On the 25th, the Ministry of Health, Labor and Welfare presented a proposed amendment to the Pension Law to the council. This will eliminate the “annual income barrier of 1,060,000 yen” and force all companies to provide employee pensions.Nikkei ShimbunMany people may think that this is a good thing, because it is reported that the basic pension will be increased by 30%, but there is a complicated mechanism behind this.

Deducting workers’ pension funds to raise basic pension by 30%

On this background,macroeconomic slidesThere is failure. This is a system that reduces the amount of pension payments to balance the pension budget, but due to political reasons, it is rarely implemented, and if it is implemented from now on out, the national pension will be reduced by 30%. . Therefore, the plan was to reduce the amount paid by 30% by 2057, but since this is no longer enough to live on the minimum, the aim of the change is the new the rate of increase.

newsletter

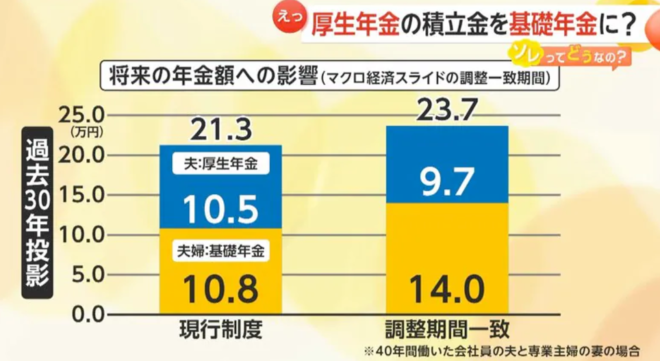

The macro slide for workers’ pensions was expected to end in 2026, but the main point of the latest revision is to divert funds to the basic pension and extend (that is, reduce) it to 2036. thisSetup time comparisonAccordingly, the monthly pension is expected to increase from 213,000 yen to 237,000 yen, but the second-level welfare pension will decrease from 105,000 yen to 97,000 yen.

FNN

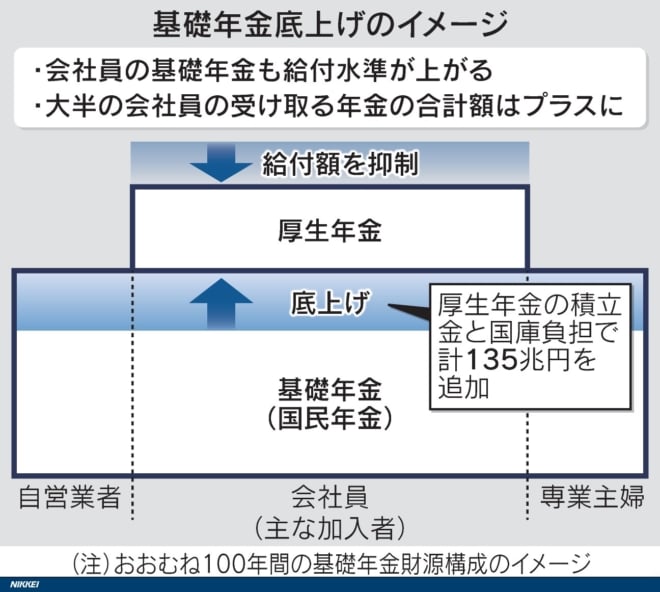

Where will the money to increase pensions come from? According to the proposal of the Ministry of Health, Labor and Welfare, the national finance is responsible andEmployees’ pension fundThe plan is to make up for the deficit by a total of 135 trillion yen. For this reason, from the next fiscal year, we will extend the scope of the Employee Pension to all employees (working 20 hours or more per week) at all small and medium-sized enterprises (5 employees or more), and 2 million people. , including part-time housewives, newly enrolling in the Workers’ Pension.

Nihon Keizai Shimbun

In other words, to make up for the deficit in the national pension system, which is quite large, the number of people with eligible workers’ pension insurance will be increased and the reserve fund will be reduced. As a result, there will be no reserves after 2036, and pension insurance premiums will be exactly the same as taxes.

Employees’ pensions are not recovered until the person dies.

This will obviously help people insured with the National Pension, but what will happen to those insured with the Workers’ Pension? The Ministry of Health, Labor and Welfare does not measure the profit and loss, but according to Shinya Yamada’s calculations, he will not be able to recover his expenses until he is 93 years old.

