Welcome to follow the WeChat subscription account of “Chuangshiji”: sinachuangshiji

Text / Ronin

Source: Business Data Pie (ID: business-data)

2020 is an extremely difficult year for traditional auto companies, but it is a very “ideal” year for new auto players. Not only has it achieved a big increase in car sales, it has also doubled its listed value in the capital market, which is quite sought after.

After Ideal Auto went public in 2020, it not only increased rapidly in shipments, and became the No. 2 player among the new domestic car-making forces, but also achieved a turnaround in adjusted net profit in the fourth quarter. On February 25, Ideal Motors officially released its financial report for the fourth quarter of 2020 and the full year of 2020. The total revenue for the fourth quarter was 4.15 billion yuan, an increase of 65.2% from 2.51 billion yuan in the previous quarter, which was 37.93 higher than market expectations. 100 million yuan.

However, in the near future, both A-shares and US stocks have made appropriate corrections to the new energy automobile industry, and the skyrocketing momentum has ceased. On February 25, local time, US new energy auto stocks collectively fell. According to Wind data, as of the close, Weilai and Ideal Motors both fell nearly 10%, and Xiaopeng Motors and Tesla both fell more than 8%.

In addition, Ideal Auto has made another major decision and is finally preparing to enter “pure electric” cars. On the eve of the earnings report, on February 24, “LatePost” exclusively learned that Ideal Motors had recently launched a pure electric vehicle project, and the first pure electric vehicle was planned to be released in 2023.

Prior to this, ideal follow-up models will still use extended-range technology. According to the prospectus, Ideal will launch its second production vehicle in 2022, which will be a full-size extended-range SUV.

After making profits for the first time, Ideal Auto still dare not all in pure electricity. Is it Li Xiang’s “program-increasing” obsession or a strategic circuitous one?

Turning losses into profit for the first time, the ideal is more radical

According to the financial report, Ideal Auto’s sales revenue for the fourth quarter of 2020 was RMB 4.06 billion, an increase of 64.6% from RMB 2.46 billion in the previous quarter. In the fourth quarter, total revenue was 4.15 billion yuan, an increase of 65.2% from 2.51 billion yuan in the previous quarter and higher than market expectations of 3.793 billion yuan.

In the fourth quarter, Ideal Auto had a gross profit of 724.6 million yuan, an increase of 45.9% from the same period last year, and an operating loss of 78.9 million yuan, a decrease of 56.2% from the same period last year, which was lower than market expectations of -79 million yuan. Ideal Auto achieved a positive quarterly net profit for the first time, reaching 107.5 million yuan.

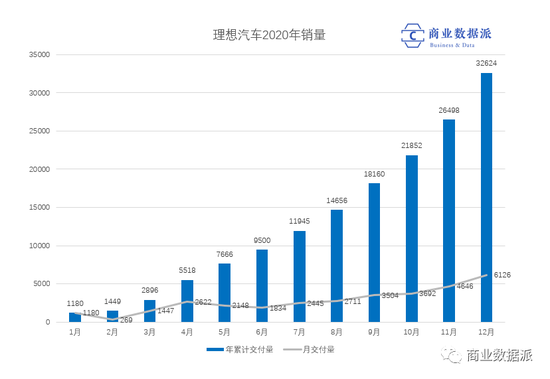

In terms of vehicle sales, Ideal Auto delivered a total of 14,464 new vehicles, setting a record quarterly delivery volume, delivering 32,624 vehicles throughout the year. For the whole year, Ideal Auto’s total revenue was RMB 9.46 billion, gross profit margin was 16.4%, and net loss was RMB 151.7 million, a year-on-year decrease of 93.8%. As of December 31, 2020, Ideal Auto had a cash reserve of RMB 29.87 billion.

Data comes from the official ideal car–

Data comes from the official ideal car–

Li Tie, Chief Financial Officer of Ideal Motor, stated that the gross profit margin of Ideal Motor’s annual car sales in 2020 will be 16.4%. It is expected that this figure will be between 19% and 20% in 2021. “As the delivery volume increases, vehicles will be significantly reduced. Cost and gross profit margin will be further improved, but we are still in constant research and development, there will be some investment, as well as network expansion, we consider these factors to get the forecast.”

