Analyse

8:23 a.m., November 28, 2024

<img loading="lazy" class="img-responsive fit-to-size" src="https://api.stock3.com/article/teaserimage/11910987.image?client_id=stock3&width=1080&height=560" width="1080" height="560" alt="DAX – Daily outlook: Quiet trading without the USA?” data-v-eb90203e=””/>Image: © Cake78 / stock.adobe.com

- DAX – WKN: 846900 – ISIN: DE0008469008 – Kurs: 19,261.75 Pkt (XETRA)

XETRA DAX: 19,262

DAX pre-market: 19,328

VDAX NEW: 15,84

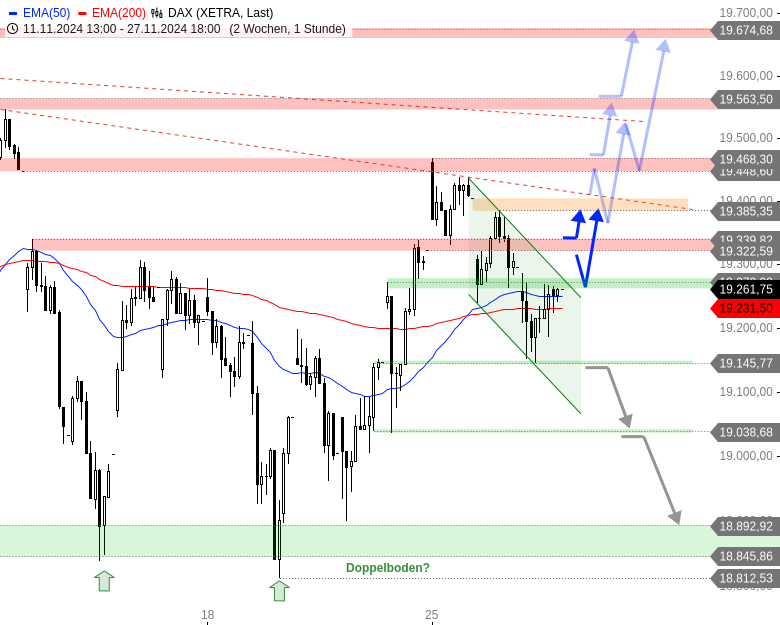

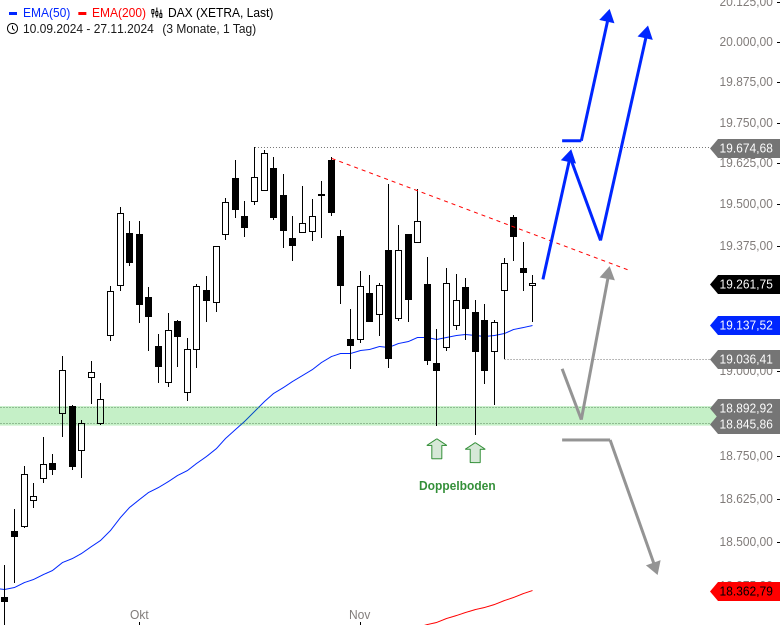

Resistors: ➡️ 19.340 ➡️ 19.385 ➡️ 19.405 ➡️ 19.468 ➡️ 19.563

Supports: ➡️ 19.273 ➡️ 19.187 ➡️ 19.146 ➡️ 19.039

DAX forecast

- Yesterday the DAX decided to extend the correction and tipped downwards again immediately after the start of trading. The correction ended right at the trigger for the bears, the 19,146 point mark. A sell signal was averted and buyers took over again, pulling it close to the day’s highs. A doji with a long shadow remained as a constructive daily candle.

