Tim Cook has sent a letter to his employees in which, before making himself known on Tuesday night in Spain, he announced the measures he was going to implement against Russia for its attack on Ukraine. And also showing that the humanity they share should not be lost, pointing out that Apple As a company, it is going to double the donations that its workers make to NGOs that support the Ukrainian victims of the Russian invasion.

And those measures mean that it stops selling its iPhones and iPods, among other products, in Russia. And it comes after the letter that Ukrainian Deputy Prime Minister Mykhailo Fedorov sent to the CEO of Apple. And not only that, he has also pointed out that the Kremlin’s propaganda outlets such as RT News or Sputnik News will not be able to be downloaded from the App Store outside of Russia, while the use of Apple Pay is limited, while they have disabled, for the safety of Ukrainians Apple Maps in Ukraine.

Without detracting from the measures or the character implemented by Apple, the truth is that last week they paralyzed exports to Russia, after the measures of the Biden Administration that prevents US technology from being sent to the country. But it is that, in addition, the collapse of the ruble, with the fall that came to exceed 40% and that with the rise in rates to 20% stabilized in falls of 28% caused the purchase of Apple products to be more affordable.

Therefore, pending how the conflict evolves and to future sales of its products in Russia if the currency does not recover, As has happened in Turkey, this drop in the exchange rate is compensated with increases in product prices, once it is clear that the sanctions imposed by the American government are also lifted.

In its price graph we see how little by little it reverses its annual falls, with the advance, in the last five sessions of 2.35% for the value that become falls of 3.6% in the month and rises, of 1 .7% quarterly. So far this year, the value has dropped by 6.2%.

Beyond that, volatility has focused on the value since the war broke out with changes in bias on the same day that separated the worst and/or best of the day with differences of 10%.

All this while the value continues to accumulate the support of analysts, such as the one it has just received from JP Morgan that it anticipates an upside in value if it can show and execute growth like it posted in its first fiscal quarter. the signature raises its shares to overweight in the market with a PO of $210 per share. They say they see larger than expected revenue growth of 4% from the sale of their iPhone 13 and SE.

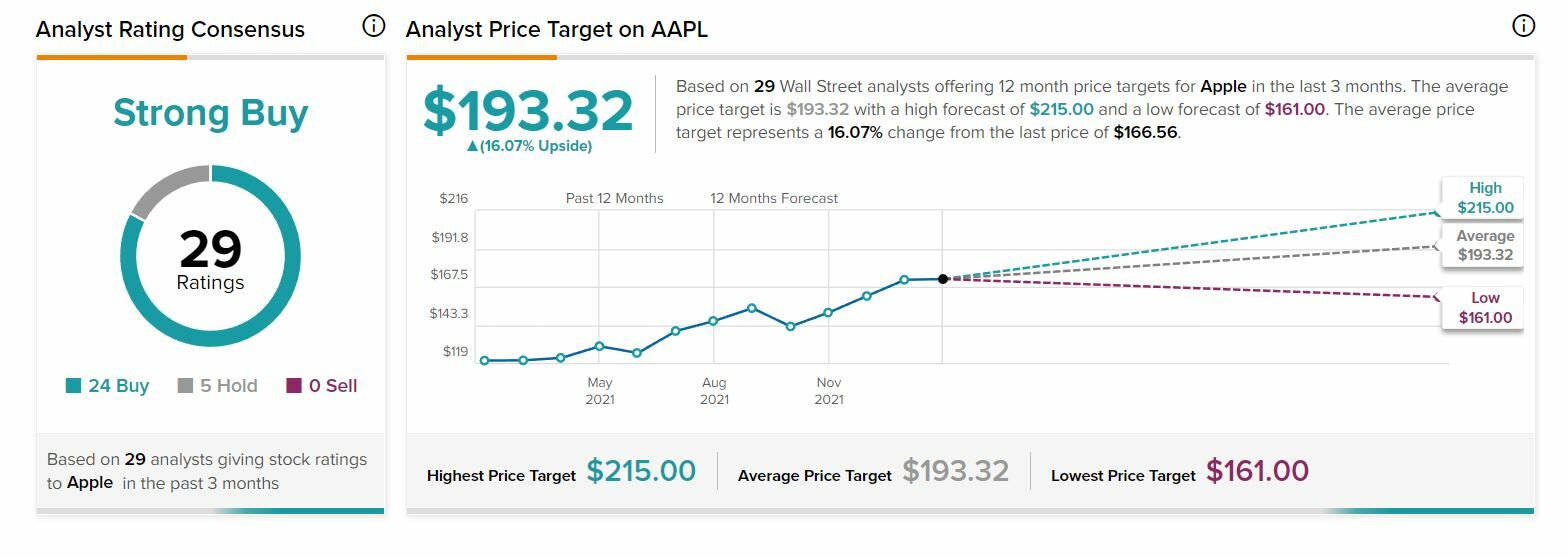

And while from TipRanks a large majority of buy recommendation by those who follow the value: 24 of the 29 analysts, while 5 choose to keep the value in the portfolio. Its median target price, $193.32, represents a potential 16% market advance for Apple.

Desde The Wall Street Journal highlight that of the 43 analysts who follow the value in the market, 27, down one from a month ago, opt to buy, with 6 overweight value, 9 who choose to keep it in their portfolio and 1 who underweight it. With advice to overweight Apple. Its average target price reaches $190.58 per share with a maximum of $215 and a minimum of $154 per share of the Cupertino company.

If you want to know the most bullish values of the stock market, register for free in Investment Strategies.

–