Close video module

Ahead of the Thanksgiving holiday, economic data was poured in, including personal consumption expenditures (PCE) for October, preliminary GDP figures for the third quarter, durable goods orders for October, and new weekly unemployment benefit claims. These data generally met expectations. There was no significant impact on the New York financial markets. What had a greater impact were the performance of Dell and HP, which were announced after the market closed the previous day. They plummeted by more than 10% after reporting lower-than-expected performance in the AI server sector due to a shortage of Nvidia’s new AI chip Blackwell and in the PC sector due to continued sluggish demand. This dragged down semiconductor stocks, including Nvidia. Fortunately, bond yields have stabilized downward, offsetting some of the negative sentiment. This was thanks to PCE prices coming in at expected levels and demand pouring into the 7-year Treasury auction, an ‘unpopular’ government bond.

Let’s start by looking at the data that came in from the morning.

① 3rd quarter GDP 2.8%

The provisional GDP growth rate for the third quarter was the same as the preliminary estimate of 2.8% announced last month. The United States announces GDP three times (preliminary, provisional, and confirmed). The details have changed slightly. Personal consumption expenditures (PCE) in the third quarter, which account for two-thirds of the U.S. economy, were revised downward to increase 3.5% compared to the previous quarter, which is lower than the 3.7% reported figure. Although it is still higher than the second quarter (2.8%). This was mainly offset by an increase in corporate facility investment (preliminary value 1.3% → 1.7%). Inflation appeared to have slowed further in the third quarter. Core PCE prices for the third quarter, excluding food and energy, were revised from the preliminary estimate of 2.2% to an increase of 2.1%.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777123.1.png)

“Growth remained robust in the third quarter, well above trend,” TD Bank said. “There are few signs that higher interest rates are weighing on economic activity beyond some areas, such as housing and commercial real estate. Thanks to resilient consumers and business investment, the U.S. “The economy is likely to finish on a solid footing this year, but the outlook for next year is slightly more uncertain due to new policy risks, such as pro-growth tax cuts and deregulation, as well as countervailing tariffs and deportation of illegal immigration.”

② Order of durable goods in October

Durable goods orders rose 0.2% in October, breaking a two-month decline. It was slightly lower than expected (0.5%). The rebound in orders was driven almost entirely by civil aviation. It increased by 8.3% in October after plummeting in September (-16.6%) and August (-19.7%). The problem is that orders for core capital goods (non-military capital goods excluding aircraft), which represent corporate investment, were weaker than expected (+0.1%) at -0.2%, and the September data was also revised downward from +0.7% to +0.3%. .

“Generally, a decline in durable goods orders is a precursor to a decline in shipments and investment,” BMO said. “Corporate capital spending is expected to slow in the fourth quarter as well, which will be negative for growth in the fourth quarter.”

③ Claim for unemployment benefits

Last week (~23rd), the number of new unemployment benefit claims was 215,000, a decrease of 2,000 from the previous week. On the other hand, the number of continuing claims filed for more than two consecutive weeks increased by 9,000 to 1,907,000. This is the highest in three years since November 2021.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777125.1.png)

Wells Fargo explained that “the latest data shows that while companies may not be hiring as many workers as they did coming out of the pandemic, they are not exactly laying off workers.”

④ PCE price

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777138.1.png)

The October PCE price index showed that headline prices rose 0.2% (0.238%) compared to the previous month, and core prices rose 0.3% (0.273%). It was as expected, but to the second decimal place, it accelerated compared to September (0.175%, 0.262%). On a year-over-year basis, headline prices rose 2.3% and core prices rose 2.8%. As expected, it is higher than September (2.1%, 2.7%). Core inflation reached its highest level since last April.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777135.1.png)

Converting the three-month core price level to an annual rate, the rate is 2.8%, which is also higher than September’s 2.4%. The six-month rate remained at 2.3%.

The price of goods fell 0.1%, but the problem was that the price of services accelerated to 0.4%, reaching the highest level since last March.