[Artaigil ùr]Shinya Yamada: Clearing the annual income barrier of 1,060,000 yen! Part-time housewives and small and medium businesses suffer huge losses! https://t.co/QwqiHLui4V #Agora

— Agora (@agora_japan) November 11, 2024

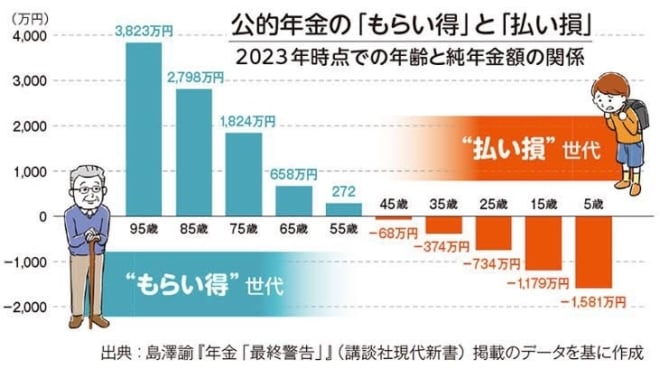

This is calculated assuming that the insurance premium is 15%, but for companies30% is labor cost including employer responsibilityTherefore, it makes sense in economics that 30% of the burden falls on workers in the long run. based on thatMr. Satoshi ShimazawaAccording to the calculations, even if people live to be 95 years old, people under 45 will not be able to recover their income until they die.

There may be an argument that not everyone can recover from insurance, but the current design of the benefit pension system means that at least half of people will be able to recover from their insurance. However, people under 50 today will lose money even if they live to be 100 (half of the national pension is taxed, so they will definitely get their money back).

Politicians who run away from the consumption tax put a burden on the working generation

The reason for this huge inequality is to balance the national pension system, which has too many benefits,Large income transfer from employee pension to national pensionThis is because he does it. Even now, 4 trillion yen of income is transferred annually to people with Tier 3 insurance from Tier 2, but this time, for the first time, money from the second tier will be transferred go openly to the first level. This is the same trick where “assistance funds” are diverted from health insurance premiums to pay the medical expenses of the elderly.

The reason isconsumption tax cannot be leviedCorp. If the current macroeconomic slide change is done entirely through a consumption tax, the burden will not be concentrated on office workers. In addition, all basic pensions will be replaced by a consumption tax.guaranteed minimum pensionThis eliminates the need for such complex accounting operations.

From April next year, a 15% insurance premium will be imposed on part-time workers at small and medium-sized enterprises, and personnel costs for small and medium-sized enterprises will rise by 30%. There seems to be talk of giving subsidies to reduce the employer’s burden to 80% or 90%, but in the end all labor costs will be the responsibility of the worker.

It seems that both the opposition parties and the media are in favor of this change to the pension law, but if these policies continue, the unfair pension system will become even more unfair, and eventually our -out among the workers Dew. Basic reforms should be considered, including replacing the basic pension with a consumption tax.

“); } else { document.write(“”); }

2024-11-27 08:05:00

#amendment #Pensions #Act #force #people #enroll #Employees #Pension #Plan #recovered #death

* Should the government prioritize addressing the funding gap in the National Pension system over potentially widening inequalities within the Employee Pension plan?

## Open-Ended Questions for Discussion:

Here are some open-ended questions divided into thematic sections based on the article, designed to encourage discussion and diverse viewpoints.

**Section 1: Pension System Funding & Inequality**

* The article argues that increasing enrollment in the Employee Pension plan is primarily to cover the deficit in the National Pension system. Do you think this is a sustainable solution or does it create further inequalities within the pension system? Why or why not?

* What alternatives to increasing Employee Pension enrollment could potentially address the funding gap in the National Pension system? Are there any drawbacks to these alternatives?

* How does the disparity in the age at which different generations are projected to recover their Employee Pension contributions impact social fairness and intergenerational equity?

**Section 2: Impact on Workers and Businesses**

* The article highlights the potential financial burden on both workers and small and medium-sized enterprises due to the increased insurance premiums. What potential measures could mitigate these burdens and ensure a fairer distribution of costs?

* How might the increased labor costs for small and medium-sized enterprises impact employment rates, particularly for part-time workers?

* Do you think the proposed subsidy to employers will effectively alleviate the financial strain on businesses, or will it merely delay the inevitable passing of costs onto workers?

**Section 3: Long Term Solutions and Reform**

* The article proposes replacing the basic pension with a consumption tax as a potential long-term solution. What are the potential advantages and disadvantages of this approach?

* What other radical reforms could be considered to ensure the long-term sustainability of the pension system?

* How can policymakers effectively balance the needs of current retirees with the financial realities facing younger generations?

**Section 4: Political Responsibility and Public Discourse**

* Do you agree with the article’s assessment that politicians are avoiding difficult decisions regarding consumption tax hikes? What role should politicians play in educating the public about the complexities of pension financing and promoting constructive dialog?

* How can media outlets contribute to a more informed public debate on pension reform, rather than potentially contributing to partisan divides?

**Note:** It’s important to encourage participants to share their personal experiences and perspectives, while remaining respectful of diverse viewpoints.