Chinese unicorn Ant Group has been ordered to rectify by mainland regulators since its failed listing plan in Hong Kong and China two years ago. Since the beginning of the month, after Chongqing Ant Consumer Finance Company was approved to raise its capital to 18.5 billion yuan, Ant Group yesterday released an announcement stating that the group changed its shareholding structure and founder Jack But he gave up the current controller of the group. This represents the further “separation” of Ant and Alibaba, or represents a turning point in the oversight of Ant.

Before understanding the new capital structure of Ant Group, it is necessary to start from the old structure.

Jack Ma once indirectly held more than 50% of the shares of Ant Group

Under the old structure, founder Jack Ma and three people acting in concert, Jing Xiandong, Hu Xiaoming and Jiang Fang controlled the two major employee share ownership platforms Hangzhou Junhan and Hangzhou Junao through 100% stake in Hangzhou Yunbo Investment, and therefore indirectly controls 53.46 % of the shares of Ant Group. Jack Ma owns a 34% stake in Hangzhou Yunbo Investment, so Jack Ma is the current controller of Ant Group.

But Yun is no longer in true control

Under the new architecture, there are several noticeable changes:

1: The relationship between Jack Ma and people acting in concert with the above three people is nullified;

2: Jack Ma retired from Hangzhou Yunbo Investment and no longer controlled Hangzhou Junao;

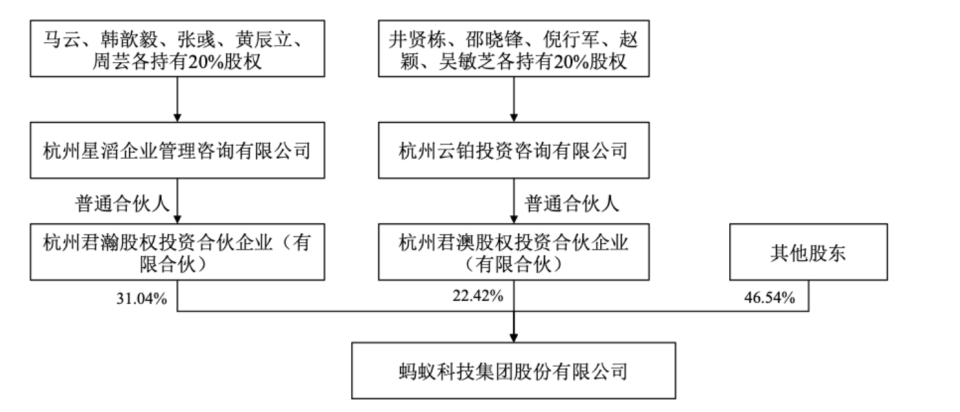

3: Hangzhou Xingtao is newly established, and Jack Ma and four other people each hold 20% of the shares, a total of 31.04% of the shares of Ant Group.

4: The voting rights of the higher shares are distributed among 10 natural persons. Junhan’s business partners include Ma Yun, Han Xinyi, Zhang Yu, Huang Chenli and Zhou Yun; Junao’s partners include Jing Xiandong, Shao Xiaofeng, Ni Xingjun, Zhao Ying and Wu Minzhi. Hu Xiaoming and Jiang Fang, the four main partners who were the top-level shareholders of Ant Group, are not in the ranks.

After the new structure, Jack Ma’s indirect stake in Ant Group dropped sharply to about 6.2%, and he no longer has effective controlling rights, at the same time there is no other effective controlling role in the new structure.

Ant said that after the adjustment, the voting rights of Ant Group’s shares will be more transparent and dispersed, which is further optimization of the corporate governance structure and will promote the constant and sustainable development of Ant Group. Ant also pointed out that among the current 8 directors on the board of directors, 4 are independent directors and plans to continue introducing a fifth independent director in the future to reach more than half of the independent directors on the board.

As for Alibaba (9988), it said its 33% stake in Ant remains unchanged, while Alibaba and other shareholders do not have absolute control over Ant Group. After the change, the voting rights held by Ant Group shareholders will be more dispersed and independent more in line with their own economic interests.

Alibaba is up 28% in the new year

After the rectification, the market hopes that Ant will re-promote the listing plan, but the company’s latest clarification indicates that it is still focusing on rectifying and upgrading the business, and has no plans to launch the listing.

But in any case, the market still has high expectations for the future development of Alibaba and Ant Group. Alibaba’s stock price closed up 8.6% today, closing at 110.4 yuan, the highest in three months. In just five trading days into the new year, Alibaba’s stock price rose by 28%, and its market value regained 2.3693 trillion yuan.

Fortune Insight and the “Wall Street Journal” jointly launched a new “FI Prime Plus” subscription plan, which costs only one-third of the original price on the WSJ official website, and can read the entire network content of the “Wall Street Journal” and most of Fortune Insight’s paid content at the same time

Sign up here:https://prime.fortuneinsight.com/web/wsj

Subscribe to FORTUNE INSIGHT Telegram:

http://bit.ly/2M63TRO

Subscribe to the FORTUNE INSIGHT YouTube channel:

http://bit.ly/2FgJTen