It was a little worrying, but Wall Street wasn’t too worried. The acceleration of service prices was largely due to a 3.5% increase in portfolio management fees in one month. This was the factor that increased core inflation by 0.058% points out of 0.273%. “Fees rose in October due to strong financial markets, including rising stock markets. That’s really it,” said Parker Ross, an economist at Arch Capital.

Evercore ISI said, “Core PCE prices were slightly higher for the second consecutive month, as expected. However, the increase in October was caused by highly volatile non-market factors, such as portfolio fees, which mechanically rise when the stock market rises. Based on market factors. We believe that the latest data shows that the wage increase rate considering productivity is 2% or lower. Based on the following, the decision to cut vs. freeze rates in December is a delicate balance, but we are still slightly inclined toward a cut. ), and producer prices (PPI) will determine the December decision.”

PCE data also includes personal income and personal consumption. Personal income surged 0.6% in October. This is much better than the average of +0.2% over the past six months. Real disposable personal income, adjusted for inflation and taxes, also increased by 0.4%. This means that consumers’ wallets are secure. Personal spending increased 0.4% in October, in line with forecasts. When adjusted for inflation, it was calculated to have increased by 0.1%. This is somewhat lower than expected and the average over the past six months.

“A lot of data today provides a snapshot of where the economy is today. Stripping away political factors, we see an economy where a soft landing is still the default scenario, although progress on inflation may be slow,” Wells Fargo said. “The rebound in core PCE prices shows that the final stages of disinflation are bumpy,” Wells Fargo said. “However, we do not expect this stagnation to prevent a rate cut in December. Monetary policy remains constrained and the labor market shows signs of slowing, so the Fed “We believe restrictions will be eased to some extent to avoid further unwanted slowdown,” he claimed.

Overall, the U.S. economy is doing well. Atlanta Federal Reserve’s GDPNow today raised its fourth quarter GDP growth estimate from the previous annual rate of 2.6% to 2.7%.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777149.1.png)

In the New York bond market, interest rates showed a slight decline from the morning. The decline was slightly larger after the economic data was released. At 3:30 p.m., the yield on 10-year government bonds fell 4.4 basis points to 4.258%. The 2-year bond was traded at 4.225%, down 2.9bp.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777150.1.png)

There was a 7-year Treasury bond bid ($44 billion). After the auction results were announced at 11:30 a.m., the decline in interest rates increased. The issuance interest rate was set at 4.183%, 1.4bp lower than the market interest rate (WI) of 4.197% at the time of issuance. This is because the bid rate was 2.709 times, which is higher than the average of 2.585 times for the last 6 times. Following this week’s 2-year and 5-year note auctions, the sale of government bonds was successful as demand also surged for 7-year notes. A bond market official explained, “Demand has been confirmed as the 10-year yield has met resistance at the 4.5% level and has come down. Expectations are also growing for the Fed to stop quantitative tightening (QT) early next year.”

Economic data was also generally in line with expectations, and expectations of a December interest rate cut by the Fed (Fed watch market) rose from 59% the day before to 66%. Government bond yields also showed a downward trend.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777151.1.png)

However, the New York stock market did not receive much strength. We started off in the morning at a steady pace. In the afternoon session, all three major indices turned downward. Nasdaq even fell more than 1.2% at one point.

The reason was not macro data. The performance of Dell and HP, which came out after the market closed the previous day, was problematic.

Dell’s third-quarter PC business sales fell 1% year-over-year and fell short of expectations. HP’s PC segment sales rose 2%, but again fell short of Wall Street expectations. “PC replacement cycles are being pushed back to next year,” said Yvonne McGill, Dell’s chief financial officer. Microsoft’s release of Windows 11 is not encouraging corporate PC replacement as much as in the past. Market research firm IDC announced that PC shipments rebounded but then declined again in the third quarter.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777167.1.png)

