European Car Sales Dip Slightly, but EVs Surge

The European automotive market experienced a mixed bag in November 2024. While overall new passenger car registrations edged down 1.7% year-over-year,reaching 1,054,043 units across 28 markets,the electric vehicle (EV) sector showed robust growth. This brings the year-to-date total to 11,847,573 units, a modest 0.8% increase compared to the same period in 2023.

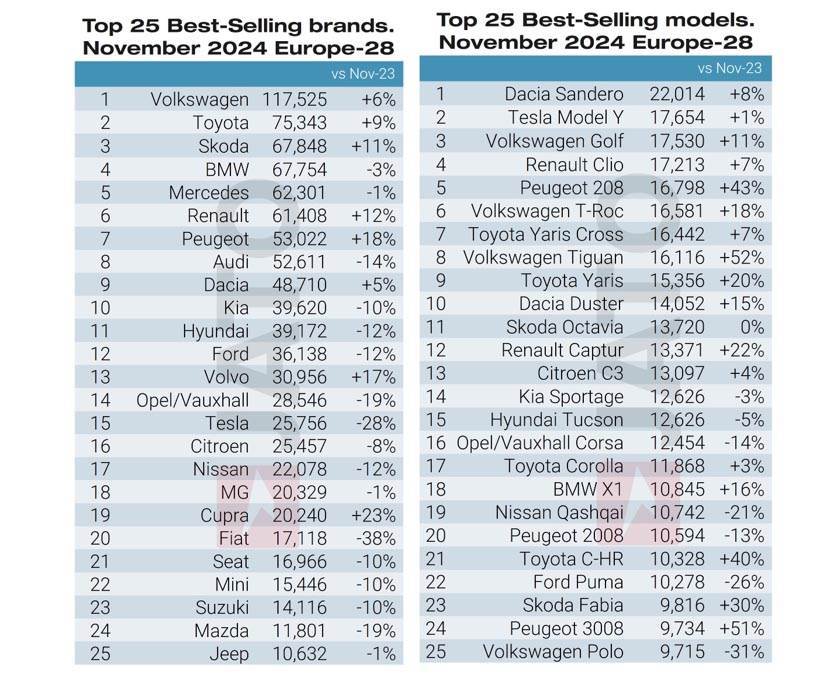

The usual industry giants dominated sales. Volkswagen Group, Stellantis, Renault Group, BMW Group, and Mercedes-Benz Group collectively accounted for a commanding 65% of the market. Japanese automakers held a 13% share, followed by Korean brands at 7.5%. American manufacturers, primarily tesla and Ford, contributed 5.9%, while Chinese automakers claimed a 6.7% share.

November’s sales figures revealed a dynamic landscape. Renault Group saw an impressive 8.6% increase, along with Toyota (9.8%) and Geely (16%).However, several major players experienced double-digit declines, including Stellantis, Hyundai-Kia, Ford, Tesla, and Nissan, as well as German stalwarts Mercedes-Benz and BMW.

Brand rankings saw meaningful shifts. skoda’s strong performance with it’s Fabia, Enyaq, and Kodiaq models propelled it to third place. Volvo surpassed Vauxhall/Opel, while MG and Cupra outperformed Fiat, which suffered a 39% drop due to the discontinuation of its gasoline-powered fiat 500.Other notable shifts included Porsche outselling Land rover,BYD surpassing Honda,Omoda exceeding Subaru,and xpeng outpacing Jaguar and Lancia.

Electric vehicles Gain Momentum

Despite the overall decline in registrations,the EV market showed resilience. Demand for battery electric vehicles (BEVs) rose by 0.8% year-over-year, capturing a 17.4% market share in November 2024, up from 17.0% in November 2023. Growth was especially strong in the UK (+58%),Netherlands (+44%),norway (+30%),and belgium (+17%),while France and Germany experienced declines of 25% and 22%,respectively.

Volkswagen Group’s electric models led the BEV segment, accounting for 26% of registrations with a 16% volume increase. Tesla, however, experienced a 28% drop, attributed to production delays for its updated Model Y. Tesla held the second spot, followed by BMW Group and Stellantis. Chinese automakers, including Volvo, Polestar, and Lotus, registered over 24,100 BEVs, a strong showing just behind Tesla, increasing their market share from 12.5% in November 2023 to 13.2% in November 2024. This growth was fueled by impressive gains from Leapmotor (+296%), BYD (+127%), Xpeng (+93%), and Geely (+33%).

November Auto Sales Reveal Surprising Winners

November’s automotive sales data paints a dynamic picture of the market, with several models showcasing impressive year-over-year growth. While the overall market trends are complex, some clear winners emerged in the monthly rankings.

Among the top ten models, the Volkswagen Tiguan, Peugeot 208, Toyota Yaris, and Volkswagen T-Roc led the pack in terms of year-over-year sales increases.This strong performance suggests a shift in consumer preferences towards these specific models.

The Dacia Sandero,however,solidified its position as the region’s most popular passenger vehicle,significantly extending its lead over the second-place volkswagen Golf in the year-to-date rankings. “the Dacia Sandero goes from strength to strength,” a recent report stated, highlighting the model’s continued dominance.

Other notable performers in November included the Renault Captur, toyota C-HR, Skoda Fabia, Peugeot 3008, Skoda Kodiaq, Jeep Avenger, BMW 5 Series, and Suzuki Swift. These models demonstrated consistent sales strength, contributing to the overall positive performance of the automotive sector.

The robust sales figures for November suggest a healthy automotive market, despite broader economic uncertainties. The continued success of certain models points to specific consumer preferences and the effectiveness of targeted marketing strategies.