–

As Gamestop stocks, which were intensively bought by US individual investors, surged, the hedge fund that shorted the stock was in a position to receive an emergency bailout. The ants gathered together and pressed Wall Street’s hedge fund.

On the 25th (local time), according to Bloomberg et al., Wall Street’s hedge fund Melvin Capital received $2.75 billion worth of capital from another hedge fund, Citadel and Point72. This is because Gamestop stocks, which had been sold shortly, surged 51.1% on the 22nd, and then surged to 144% on the 22nd, pushing them into a’short squeeze’. Short squeeze refers to a situation in which stocks that were sold short have risen so much that they have to buy back and pay off the stocks they sold.

–

–

–

Founded in 2014 by star portfolio manager Gabe Plotkin, Melvin Capital has earned a high annual average rate of return of 30%. They lost 15% of their capital ($12.5 billion) until last week by short selling GameStop, and on that day, the loss ranged to 30%, leading to a crisis. Therefore, it urgently raised funds from Point 72.

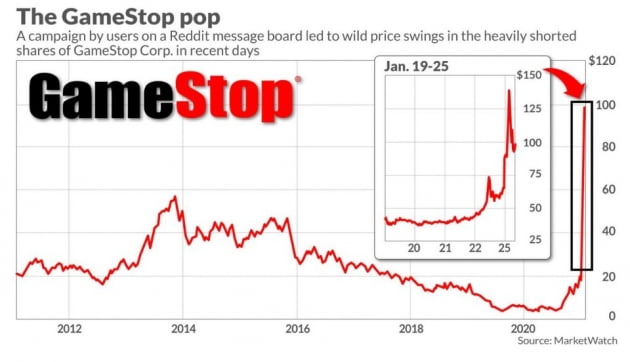

Gamestop, a video game distributor, has been a forgotten stock for a while. Until July of last year, the stock price remained at the 4 dollar level. However, on the 13th, the news that Ryan Cohen, co-founder and activist investor of the pet shopping mall Chewy, joined the board of directors in August last year, began to surge. After Cohen bought a 13% stake through his RC Ventures, three people including himself decided to join the board. At the end of last year, he had been asking GameStop to sell off all offline stores and turn them into online retailers to improve profitability.

–

–

–

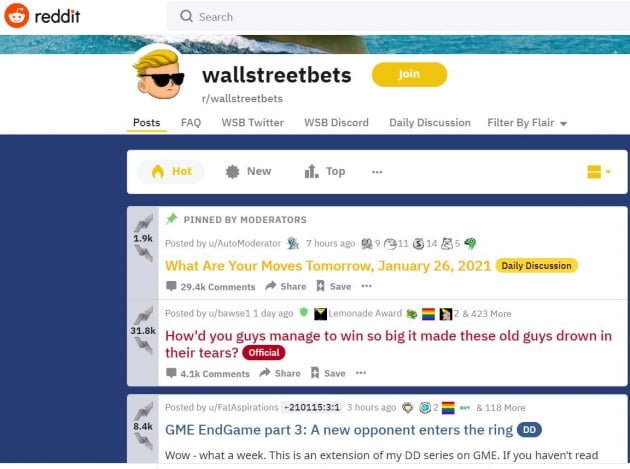

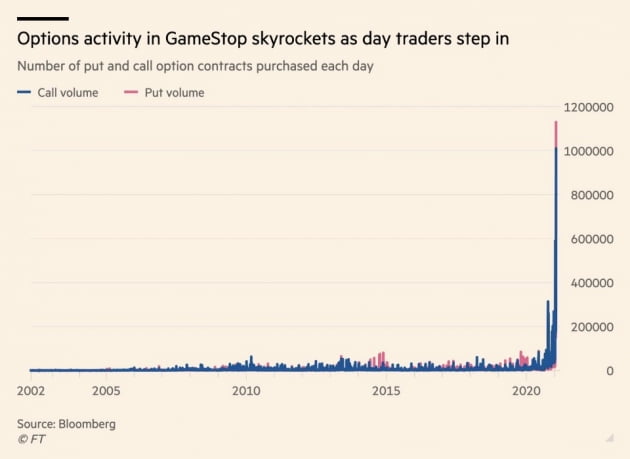

Individual investors, so-called’Robin Hood Investors’, added to this argument. They set up a discussion room called “wallstreetbets” on Reddit, an online community, and started buying groups. They bought not only stocks, but also stock call options. When the stock price soared, some criticized the saga of making $11 million in a few days by investing $53,000 on Reddit in options. In fact, on the 22nd, the call option price of GameStop, which was $60, jumped from 2 cents to 16.7 dollars during the day.

–

–

–

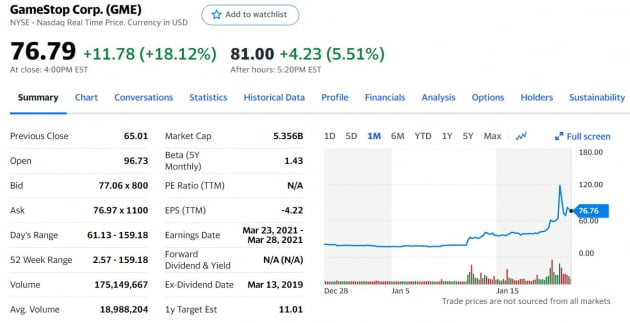

The stock price of GameStop, which was around $19 on the 12th, ended at $65.01 on the 22nd. It surged 235% over ten days. On this day, it jumped 144% to $159.19 at the beginning of the market. The trading volume also reached 170 million shares on the same day, greatly exceeding the 30 million shares, the average of 30 days.

As GameStop stock prices soared regardless of fundamentals from the 13th, several hedge funds such as Citron Research and Melvin Capital launched mass short selling. The stocks they sold shortly accounted for 138% of the circulation of GameStop. Theoretically, even if they bought all the stocks in the market, they sold them so excitedly that they couldn’t meet the short selling volume. As short selling became popular, the interest rate for borrowing GameStop stock soared to 23.6%.

However, as the ants did not lose and continued to buy and the stock price rose endlessly, the funds that had been short selling were caught in a’short squeeze’ in which they had to buy and repay the stock. Institutional investors who sold call options also became “gamma squeezes” to buy stocks. This is the background of the skyrocketing stock price.

–

–

–

Melvin Capital isn’t the only hedge fund that raises both hands to ants. Citron, famous for its short selling strategy, abandoned short selling on the 22nd. Bloomberg reported that S3 lost $6 billion on the day of the short selling force.

On this day, GameStop fell sharply to negative compared to the day before during the intraday, but eventually ended at $76.79, up 18.12%.

–

–

–

These speculative individual investors are moving to other stocks as well. On the 22nd, the intraday share price of BlackBerry rose more than 100%, and on that day, the blackberry soared 47%. Blackberry, which ended at a 28.42% increase on the same day, released a press release saying that it does not know why the stock price is soaring.

Reporter Kim Hyun-seok [email protected]

–

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution

–

:strip_icc():format(jpeg):watermark(kly-media-production/assets/images/watermarks/liputan6/watermark-gray-landscape-new.png,573,20,0)/kly-media-production/medias/3288486/original/088659700_1604588669-20201105_213526.jpg)