The AI field was definitely good. Dell’s infrastructure segment (including servers) revenue rose 34%, slightly beating estimates. But there was a problem here too. Dell announced that it shipped $2.9 billion worth of AI servers in the third quarter. This is down from $3.1 billion in the second quarter. “AI is a powerful opportunity and there are no signs of demand slowing down,” Dell said, explaining that its stacked AI server orders increased from $3.8 billion in the second quarter to $4.5 billion in the third quarter. CEO Michael Dell explained, “We saw a sharp shift in orders to Blackwell in the third quarter. As a result, orders are piling up. Blackwell chips have entered production and are in the process of ramping up production.” After the Blackwell chip was released, customer orders are pouring in, but they are unable to sell it properly because they cannot obtain enough chips. Both companies released sales guidance for this quarter that fell short of expectations. In the case of Dell, it presented fourth quarter sales guidance of $24 billion to $25 billion, which is below Wall Street’s expectations of $25.5 billion. Dell’s stock price fell 12.2%, and HP’s fell 11.3%.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777168.1.png)

“Dell’s third-quarter results were somewhat disappointing,” Bernstein said. Revenues were slightly below consensus, and the company expects fourth-quarter revenue to be nearly $1 billion less than Wall Street expectations due to delays in the PC upgrade cycle and delays in AI server deliveries due to Blackwell. Given Supermicro’s (SMCI) recent problems, some investors had expected more meaningful order growth from Dell. As explained, the switch to Blackwell could delay Dell’s revenue generation and we are concerned that the Blackwell system will put further pressure on margins.

It’s not just their stock prices that have fallen. Semiconductor stocks such as Nvidia, which does not provide enough Blackwell, and Micron, which supplies HBM (high bandwidth memory) to AI servers, were also hit. In addition, AI-related software stocks such as Crowd Strike and Workday, which released (not bad) performance yesterday, also fell significantly.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777183.1.png)

Semiconductor stocks have lost strength recently. The Philadelphia Semiconductor Index is down 6.90% for the losing month, including down 1.51% today.

As can be seen from Dell and HP’s performance, demand for PCs is not reviving. The deepening conflict between the US and China is also negative. China is the world’s largest importer of semiconductors and equipment. The Joe Biden administration is controlling exports of semiconductor equipment and AI chips to China. President-elect Donald Trump is also showing a more hostile attitude, calling for additional tariffs on China. President-elect Trump nominated attorney Jamison Greer as the U.S. Trade Representative (USTR) yesterday. Greer was a senior adviser to USTR representative Robert Lighthizer during Trump’s first term. In May, Greer called for a “strategic separation” from China, saying China’s ambitions and actions were a “generational challenge” to the United States.

It is also negative that Trump’s transition team is saying that they will eliminate support under the semiconductor law. “We gave billions of dollars to rich companies to come in and build semiconductor factories here, but they wouldn’t be good companies for us anyway,” Trump said during the campaign. You didn’t have to pay even 10 cents. Tariffs could do that. “The idea is to impose very high tariffs so that they can come and set up semiconductor companies for free,” Vivek Ramaswamy, who will lead the Department of Government Efficiency (DOGE) along with Elon Musk in the Trump administration, posted on X yesterday. The Eden administration is “rapidly releasing wasteful subsidies under the Inflation Reduction Act (IRA) and the Semiconductor Act before January 20th.” “DOGE will re-examine all of these 11th hour gambits and recommend that the auditors investigate them further.”

In the end, the S&P 500 index fell 0.38% and the NASDAQ fell 0.60%. The Dow fell 0.31%.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777191.1.png)

Including NVIDIA -1.15%, ▲Microsoft -1.17% ▲Tesla -1.58% ▲Amazon -1.02%, etc. ▲All Magnificent 7 stocks except Alphabet (+0.12%) showed a decline. By industry, IT fell the most (-1.19%).

