5-year variable rates are currently around 1.40% and 5-year fixed rates are around 2.99%. If you have to take out or renew a mortgage, what choice would you make? (Photo: 123RF)

–

GUEST BLOG. I’ve always been a fan of adjustable rate mortgages. I want to brag about its merits, even though the Bank of Canada has already announced an increase in its key rate. Variable rates directly follow the prime rate.

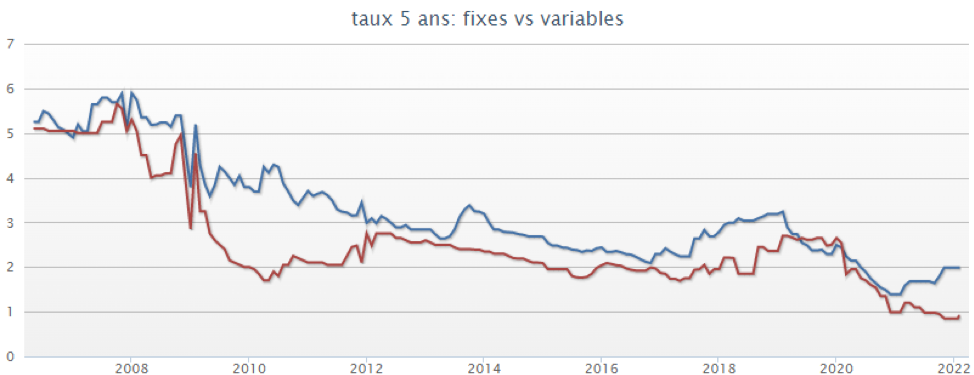

The prime rate is greatly influenced by the key rate. Over the past 14 years, the variable rate has always been lower than the fixed rate, except in 2019.

Source: ratehub.ca

To be more economical, variable rates (red line) do not have to be lower than fixed rates (blue line) over the entire five-year term. They prevail if the average variable rate over the five-year period is lower than the fixed rate.

This is what Moshe Milevsky, a professor at York University, calculated for the period between 1950 and 2007. In 90% of cases, variable rates were the best choice. For a $100,000 mortgage to be paid off in 15 years, the average saving was $22,000 in interest payments.

As the banks add a premium to guarantee their fixed rate, this result is not so surprising. Peace of mind comes at a price. Those who choose a variable rate must be able to live with some uncertainty.

If you are a new buyer, your mortgage is close to the maximum allowed by your bank, your down payment is only 5% and you have concerns about your job, take a fixed rate! The choice of the type of rate depends on the circumstances of each one.

Cheaper penalty

An advantage of a variable rate mortgage is that the penalty for breaking the mortgage before the end of the term is generally lower, because it does not take into account the rate differential calculation as for a fixed rate mortgage. The penalty is three months interest only.

An interesting strategy is to choose a variable rate and increase your regular payment to what it would have been if you had chosen a five-year fixed rate. In addition to reducing capital more quickly, this better prepares you for any future rise in the key rate.

Some banks allow you to convert your variable rate into a fixed rate. If the interest rate on your variable rate mortgage increases and you fear further rate increases, you can convert it to a fixed rate mortgage. It’s likely that you’ll get a higher fixed interest rate than you would have had when you originally got the mortgage.

Myth: Mortgage payments vary

This is not necessarily the case. Some banks have fixed payments for their variable rate mortgages. Changes in interest rates affect how the payment amount is applied to the mortgage. For example, if interest rates rise, a larger portion of the payment is made as the interest payment, and a smaller portion is made as the principal payment.

increasingly popular

The market share of new variable rate mortgages increased from 10% at the start of 2020 to 51% in July 2021. This market share has continued to increase since. The popularity of variable rates is explained by the high spread between variable and fixed rates. Key rates have fallen since the start of the pandemic and fixed rates have risen recently.

5-year variable rates are currently around 1.40% and 5-year fixed rates are around 2.99%. The 1.49% difference is significant. If you have to take out or renew a mortgage in the next few months, what choice should you make?

My advice

At the beginning of a 5-year term, the variable rate is advantageous and it exceeds the fixed rate only after six increases of 0.25%. The variable rate must continue to rise to compensate for the gain made at the beginning. Experts are currently predicting several 0.25% increases in variable rates. Will there be more than six?

Since variable rates have historically been the best choice in 90% of cases, one strategy is simply to forget the predictions and take a variable rate for each term. It is possible that you will lose from time to time, but it will be relatively little. You will almost always win.

Variable rates are not necessarily as risky as they first appear. Even with a variable rate, one can sleep well at night, if it is a matured and informed choice. Only those looking for low risk should take a fixed rate. They must agree to pay the premium that the banks include in the fixed rate.

–