Since last July, the supply of bank loans has weakened markedly. Yet mortgage rates have never been lower. The tightening of access to credit desired by the Banque de France is therefore producing the expected effects. But the decline in the old-fashioned loan market, which will continue for the rest of the year, is dragging in its wake home purchases by individuals.

–

The year 2021 will therefore end less well than it had started and the fall will be rather sad, compared to a blazing spring. However, the prices of old housing continue to climb. But without the evolutions observed everywhere on the territory really upsetting the price differences observed between cities, large and small.

Ever higher prices, in the old

As soon as the first lockdown came out, the prices of old houses recovered sharply to remain at a high level until the end of 2020. But despite the improvement in credit conditions, part of the demand s’ is exhausted: especially in large cities, due to the prices charged and the deflation of portfolios of goods available for sale; but also in small and medium-sized towns where would-be buyers more and more often come up against the constraints of access to credit imposed by the Banque de France. During the first half of 2021, tensions therefore eased and prices slowly fell, regardless of the surface area of homes sought: the decline was then all the more apparent as the “beautiful” properties had become more rare, with the exhaustion of their demand. However, after 6 months of deterioration, signed house prices began to rebound in July according to the LPI-SeLoger Barometer and the increase accelerated during the summer, at a rapid pace to reach + 3.4% on 3 months in September.

In addition, the increase in the prices signed for old apartments is continuing at a sustained pace (+ 6.5% over one year at the end of September, against + 4.9% a year ago). It benefited from continued sustained growth during the summer: the rate of increase was also established at + 2.8% in September alone. All apartment sizes are experiencing such an evolution, even the prices of the largest apartments (6 rooms and more), which are already very high, everywhere.

It is therefore not surprising that, for example, apartment prices rise by at least 10% year on year in more than a quarter of cities with more than 50,000 inhabitants, without any real signs of slowing down. the increase. While the increase is strengthening in almost all cities of more than 100,000 inhabitants, while the attractiveness of the peripheral municipalities highlighted during the first confinement gradually diminishes. But this is not new and only confirms the findings that the LPI-SeLoger Barometer presents, month after month, since the spring of 2020. It is therefore not surprising if the price differences between cities or between urban spaces did not diminish during the crisis caused by Covid-19. Whereas, on the other hand, the “predictions” widely taken up a year ago announced a relatively severe fall in prices to come in rural communities.

For example, while the prices signed in Paris exceed € 11,300 / m², up 7.3% over one year and with no prospect (other than seasonal) of weakening, crossing the ring road to the west is no longer useful. to much, if we do not also cross the Seine: now the prices are indeed comparable to Levallois-Perret and Neuilly-sur-Seine. While the Parisian fever is gradually gaining in Boulogne-Billancourt, south of the ring road (while Vincennes is still a little far away, and to the east). On the other hand, crossing the Seine west of Paris for Asnières or Courbevoie ensures savings per m² of around 35%. And if the adventure leads beyond La Défense, to Colombes or Nanterre, the buyer can expect a 50% price reduction: the savings can even represent 60% if the ring road is north of Paris, with a purchase in Aubervilliers or Saint-Denis.

Of course, the discount is always associated with a distance from the “capital”, its lights and its services, at the cost of longer travel times… and all of this is old!

But this is not specific to the Paris region. Even if the income levels (not to mention the assets) of Parisian buyers are clearly higher than those of Bordelais or Lyonnais; and what if we compared them to those of Stéphanois or Calaisiens! So of course, Colombes and Nanterre are more expensive on the order of 10% than Bordeaux or Lyon; and even 5% more expensive than Annecy or Cannes. When Aubervilliers and Saint-Denis are worth as much as Nantes, Rennes or Strasbourg. But compared to Bordeaux, living in Mérignac or Pessac is like crossing the Seine for Asnières or Courbevoie. Whereas compared to Lille, going to Roubaix is like crossing the ring road north of Paris …

And what about all these provincial towns where the price per m² struggles to exceed 2,200 € / m², while being unaffordable when compared to the predominantly rural departments whose prices hardly reach 1,300 € / m²? … Certainly not, as we often read, that if the markets have been seizing up for several months in these territories, it is because the rise in prices has made demand insolvent there!

