The prices have increased diesel – used to power trucks, power cars and heat homes – by around 50% due to shrinking inventories and a tight export market.

Diesel is the most important fuel for the global economy, as trucks, buses, ships and trains depend on it. It is also used to operate construction, manufacturing and agricultural machinery as well as to heat homes and generate electricity after the high price of natural gas.

Within the next few months, nearly every region of the planet will face a diesel shortage at a time when a supply crisis in nearly every energy market worldwide has exacerbated inflation and stifled growth.

In the United States alone, the high cost of diesel will cause an estimated $100 billion of economic damage, according to Mark Finlay, an energy fellow at Rice University’s Baker Institute for Public Policy, told Bloomberg, which was seen by Al Arabiya. net .

Inventories of diesel and heating oil in the United States are at an all-time low for this time of year in data going back four decades. Northwestern Europe is also facing low inventories: inventories are expected to hit a low this month and then decline further by March, shortly after the start of sanctions that will cut the region off Russian naval supplies.

It comes as global export markets have become so overcrowded that poorer countries like Pakistan have been shut down, with suppliers unable to book enough shipments to meet the country’s domestic needs.

“It’s definitely the biggest diesel crisis I’ve ever seen,” said Dario Scavardi, former chief executive officer of Italian oil refinery Saras SpA, who spent nearly 40 years in the industry.

Evolution of the cost of diesel

Diesel in the New York Harbor spot market, a key benchmark, is up nearly 50% this year. The price hit $4.90 a gallon in early November, about double last year’s levels.

Fuel spreads versus crude have also widened, a sign of how scarce refining capacity is and in terms of supplies to be delivered later. In NW Europe, diesel futures cost around $40 a barrel relative to Brent, compared to a 5-year average of just $12. New York diesel futures for December delivery are also trading about 12 cents higher than those in January.

What causes the shortage?

And after the lockdowns devastated demand and forced refineries to close some of their least profitable plants, the looming shift away from fossil fuels further dampened investment in the sector.

Since 2020, US refining capacity has shrunk by more than a million barrels per day. Meanwhile in Europe, shipping disruptions and worker strikes have impacted refinery output.

Europe

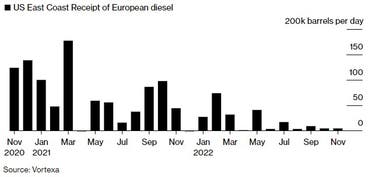

Things could get even more dramatic with the looming withdrawal of the European Union from Russian supplies. Europe relies on diesel more than any other region in the world. Nearly 500 million barrels a year are delivered by ship and about half is routinely loaded at Russian ports, according to data from Vortexa. The United States has also cut off imports from Russia, which was a major supplier to the East Coast last winter.

A sustained diesel shortage in the US is certainly unlikely as the country is a net exporter of fuel. But local outages and price hikes are likely to become more frequent, especially on the East Coast, where pipeline shortages are creating huge bottlenecks. The region relies heavily on the Colonial Pipeline, which is often full. A century-old shipping law, known as the Jones Act, further complicates the circulation of domestic fuels and encourages Gulf Coast producers to prefer exports over sourcing domestically.

Slowdown of supplies to Europe

With the end of the sanctions against Russia approaching, Europe still imports a huge amount of diesel from Russia. It also withdraws huge quantities from Saudi Arabia, India and others. As a result, seaborne imports for October hit their highest levels since at least early 2016, according to Vortexa data compiled by Bloomberg.

Russia holds the stage

Germany was already experiencing difficulties, with lower levels of the Rhine hampering deliveries and reducing production, while refineries in neighboring Hungary and Austria also experienced significant disruptions. French manufacturing was stifled by a wave of workers’ strikes over wages.

“If Russia is no longer a supplier, this will have a huge impact on the system and will be difficult to fix,” said former Saras CEO Scavardi.

Poor countries suffer

Global pressure on fuel has made it more profitable for exporters like China and India to send shipments to countries in Europe that can pay high premiums. Overall fuel exports from China are expected to increase by 500,000 bpd to nearly 1.2 million bpd by the end of the year, according to energy consultancy FGE.

Whether this will be enough to close the global supply gap remains to be seen, while poorer countries that cannot afford higher prices suffer.

Cash-strapped Sri Lanka’s energy minister said he was struggling to afford global fuel prices and unable to secure adequate supplies. Thailand has extended a diesel tax cut in a bid to protect consumers from higher prices, with the government expecting the move to cost around $551 million in lost revenue. And Vietnam is trying to implement emergency measures, including using its central bank to open more loans to domestic fuel producers in order to boost supplies.