Zacatecas, Zac. Meganoticias Zacatecas received the complaint about cell phone applications where loans are requested by simply sending photographs of your voter ID and a personal photograph.

However, what is easy and simple can end in a legal conflict, since when a payment is delayed, the staff that works for these applications begin to send messages out of tune, as well as to send messages to all the contacts that have a mobile phone.

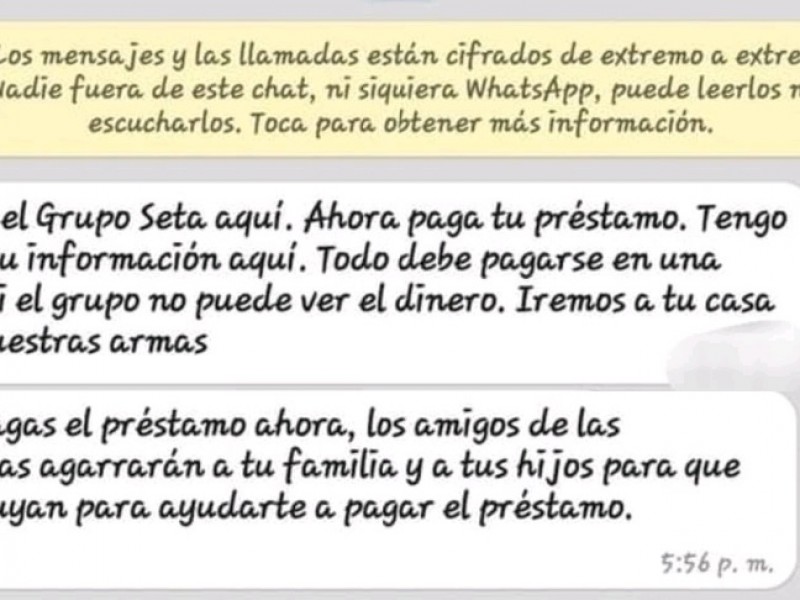

These messages issued by the so-called “collectors” are very aggressive, since they provide a photograph of the borrower, indicating them as debtors, extortionists, traffickers or kidnappers, when in reality the only thing they owe is some payment.

This modus operandi has already been detected by the National Commission for the Protection and Defense of Financial Services Users (CONDUSEF), where it is added that in some other applications, they ask for advances to be able to grant loans, which becomes a scam that has reached up to 200 thousand pesos.

“What is the hook in all this? That everything is too attractive, we do not verify the credit bureau, we do not verify if you have your pay stubs, your income, etc. So the offer of credit is very attractive” Saúl Alfonso Hurtado, Head of the User Attention Unit of CONDUSEF Zacatecas

In addition to this, the impersonation of 6 financial institutions duly constituted and registered in SEPRES has been detected, where they contact citizens and request advances in order to deliver a larger amount.

“We have had issues here of people who have deposited from three thousand, five thousand pesos, up to 250 thousand, the problem here is when you start to formalize, you no longer locate them. They come here with us, we check, we already have a list that users at the national level have told us, the list of entities that have been supplanted, so far this year, is 60” Saúl Alfonso Hurtado, Head of the User Service Unit of CONDUSEF Zacatecas

For those people who unfortunately have been victims of these frauds, it is pointed out that you must go to the Attorney General’s Office of the State of Zacatecas (FGJEZ) to file a complaint.

“You file your complaint there, precisely so that with the tools you already have, you can open your investigation folder, to see where that money went, who opened that account, what state it is in, etc.” Saúl Alfonso Hurtado, Head of the User Service Unit of CONDUSEF Zacatecas

Particularly in Zacatecas, in the month of May, 13 legal advisories were provided on these cases, presenting an increase since the month of January, when 2 were registered. In addition to the fact that the Covid-19 pandemic and the loss of jobs, intensified this type of fraud.

“Perhaps they already existed before, but as you say, they shot up a bit because people couldn’t go out, there was confinement, etc. and these types of offers came to you, so many were accepted” Saúl Alfonso Hurtado, Head of the User Service Unit of CONDUSEF Zacatecas

For this reason, before requesting a loan, it is recommended to enter the CONDUSEF portal and in the “Financial Institutions” section the System of Financial Services Providers (Sipres) is located where you can verify the duly constituted institutions. Signature

–