But more restrictive loan granting conditions

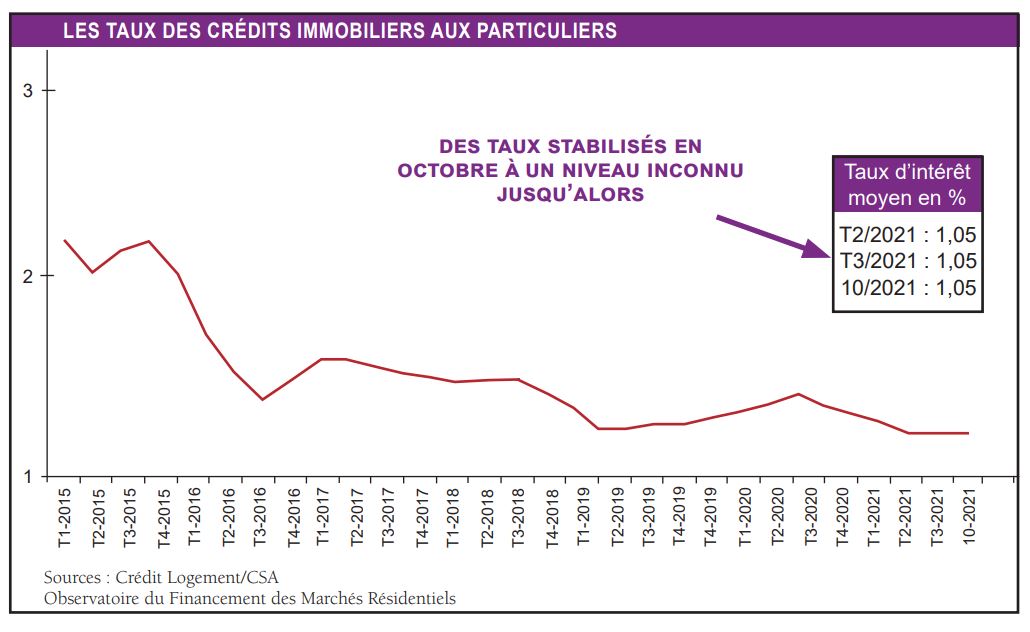

Last October, mortgage rates stood at 1.05%, for the third consecutive month. They have never fallen so low since the end of the 1940s. And yet, the activity of the old loans market deteriorated markedly throughout the summer. Because, of course, it is accepted that exceptional credit conditions allow those who have a sufficient personal contribution to get into debt, to bear reduced repayment costs. But it is not because the rates are low that the activity will be high: it is still necessary that candidates for the purchase of old housing can access the credit market, so that their personal contribution is sufficient. .

And if the candidates for the purchase can no longer enter the market, it is not because of the increase in the prices of the old, too low usury rates or bad credit conditions, but because the personal contributions demanded by banks are at levels such that a large part of the potential demand is excluded from the market. The decision taken by the Banque de France to tighten access to credit has indeed severely penalized the demand for housing: the so-called HCSF recommendations of December 2019 and December 2020 have altered the dynamism of the old market.

More specifically, the level of personal contribution mobilized by those who can enter the old market has increased sharply according to the Housing Credit Observatory / CSA since the end of 2019, before the Bank of France does not decide to tighten access to credit to meet the requirements of the European Systemic Risk Board (CERS / ESRB) formulated with France in September 2019: + 13.1% over the first 9 months of 2021, year-on-year , after + 12.3% in 2020, i.e. more than 33% since December 2019! Personal contribution rates have therefore literally “exploded”, up 31% since the HCSF recommendation of December 2019: they had fallen to levels never seen in the past, allowing the market to develop as never before, thanks to the arrival of young or modest households with little personal support but who now only benefit from limited access to credit.

Moreover, in order to illustrate the consequences of the demands formulated by the banks over the past two years, the increase in personal contributions represents an additional € 18,000 that the loan candidate must be able to mobilize. According to the Housing Financing Observatory of the CSA Institute, such an increase amounts to increasing by 40% (!) The contribution of 55% of first-time buyers in the former with an annual income. less than 3 minimum wage: which is difficult to imagine, without a helping hand… On the other hand, the increase is only 15% for the 15% of buyers whose annual income is higher than 5 minimum wage!

It is therefore not surprising that the activity of the old loans market is declining despite the rate conditions offered to customers, dragging in its wake the purchases of old homes by resident individuals.

And a worrying decline in loan production

The implementation of the recommendations of the HCSF which for two years has not ceased to destroy the dynamism of the old market seems to have achieved its objective. Of course, the first half of the year 2021 was excellent, by reference to an equivalent period which in 2020 (and it must be remembered) had suffered the full brunt of the shock of the first confinement. In addition, the dynamism of the market has been artificially maintained by a banking offer preparing for the transposition into the regulations of the tightening of the criteria for granting loans (transposition initially planned for July 2021, before being postponed to January 1, 2022) , until becoming legally binding: knowing that a strict application of the recommendations of the HCSF will henceforth weigh on the new offer dedicated to the financing of the old one.

Also, after several months of rapid growth in activity, the rate of change in production began to slow down markedly in July. And this slowdown intensified throughout the summer, well beyond the usual seasonal weakening of the market. Thus and despite the dynamism of the banking offer which was still observed in June, the number of old loans measured at the end of September 2021 on a sliding quarterly level is down by 28.6% compared to the third quarter of 2020 ( against + 18.5% in September 2020). The shock is severe. However, taking into account the results of the first half of the year, the number of old-fashioned loans measured over the first 9 months of 2021 increased by 5.9% compared to the equivalent period of 2020. While the number of loans measured over the first 9 months of 2021 is down 5.9% compared to that of the first 9 months of 2019!

This trend observed in the number of loans can obviously be seen in the number of compromises signed. Since, according to the LPI-SeLoger Barometer, while purchases of second-hand housing did indeed increase by 10.2% at the end of September (9 months 2021 compared to 9 months in 2020), they nevertheless remain down by 9.2% per year. compared to 2019 (9 months 2021 compared to 9 months 2019). Concerns about future developments in the old-fashioned market therefore have every reason to increase if, which is highly probable, the Banque de France does not reverse its previous decisions.

SURVEY METHOD

This article summarizes the main results of the LPI-SeLoger barometer, the Residential Market Financing Observatory (Housing Credit / CSA) and the OPCI, the Real Estate Credit Production Observatory.

–