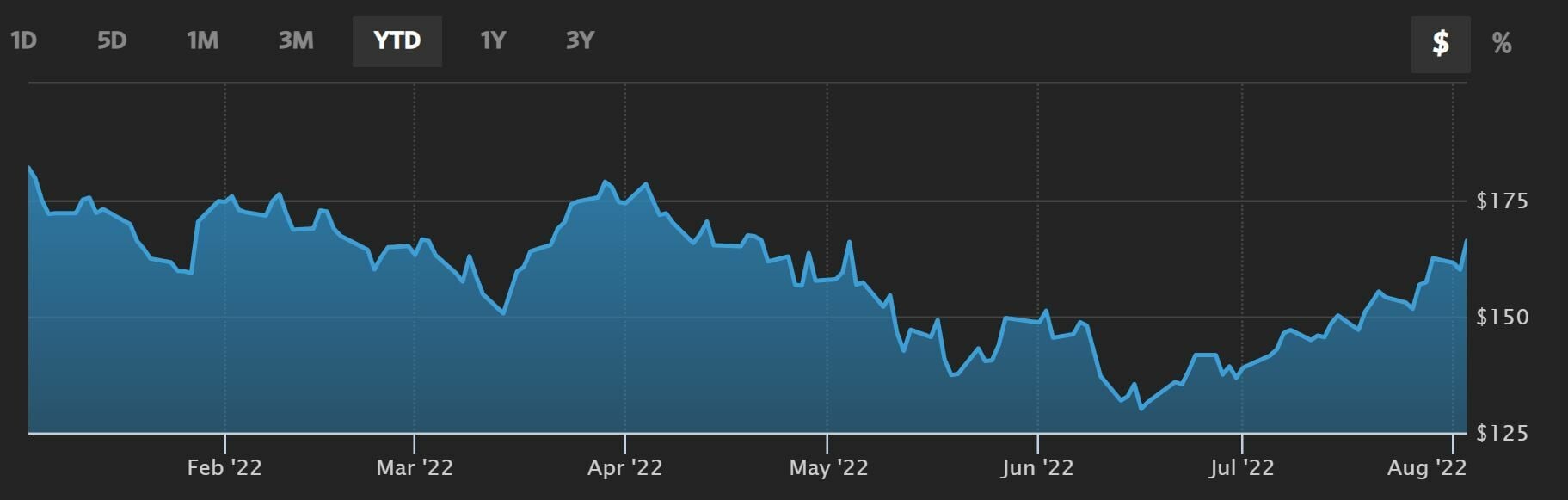

In its stock chart, we see that the value recovers positions significantly. In July it gained 19% and since it presented results, its price gains have reached 6% for Apple. In addition, in the week it presents advances of 5.6% that become double-digit improvements in the last month, of 13.52% specifically. In the quarter, also a positive balance of 6% and in the year losses are minimized to 6.4%. Its capitalization is already above 2.51 billion dollars.

In the debit part of the results we find that his The App Store no longer shows growth in July and is only up 5% in its fiscal third quarter which ended on June 25, which confirms the weakness in consumption that is already here.

But despite the environment, Apple has two fundamental strengths in its favor. They are leverage level is the first. Despite the fact that Big Tech in general and Apple in particular are adverse to rate hikes and high inflation, the truth is that their level of liquidity supports them and sets them aside compared to other companies and their indebtedness to continue investing. We are talking about 70,000 million dollars.

The second comes from the medium term. The aggressive rate hikes are expected to make a direct and immediate dent on inflation with what, Prices are expected to fall in the medium term and rates will moderate, which would have a positive impact on the company.

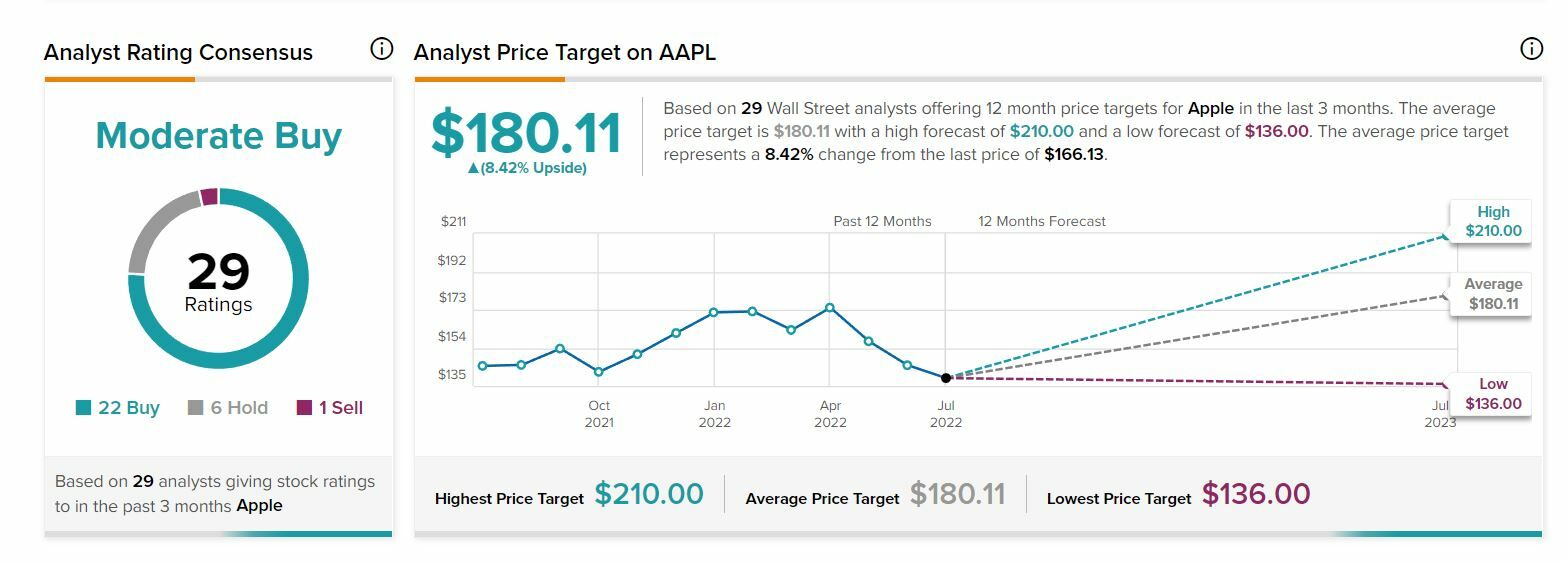

As for recommendations, from TipRanks we see that, of the 29 analysts who follow the stock, 22 opt to buy, 6 to hold and one to sell with an average target price that is slightly above $180 per shareand which gives it a very moderate margin for improvement, barely 8%.

From Evercore ISI they give it an overweight rating with a price target of 185 dollars per share. In KeyCorp they lower their PO to 173 dollars, with little room for improvement, from the previous 177, although they are overweight their shares. And at Barclays, they leave Apple with no room to rise: with a PO of $166 down from $169 after the results. The same price you bet on Apple Credit Suisse.

According to the technical indicators prepared by Investment Strategies, rebound and with an improvement of one point, the total score of Apple reaches 4 total points of the 10 to which the value can aspire. With mixed trend, bearish in the long term, but bullish in the medium.

Total momentum mixed too, slow negative and fast positive for Apple stock. The volume of business is shown to be increasing in the long term and decreasing in the medium term, while the volatility or amplitude range continues to rise: it is growing both in the medium and long term.

–