During the earnings call, Ideal Auto reinterpreted its second strategic stage goals, including “expanding product lines, enriching products, and enhancing brand awareness” and “increasing sales more radically.” To achieve these goals, Shen Yanan, President of Ideal Motors, said that new models will be launched in 2022. In addition, Ideal Motors’ first pure electric vehicle is planned to be released in 2023.

Not only that, Li Xiang, the founder of Ideal Auto, also mentioned that from 2022, Ideal Auto will enter a period of intensive product launch. The price covers the range of 150,000-500,000 vehicles, and at least two models are launched every year, covering two platforms, extended-range electric and high-voltage pure electric. Behind the seemingly radical goal is to achieve the new goal mentioned in its internal letter: to obtain 20% market share in 2025 and become China’s No. 1 smart electric vehicle company. On top of this goal, the ideal car needs Take over 25% of the global market share in 2030.

Among the three new car manufacturers, the ideal car has the highest operational efficiency. On the one hand, the ideal ONE model alone has stabilized the mid-to-high-end domestic SUV of 300-35 million yuan, proving its strength in the field of high-end vehicle manufacturing. According to the financial report, since the delivery of the new car in 2019, its gross profit margin has turned positive And it reached the current 16.4%. Thanks to the cost advantage of extended-range vehicles, Ideal has gotten rid of the problem of selling one and losing one from a very early time. Weilai followed closely and pointed out the gross profit rate of the whole vehicle in the third quarter of last year. At 14.5%, Xiaopeng is relatively low, with a gross profit margin of 4.6% in the third quarter of last year.

On the other hand, compared with Weilai, Ideal Auto’s investment in research and development is much greater than in promotion and marketing. Earlier, Li Xiang once publicly stated that “50% of its money is spent on research and development, and about 30% of its money is spent on research and development. Less than 20% of the money is spent on personnel and marketing.” The rival of the same level, Weilai, invested 8.006 billion yuan in technology research and development in 2019 and 8.831 billion yuan in marketing expenses. It can be seen that Ideal Auto is in marketing funds. Investment is more cautious.

Looking forward to the first quarter of 2021, Ideal Auto expects its quarterly revenue to reach between 2.94 billion yuan and 3.22 billion yuan, an increase of approximately 245.9% to 278.8% over the same period in 2020, and vehicle deliveries will reach 10,500 to 11,500, year-on-year An increase of approximately 262.6% to 297.1%.

The ambitious ideal car has become a microcosm of the current upstart electric cars.

Three upstarts are hard to separate

Before discussing the future development of the ideal car, we might as well make some comparisons with the current domestic new car forces.

According to official data, Ideal Motor delivered 6,126 vehicles in December 2020, an increase of 355% from the previous year. From January to December 2020, Ideal Automobile delivered a total of 32,624 vehicles, setting a new historical record. Ideal ONE is currently the only mass-produced model of Ideal Automobile. As of December 31, 2020, Ideal Automobile has established 52 retail centers across the country, covering 41 cities (it has reached 60 in January, covering 47 cities); after-sales maintenance centers There are 114 authorized sheet spray centers covering 83 cities. According to the latest official target recently announced, Ideal Auto will expand to 200 offline stores in 2021.

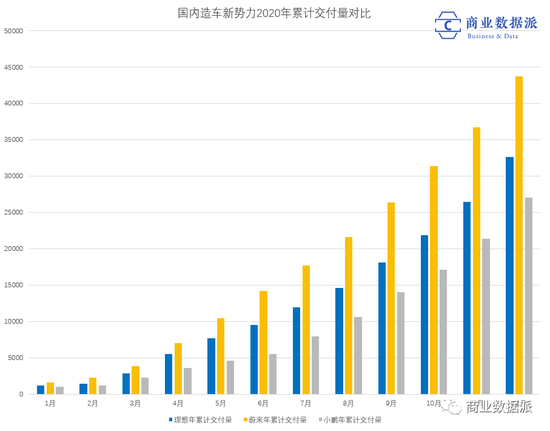

NIO, which is also a new force in car manufacturing, delivered 7007 new cars in December 2020, an increase of 121% year-on-year. From January to December 2020, NIO delivered a total of 43,728 cars. Among the mid-to-high-end SUV models priced at 300,000 yuan, NIO competes directly with Ideal Auto, and is also in the first echelon to become a hot-selling model. However, compared with Ideal Auto, Weilai has a total of 224 service outlets across the country, covering 107 cities, and will “firmly deploy channels.” At the same time, according to Weilai’s plan, in 2021, it plans to expand the country’s replacement power stations to 500.