- There are signs of a firm opening for trading today. The DAX is likely to break out of the three-day flag correction upwards at the start; the resistance areas at 19,340 and 19,385 – 19,405 could be tested.

- A return above 19,410 would allow an attack on the hurdle at 19,440 – 19,470. Above this, impulses arise for the bulls, targets would then be at 19,540 – 19,564 and at the all-time high at 19,675.

- The area at 19,260 – 19,275 has a supportive effect. Furthermore, small sell signals only arise below 19,140.

XETRA DAX hourly candlestick chart

XETRA DAX daily candlestick chart

New partners, wider product variety and continued unbeatable conditions

By connecting the issuers Morgan Stanley and DZ Bank, justTRADE is expanding its range of cost-effective trading options for private investors. In the future, more than 1.2 million certificates & warrants will be tradable on justTRADE.

Open a depot now and benefit from our promotion!

Disclosure by the editor-in-chief of stock3 AG due to possible conflicts of interest

**Given the DAX forecast predicts a potential breakout, but acknowledges the quiet trading due to the US holiday, what strategies might traders employ to navigate this period of potentially reduced liquidity and heightened volatility?**

## Interview on DAX Forecast

**Introduction:**

Welcome to World Today News, where we dissect important financial market trends. Today, we’re joined by two esteemed experts to discuss the DAX forecast published on our website. [Guest 1 Name], an experienced financial analyst, and [Guest 2 Name], a renowned market strategist, will shed light on the current market situation and potential trading opportunities.

**Section 1: Market Overview and US Impact:**

* The article mentions that trading is expected to be quiet today due to the US Thanksgiving holiday. [Guest 1], could you elaborate on how the absence of US markets usually impacts trading in the DAX, especially considering the recent correction discussed in the article?

* [Guest 2], the article highlights a “constructive daily candle” for the DAX. Could you explain what this pattern signifies and how it might influence future trading decisions?

**Section 2: Bullish Signals and Resistance Levels:**

* The forecast suggests a potential breakout above the three-day flag correction and highlights resistance levels at 19,340, 19,385-19,405. [Guest 1], do you see any factors that could hinder this bullish momentum, and what are your thoughts on the significance of these resistance levels?

* Looking at the hourly and daily candlestick charts provided, [Guest 2], what are some key technical indicators that support the bullish outlook for the DAX, and what are the potential implications if the DAX fails to break through these resistance levels?

**Section 3: Bearish Scenarios and Support Levels:**

* While the article leans towards a bullish outlook, it’s important to consider potential downsides. [Guest 1], what are the potential triggers for a bearish reversal in the DAX, and what support levels would you watch closely?

* [Guest 2], could you elaborate on the significance of the support level at 19,260-19,275? How crucial is it for the bulls to maintain this level, and what could happen if it is breached?

**Section 4: Investment Opportunities and Risk Management:**

* Looking at the overall market landscape and the DAX forecast, [Guest 1], what specific investment opportunities do you see for traders at this moment?

* [Guest 2], could you share some risk management strategies that investors should implement when considering trading the DAX in the current market environment?

**Conclusion:**

Thank you, [Guest 1] and [Guest 2], for providing such valuable insights. This discussion highlights the dynamic nature of the DAX and the importance of considering multiple perspectives when making investment decisions. Remember, market movements are inherently unpredictable. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.