“It’s starting to look like a ‘tech mess,’” said Jonathan Krinsky, technical strategist at BTIG. “The relative decline of tech stocks is a concern heading into 2025, but the good news so far is that cyclical selling is expanding to other parts of the market. “The market upward trend is maintained,” he explained.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777192.1.png)

However, today, the industries benefiting from the ‘Trump trade’ did not rise significantly. ▲The financial sector rose by 0.26%, but the ▲materials (-0.09%) and ▲industrial (-0.36%) sectors showed a downward trend. The small-cap Russell 2000 index was flat at 0%. The number of stocks that rose outnumbered those that fell, but the gains were weak.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777195.1.png)

In this regard, Ned Davis Research compared the market reaction in 2024 and 2016 after the presidential election and found that the ‘Trump trade’ is proceeding similarly to the trend in 2016. Asset classes such as stocks, gold, and the dollar tend to follow the 2016 pattern. However, when we analyzed the similarities with 2016 by stock industry (energy, industry, healthcare, finance, technology, and communication services), we found that these industries, which showed similar movements to 2016 after the presidential election, “seem to be reaching a major inflection point.” “He stated. “This suggests that the effects of the initial ‘Trump trade’ may have already been priced in,” said Ned Davis Research. Considering these similarities, there is a possibility that the leadership by industry will become more diverse in 2025, while the current ‘overweight’ will be maintained in the energy and financial sectors. “We maintain ‘underweight’, but if this trend reverses like in 2016, we may switch to ‘neutral’,” he said.

![‘The last bear’ JP Morgan surrenders… Last minute of ‘Trump trade’? [김현석의 월스트리트나우]](https://img.hankyung.com/photo/202411/01.38777201.1.png)

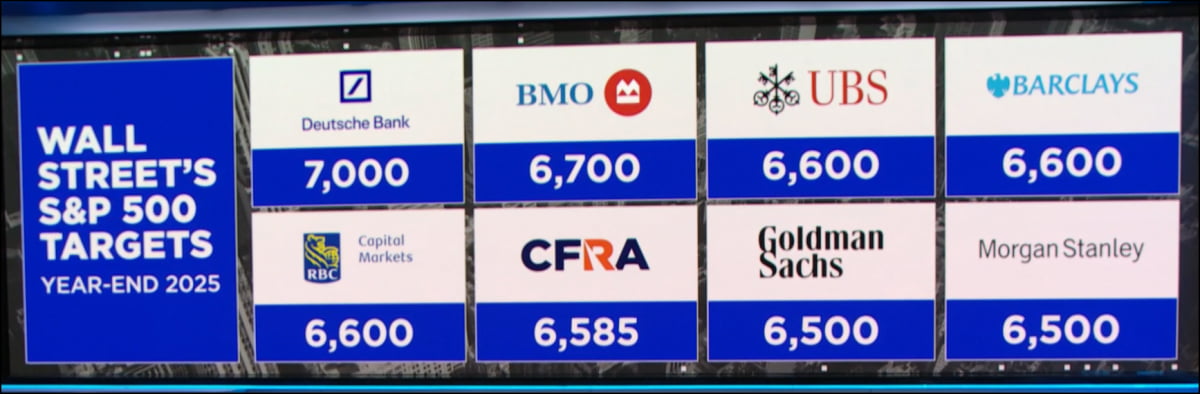

In any case, there continues to be speculation on Wall Street that the market upward trend will continue. Yesterday, Deutsche Bank predicted the S&P 500 index to be 7,000 at the end of next year. JP Morgan, which has maintained 4200 for some time, finally raised its forecast to 6500 at the end of next year. That’s a whopping 55% increase. It’s been almost five months since ‘pessimist’ Marko Kolanovic was fired last July. JP Morgan stated that “the U.S. will continue to serve as a growth engine for the global economy, based on an expanding economic cycle, a healthy labor market, increased AI-related capital spending, and the outlook for increased capital market activity.” “The outlook is extraordinarily complex, with rising geopolitical uncertainty and evolving policy agendas, but the opportunities likely outweigh the risks. “The potential for deregulation, a business-friendly environment, improved productivity and capital investment is being underestimated,” he explained.

New York = Correspondent Kim Hyun-seok [email protected]

![Ahn Se-young, first win since the Olympics… What team does he belong to? [퀴즈: 시사 레벨업] : ZUM News Ahn Se-young, first win since the Olympics… What team does he belong to? [퀴즈: 시사 레벨업] : ZUM News](https://thumb.zumst.com/530x0/https://static.news.zumst.com/images/36/2024/11/28/da26da28ca334657a067f2d266c005d8.png)