A downtown apartment complex seen from Namsan in Seoul. 2024.10.23 Yonhap News

After the government began ‘tightening loans’ last month, sales of mid- and high-priced apartments under 900 million to 1.5 billion won in Seoul decreased significantly, and the proportion of apartment transactions under 900 million won increased. This is interpreted to be because, as the banking sector’s housing mortgage loan interest rates continue to rise and the apartment transaction volume itself has plummeted, apartments priced under 900 million won, which are less affected by lending regulations, are being traded.

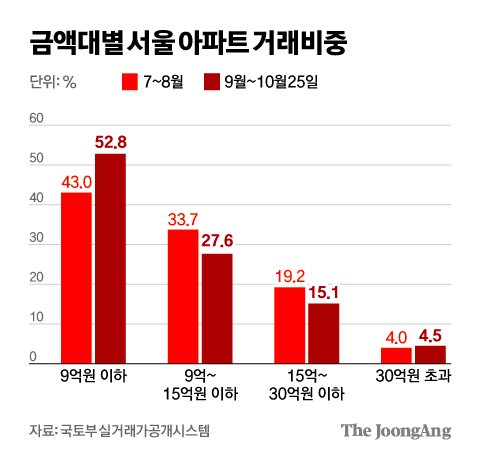

According to the Ministry of Land, Infrastructure and Transport’s actual transaction price system on the 27th, there were a total of 4,138 apartments in Seoul that were sold and reported from September to the 25th of this month, of which 2,184 transactions were under 900 million won, accounting for 52.8% of the total. In July and August, before the loan regulations were implemented, apartment prices in Seoul rose and the number of sales reached 15,341. At that time, the proportion of transactions under 900 million won was 43.0%. Even in May and June, the proportion of transactions under 900 million won was 41.3%. After the loan regulations were implemented, the proportion of apartment transactions worth 900 million won or less increased by about 10 percentage points.

On the other hand, after loan regulations, apartment sales in the mid- to high-priced range of 900 to 1.5 billion won were found to be hit the hardest. The transaction proportion of apartments priced below 900 million to 1.5 billion won was 33.7% in July and August, but decreased by 6.1 percentage points to 27.6% in September and October. The proportion of apartment transactions in the 1.5 to 3 billion won range also decreased by 4.1 percentage points from 19.2% in July to August to 15.1% in September to October.

Designer Younghee Kim

The increase in the difference in the proportion of apartment transactions based on 900 million won is due to the influence of loan regulations. Houses worth less than 900 million won can receive government policy loans at a low interest rate of 1-3%, such as special provisions for newborns and first-time home purchase funds, but apartments worth more than 900 million won are not eligible for support. Above 900 million won, you will be immediately affected by bank interest rate hikes and strengthened financial regulations.

Last month, the government implemented the second-stage stress DSR (total debt service ratio) and also restricted mortgage loans and jeonse loans for those who own a home. As purchase sentiment declined, the number of apartment sales in Seoul, which reached 9,024 in July (based on the contract date), decreased to 6,329 in August, and in September, it fell by half to 2,890 compared to the previous month.

Park Hap-soo, an adjunct professor at the Graduate School of Real Estate at Konkuk University, said, “As apartment prices have been on the rise since May of this year, sales of mid- to high-priced apartments around 1.5 billion won have increased due to the demand for ‘smart houses.’” “However, in the past 2 to 3 months, house prices have risen too much. “Transactions have slowed due to overlapping lending regulations,” he said.

Meanwhile, the transaction proportion of ultra-high-priced apartments exceeding 3 billion won increased from 4.0% in July to August to 4.5% in September to October. This means that despite the overall decrease in transaction volume, ultra-high-priced apartments were less affected by loan regulations. Professor Park said, “Ultra-expensive apartments are less affected by lending regulations because they are traded by cash-rich people or professionals who can take out large loans.”

Reporter Baek Min-jeong [email protected]