Compared with the first two, Xiaopeng Motors, another new energy player, is not to be outdone. In December 2020, it delivered 5,700 new cars, an increase of 326% over the same period last year. From January to December 2020, Xiaopeng Motors delivered a total of 27,041 units, which is the same A record high. However, Xiaopeng Automobile has not announced the number of its offline stores. On May 1 last year, Xiaopeng Automobile announced that it has opened 17 sales stores in 11 cities across the country, and its national sales and service network covers 166 stores in 57 cities.

(Data comes from the official websites of Ideal Auto, Weilai and Xiaopeng)–

(Data comes from the official websites of Ideal Auto, Weilai and Xiaopeng)–

As the current leaders of new car-making forces, Ideal Auto, Weilai, and Xiaopeng Auto have developed rapidly in 2020. In 2020, their share prices have reached record highs. The market value of Ideal Auto has increased from US$13.8 billion since the IPO to US$25.9 billion at the end of the year. The market value of Weilai has risen from US$4.3 billion at the beginning of 2020 to US$76.2 billion at the end of the year. The market value of Xiaopeng Motors has increased from US$15.3 billion since the IPO to US$25.9 billion at the end of the year. The year’s 33.5 billion US dollars.

Like Tesla, the three upstarts have achieved their goal of rapid growth in 2020.

However, on this basis, the current strength of these three players in the new energy market is almost equal, but their combined sales are still far less than Tesla’s global 499,600. Since its development, Ideal Automobile has only launched one model. Weilai has launched four models, ET7, EC6, ES8, and ES6. Xiaopeng has launched two models, G3 and P7. Compared with Tesla’s current Model S, Model 3 and Model X For Model Y and Cybertruck, the new domestic car-making forces are still in the initial stage of development, and their coverage prices are mostly concentrated in the mid-to-high-end areas of 200 to 350,000 yuan, and each is facing competitive pressure.

Car critic Renxuan said that the car believes that the rapid development of these upstarts is inseparable from the support of the market environment, because “consumers have no choice, especially users in Beijing. It is difficult to take pictures of new energy sources and cannot buy fuel vehicles. There are only these three at the same price.” Just like the third generation, there are only a few cars and so many consumers, which actually creates opportunities for more new players.

The current market environment still welcomes new players to participate. After all, China’s high-end new energy vehicle market is still in the early stage of development. For example, Baidu previously established a smart car company and confirmed that former Mobike co-founder Xia Yiping will serve as the company’s CEO; SAIC and Alibaba have jointly launched a smart car, and Huawei also has a multi-faceted layout of software and hardware on smart cars.

In 2021, a new battlefield has just opened.

The ideal future is “pure and impure”

“Pure electric” or “extended range” has always been a controversial point for ideal cars.

The ideal car powered by extended range has been questioned a lot in the early days of its release, and this voice has not disappeared even now. In the era when the market is generally optimistic about the field of pure electric vehicles, ideal cars have begun to sway and deploy pure electric products, but they still dare not all in pure electric.

First of all, is the extended program the future of new energy vehicles?

From the perspective of industry development, the answer may be no. Extended-range cars will burn oil after all. It does not represent the long-term future. But in October last year, after the publication of the “Energy-saving and New Energy Vehicle Technology Roadmap 2.0” compiled by the Ministry of Industry and Information Technology and organized by more than 1,000 experts from the entire industry organized by the Chinese Society of Automotive Engineers, we saw a “full electric drive” The concept of “Plan” replaces the earlier “burning ban”. The report emphasizes the development strategy of pure electric drive. By 2035, the new energy vehicle market will account for more than 50%, and energy-saving vehicles will be fully hybridized.

This gives some car companies that have switched from traditional fuel vehicles to new energy sources an important window period. During the long transition period when pure electric vehicles cannot be fully popularized, market education is completed through extended-range electric vehicles. The current profitability of ideal cars seems to indicate this. Roads, and have opportunities for at least ten years. Therefore, traditional car companies including Baoneng Group, Dongfeng Motor, and Geely Group have also entered this track. These conservative companies can not only make good use of their technological advantages in traditional cars, but also In the aspect of intelligence, it cooperates with technology giants to realize the transformation of power and intelligence.

