The text of the search report

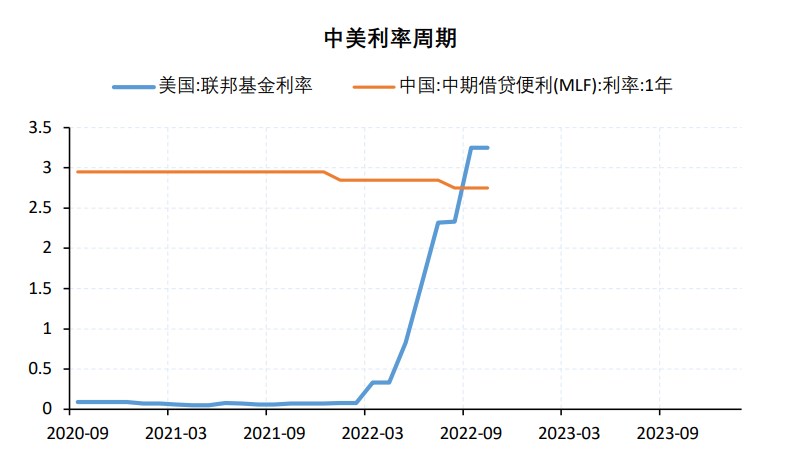

Macro: At the moment, domestic and foreign policy cycles are just the opposite: China’s housing decline and weak interest rates, while the US is due to high inflation and accelerated tightening, even the official interest rate of the United States significantly exceeded China’s level over the same period.

The money supply represented by the level of interest rates represents the financial environment of economic growth, which means that demand in Europe and the United States could slow further in the future and the Chinese economy could drive the recovery in Europe and in the United States .

Supply and demand: long facing a small peak in copper mining supply: from 22 to 24 years, copper mines will have an annual supply growth of 5% and the supply growth rate will be higher at the potential demand level of 3%, copper supply and demand will be slightly weak, TC copper concentrate will increase.

June to July: Due to the slow domestic recovery and the expected overseas economic recession, the destocking of the industrial chain led to a 30% drop in copper prices.

August to October: As foreign demand, particularly the US economy, has not really declined, the market is back on the trade path of Chinese demand recovery, with a nearly 20% rebound. Indeed, domestic demand for electrolytic copper watches in the third quarter reached 9% and processing orders continued in October and China’s actual performance was relatively strong. In November, the increase in demand driven by continued domestic stimulus and the decline in demand following the sharp rise in foreign interest rates remained at the center of the conflict.

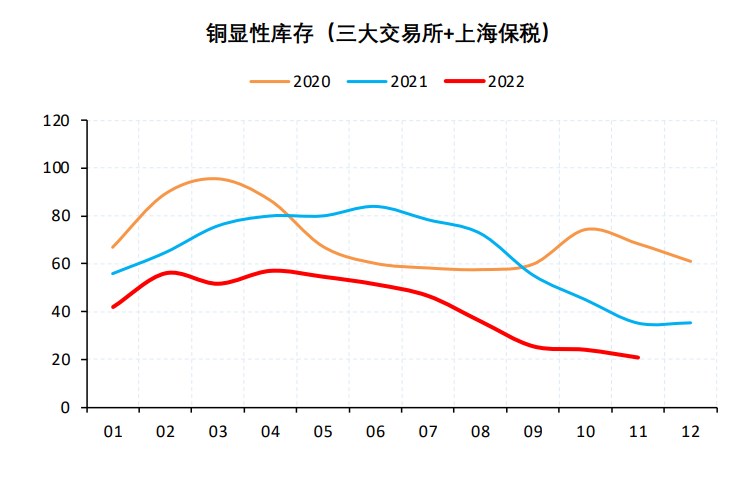

Inventory: This week, domestic stocks increased by 15,000 tons to 115,000 tons, and copper stocks in the world’s three largest exchanges plus Shanghai Bonded fell by 32,000 tons to 206,000. Stocks are low.

Spread: captive bill of lading premium 135 US dollars / ton (+13 this week), Shanghai spot premium 168 yuan / ton (this week -200).

Opinion: Aggressive hikes in foreign interest rates, weak demand expectations. In November, domestic copper scrap and smelting accelerated growth on a monthly basis, while copper processing remained stable and the supply and demand margin weakened. In any case, the delisting of Russian bronze by the LME deserves attention. General shock.

Sina Statement: This news is reproduced by the Sina cooperative media. Sina.com publishes this article for the purpose of conveying more information and does not mean to agree with its views or confirm their description. The content of the article is for reference only and does not constitute investment advice. Investors therefore operate at their own risk.

Massive information, accurate interpretation, all in the Sina Finance APP