Speaking of ideal cars, although they will remain in the extended-range car field until 2022, the plan to launch pure electric vehicle products in 2023 proves that the next step is pure electric vehicles. Li Xiang mentioned last year that “the ideal ONE will no longer be emphasized as the concept of extended-range electric vehicles in the future, and the ideal ONE is a plug-in hybrid electric vehicle.” This point was still emphasized in the November earnings call: “extended range It’s just a charging solution, but consumers are not buying an extended range, they are buying a better smart electric car.”

For such a stock market, how to seize opportunities for new energy vehicles is not only a problem that ideal cars have to face, but also a common topic for all new car-making forces. At present, in order to solve this problem, the following four challenges cannot be ignored:

1. Energy issues. The convenience of charging is still an obstacle to the popularization of new energy vehicles. This is actually the helpless situation when it first adopted the extended range. For the real future trend, Ideal Car believes that there will be two ways in parallel. The first way is to use urban pure electricity and long-distance power generation as the user value extended range electric platform (power bank); the second way is to provide ten minutes to supplement 300-500 kilometers A 400-kilowatt super fast charging high-voltage pure electric platform (super charger) with battery life. As Li Xiang said, “Only when the charging station is really as convenient and fast as the gas station, can all consumers change the fuel-burning vehicles to smart electric vehicles.”

2. Battery problem. The reason why the battery problem is not ranked first is that revolutionary technologies in this field have not yet appeared. For new energy car companies, the current progress of lithium iron phosphate batteries and ternary lithium batteries is very slow, which together restrict the battery breakthrough of electric vehicles. In the foreseeable future, solid-state battery technology may set off a new storm, but it still needs At the time, NIO previously announced that it would deliver solid-state batteries in the fourth quarter of 2022, but no matter which car manufacturer solves one of the energy and battery problems, it can quickly attract users.

3. Intelligence issues. The core of the intelligence problem is to make cars have intelligent perception, which depends on the increase in computing power and hardware upgrades. The biggest advantage of smart electric vehicles is that users can always grow after purchase, and they have more and more convenient and easy-to-use functions. Coupled with the upgrade of automatic assisted driving technology, all this depends on the increase of the car’s computing power. Li Bin once mentioned that “(Electric vehicles) computing power increases too fast. If there is no advance amount, it will be more passive in the future.” And soon, electric vehicles with computing power exceeding 1000 TOPS will come out.

4. Number of offline stores. Xiaopeng Automotive Internet Center Deputy Manager Liu Yilin once mentioned that “a car is a product that you have to see before you can buy it with confidence.” Less than 10% of Tesla’s sales in China are located in areas without a store layout. It can be seen that although the three new energy giants are gaining momentum nowadays, traditional car manufacturers like BBA still dominate the sales volume of cars. In addition to the brands and product strengths built over the years, the important reason is that these brands have offline stores all over the country. The number of stores has played a large role in decision-making guidance for car consumers. In terms of new energy vehicle brands, these three players still need to significantly expand offline channels.

In fact, solving all these problems requires not only capital, but also heavy investment in research and development. On February 2 this year, Ideal announced that it would set up a research and development center in Shanghai, which has become another important part of its investment resources outside of Beijing. According to official disclosures, the scale of its Shanghai R&D center will exceed 2,000, which is also in preparation for its follow-up launch of pure electric models and research and development of autonomous driving technology.

According to the official report, Ideal Motors will also launch a facelift of Ideal ONE in the second half of this year. As more and more manufacturers join, the track of extended-range cars is becoming more and more crowded. Baoneng Motors, Lantu under Dongfeng, and LEVC under Geely have shown relevant technologies and plans to launch new cars. In the second half of last year, Li Yinan, the founder of Mavericks Electric, also officially announced that it would enter the field of extended-range electric vehicles.

It is almost foreseeable that the ideal car will be invested in the extended range and pure electric fields at the same time, and it will consume much more resources than it is now.

After generating pure electricity, the cost of an ideal car will inevitably rise. It is a question of whether the current operating advantage level can be maintained at that time.

–

–

–